Can you believe we are already halfway through 2018?

The second quarter of 2018 is officially wrapped up. Which means it is time for another online income report!

If you’re new here, you should know a few things. First, I love reading other bloggers and online entrepreneurs’ income reports. However, some of them aren’t very helpful. In fact, many of them make it seem way too easy. Not all, but most, just show revenue, ignoring expenses. They discount the years it took them to get there.

Blogging takes time and patience. It is hard. Freelancing is easier, but only in that you don’t need to put the years in to build a blog following before you make income. I want my online income reports to be different. I want them to be fully transparent about the work that is required.

Second, it helps to have context. I started my blog in February of 2017. I started freelance writing in the last week of December 2018, right after leaving my hedge fund career. Currently, I am on a two-year “mini-retirement” with a goal of building an online business. You can read about my long-term goals here. Growing this business is my full-time job, and I spend at least 40 hours a week working on it. Often more. If you are a new blogger or freelancer, remember – Never compare your beginning to someone else’s middle.

With that, let’s look at how things went in the second quarter!

Related post: Fully Transparent Online Income Report: First Quarter 2018

Table of Contents

What happened in Q2’2018?

The second quarter of this year was a good one for freelance writing but required a lot of focus. We spent most of the quarter living at my in-laws in NJ. This is fantastic for family time, though not as excellent for productive work.

Here are some top highlights from the quarter!

- I was a guest curator on Rockstar Finance!

- Two of my seven posts published for my Forbes contributor blog received “Editor’s Choice,” and one of the other articles was trending on the site for over three days, receiving over 35,000 views.

- Site redesign for Mama Fish Saves went live, along with my new core e-mail opt-in -> The Complete Financial Swim Test. I am very proud of the swim test. I spent a lot of time on it and think it is an excellent resource for understanding your financial health.

- We signed our lease for our new rental house in CT and are no longer technically homeless! Move-in day is two weeks from today. ?

- We went strawberry picking three times to enjoy plenty of fresh berries while saving lots for the rest of the year. Each time we were surprised Fuss didn’t explode from eating so many berries…

Quarterly Blog and Online Income Report

Let’s get into the nitty-gritty. Each quarter in these reports I am going to give you a full, transparent look into how my blogging and freelancing business is going.

I want to show everything it takes to reach long-term goals. And I also know that having to write these reports each quarter keeps me accountable. As such, these posts may be a little long, but feel free to just jump to the charts and the bold sections if you are only curious about my stats. ?

Related content: Kicking Off Our Two-Year Online Income Experiment

Did I Reach My Goals?

In my Q1’2018 online income report, I set four goals. I managed to achieve just one of them. Oops!

❌ Goal 1 – Improve Freelance Pitching & Secure 2 New Clients a Month

This was the failure of all failures as far as actually following the steps I outlined. I was supposed to come up with a new pitching strategy, send two new pitches a week, and secure two new clients every month. I did exactly none of those things.

However, I’m not all that fussed about it. In fact, I am impressed that I managed to secure four new clients during the quarter all while sending exactly one pitch. ?

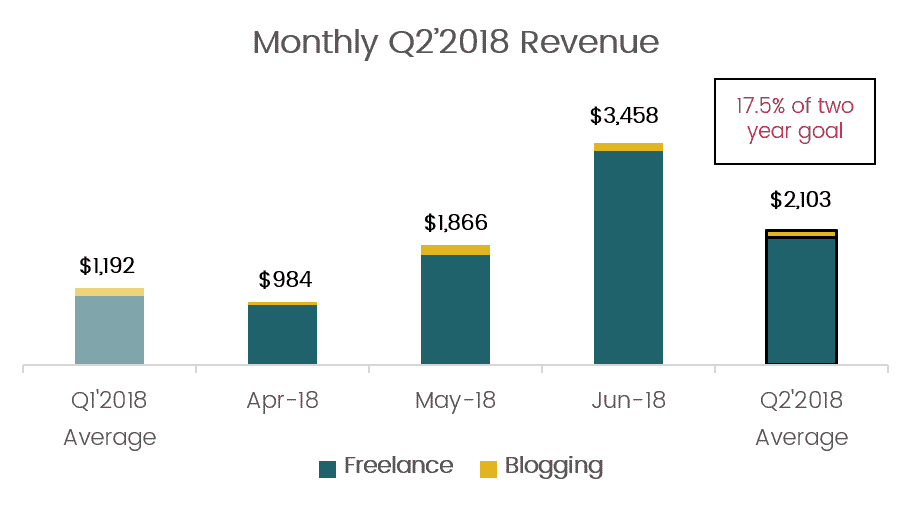

Not to mention that getting new clients was all about increasing income. Which definitely did happen, with freelance income going from $980 in April, to $1,720 in May, to $3,330 in June. Two of the four clients I made agreements with during June and will start assigning projects in July. Not too shabby.

❌ Goal 2 – Increase Affiliate Income by 25%

Nope, nope, nope. Affiliate income actually FELL by 62% in the quarter.

While I did go through and improve some old posts for affiliate conversion, my traffic fell considerably from Q1 to Q2. Since you need pageviews for strong affiliate performance, I have work to do there. (Understatement.)

❌ Goal 3 – Increase Email List by 500 Subscribers

Are we sensing a trend here? I pretty much set step-by-step goals for Q2 at the beginning of the quarter and then said, “Ah, the hell with it!”

I was supposed to make my 30-day $500 savings challenge and evergreen opt-in. Instead, I took Amy Porterfield’s List Builder Lab course. This course recommends having a core freebie that is a quick win, that is visible when someone lands on your website and speaks to your reader’s needs.

Thus, I created the Complete Financial Swim Test, re-did my homepage, and created a welcome sequence I’m really proud of. This took a lot of work but I think will pay dividends over time.

✔ Goal 4 – Post on Mama Fish 2x a Week

Yay! I got one! I posted twice a week throughout the quarter on Mama Fish. I’m considering going to three posts a week starting in August. But we will see how it goes.

I also remain two weeks ahead on content and expect to be three to four weeks ahead by the end of Q3’2018.

In June, I also added seven posts a month to my Forbes contributor blog. While this doesn’t directly benefit Mama Fish Saves, I do like that it builds my brand. (And brings in a little income.)

Blog Metrics

This is one of the places where I now feel like a seasoned blogger. Not because of my pageviews, you’ll see that in a second. But because when the numbers go up and down, it no longer stresses me out. I check Google Analytics about once a week and try to focus on the important stuff. Like the Six Weeks to a Profitable Passion challenge that I am running with 20 highly engaged readers. That is gold.

Still, here is where things stand for the curious.

Posts – 24

I published twice a week on Mama Fish Saves throughout the quarter! Woohoo!

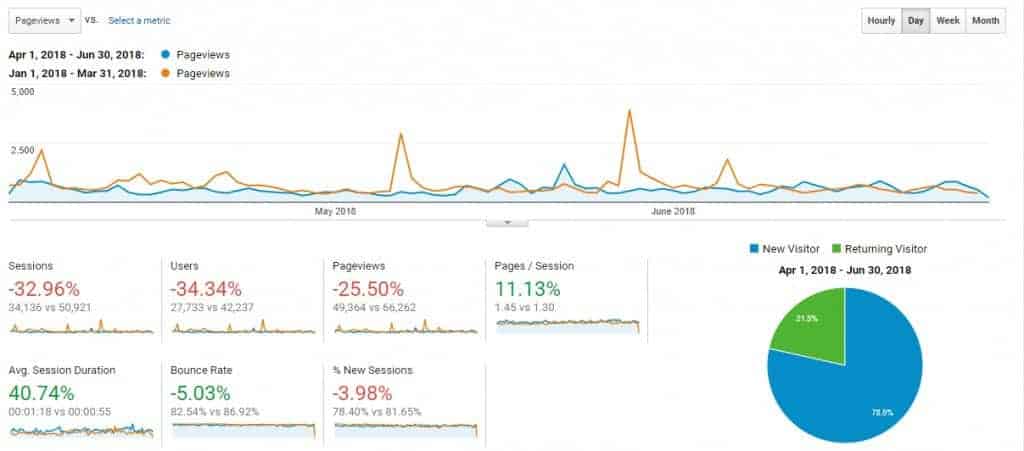

Traffic – 49,364 Pageviews (-25.5%) | 34,136 Sessions (-33.0%)

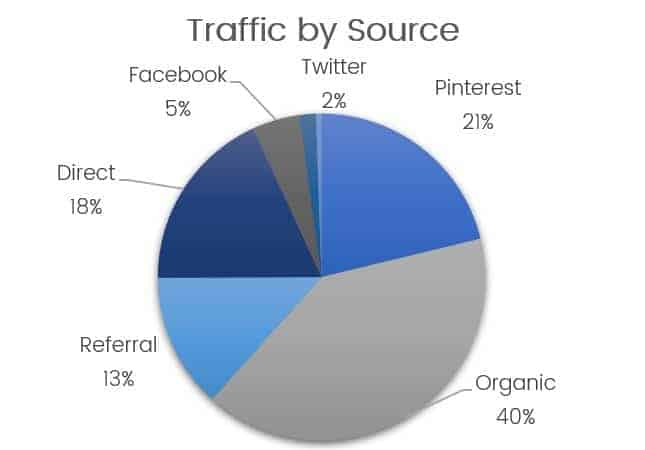

My blog traffic plummeted in Q2’2018. Pinterest traffic fell off by 63% as I moved to BoardBooster from manual pinning, contributed far less time to the platform, and got walloped by the algorithm changes. I also had two Rockstar Finance features in Q1’2018 and none in Q2.

On the positive side, organic search traffic was up over 20%. Historically I haven’t focused on SEO much. But I did some work improving my post on the best college 529 plans and have some articles in the pipeline that will be more focused on high-traffic SEO keywords.

Similar to last quarter, you can see my breakdown of traffic by source below. Organic search replaced Pinterest as my top traffic source, which has its pluses and minuses. The apparent minus is that the swap came from Pinterest traffic falling, not organic surpassing it. The positive being that organic search traffic is much higher quality for me. Readers visit more posts and stick around longer.

Most Popular Posts

Here is a quick look at what posts were really killing it for me this quarter. These are the top five highest traffic posts for April through June:

- Side Hustle Showcase: What It’s Like To Be An Usborne Consultant – This post gets a ton of views and has zero monetization. If any other bloggers have some ideas, I would love to hear them!

- Average Time on Page: 6 minutes, 31 seconds

- Share of Quarterly Pageviews: 11.98%

- Our Go-To Family Dinner Recipes

- Average Time on Page: 3 minutes, 0 seconds

- Share of Quarterly Pageviews: 6.2%

- Fully Transparent Online Income Report: First Quarter 2018

- Average Time on Page: 5 minutes, 10 seconds

- Share of Quarterly Pageviews: 2.87%

- Whole Vs. Term Life Insurance: Let’s Do The Math!

- Average Time on Page: 6 minutes, 13 seconds

- Share of Quarterly Pageviews: 2.68%

- You Need a Budget: Book Review

- Average Time on Page: 3 minutes, 31 seconds

- Share of Quarterly Pageviews: 2.58%

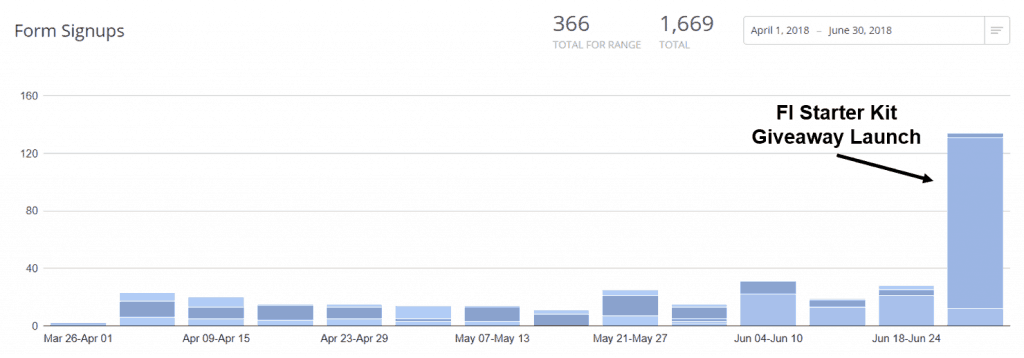

Email Subscribers – 1,669 subscribers (+12.5%)

The goal for Q2’2018 was to get back up to 2,000 email subscribers, which didn’t happen. However, I am excited about my new core opt-in and am currently running a Financial Independence Starter Kit giveaway in honor of July 4th. The giveaway will be open until July 10th and should hopefully bring in some more subscribers.

Income and Expense Report

Writing an utterly transparent account of my blog and freelance income still feels a little weird. And I can’t stop myself from peeking at other blogger’s reports, so I guess it makes sense to publish my own.

Anyway, here we go!

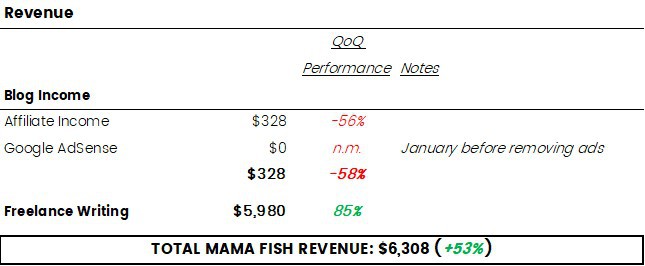

Net Income – $4,052 (+46%)

Another quarter strongly in the black and with almost a 50% increase in profitability! Love it.

My net income should have been much higher but I bought two more expensive courses which I will explain more below, one average priced course on affiliate marketing and paid for my site redesign.

Revenue – $6,308 (+53%)

As a reminder, my goal is to get to $12,000 in monthly revenue by December 2019. I averaged 17.5% of that goal in this quarter.

Freelancing: Even though my goal was to pitch two new freelance clients a week all quarter, I failed miserably at this goal. I sent only one pitch. But I did manage to pick up four new clients (two of which will start assigning me work in July) and grew my workload with existing clients.

Blogging: The blog brought in $328 in revenue in the second quarter of the year, all affiliate income. My affiliate income was down considerably, mostly due to lower traffic. Or, at least, that’s what I’m attributing it to. ?

For those curious, my best affiliates in the quarter were Personal Capital, blooom (I published a review of bloom’s free 401(k) assessment), and Amazon.

Expenses – -$2,255

SOMEONE MAKE ME STOP BUYING COURSES. I bought $958 of courses again this quarter. However, I did actually complete Making Sense of Affiliate Marketing before purchasing any new courses. And I’m almost done with Amy Porterfield’s List Builder Lab.

The course I am super excited about is Instagram With Intention and Social Stories, but I haven’t jumped into it yet. The course was expensive, at $397. But I’ve found that my ideal reader spends a lot of time on Instagram, and I want to grow my presence on the platform.

This quarter I also got to experience something fun – quarterly taxes. I had to ship off a check for Q1 and Q2 estimated taxes. Luckily, Quickbooks Self-Employed ties in with Turbo Tax. So it just updates me with precisely what I have to pay each quarter.

BIG NEWS. You’ll also see a $100 charge in the table below for a Pinterest VA. That is the setup fee for my new VA. This lovely lady will be designing all my pins and doing my scheduling in Tailwind starting from July 1. The control-freak, perfectionist in me is still struggling with this a bit. BUT, I know that if I want to keep growing my freelancing business, I need to take something off my plate. And I have told Lauren flat-out to shout me down if I start trying to wade into Pinterest. We’ll see how it goes!

What Worked and What Didn’t

Each quarter I want to share some of my trials-and-errors. I’m still figuring this whole online income thing out (obviously). Hopefully, you can learn from my mistakes.

What Worked This Quarter

- Daily planning: At the beginning of each week this quarter, I sat down and compiled what had to be done that week. Then, I chunked it out by work days. This was amazing because I didn’t waste time each morning trying to determine where to start. I could just jump in and shut down my computer as soon as my list was tackled.

- Making time for courses: In the past, it was so easy for me to put off actually doing the work on a course I had purchased. There was just so much writing that had to be done, images created, etc. The day would get filled, and I would only dabble in any course I bought. Now, I make a few hours of time a week to listen to course lessons and actually implement.

- Connecting with readers: Earlier in June, I did a Facebook Live in the #WomenRockMoney community about the importance of passion projects. Many group members had things they dreamed of doing but didn’t know where to start. So, I outlined a six-week challenge, including accountability check-ins regularly from me, to help get people started. I opened up 15 slots and sent the request to my list for free. I ended up with over 30 responses. We are only about 10 days into the challenge, but it has been so incredible to connect on a regular basis with a core of readers.

What Didn’t Work This Quarter

- Pinterest: I saw a lot of Pinterest success early in the year when I was making three pins for every post and pinning manually. But I got burnt out fast. I switched to BoardBooster (RIP) and only made one image per post, using RelayThat. My traffic plummeted. It was tough to see, but it did help me make an important decision. Pinterest is an excellent source of traffic, but not something I enjoy spending time on. So, I hired a Pinterest VA and committed my time elsewhere!

- Working from Home: As we are still at my in-laws, working from home continued to be a mess. I’ve been heading out to the library for several hours four days a week. I’m much more productive there. But I am sincerely hoping that once we get my office set up at the new house, I can get into a rhythm there. Watch out for pictures of my new home office on Instagram!

Goals for Q3’2018 (& How I’m Going to Get There)

“A goal without a plan is just a wish.” – Antoine de Saint-Exupéry

Each quarter I am going to set 3 (sometimes more) goals and share them in these reports. I will also lay out what steps I am going to take to get there, so I have a reliable way to review progress come next quarter. And I promise to try to stick to them more than I did in Q1…

? Goal 1: Average $5,000 a Month in Revenue

This revenue goal marks a 150% increase from the Q2’2018 average and a 50% increase from my June revenue. But, I think it is possible. And it would put me 42% of the way to my December 2019 goal.

Here’s how I am going to do it.

Step 1: Continue to increase freelance work.

I’m not even going to pretend I’m going to do a lot of pitching. But I know I already have at least two new clients coming on board this quarter. And I plan to grow my workload at existing clients.

Step 2: Increase traffic to improve affiliate income.

Hopefully, Pinterest traffic begins to pick up in Q3. Especially in September as the summer doldrums wear off. But I will also run some traffic-focused Facebook ads to affiliate posts during the quarter.

Step 3: Consistently post on my Forbes contributor blog.

Not surprisingly to other freelancers, Forbes is my biggest name client and the lowest paying. So for the first two months, I was a contributor but, I didn’t do much with them. However, since I committed to a regular post schedule, it has really helped get my name out there as a writer. I’ve had inbound requests from a few clients who saw my work there.

Step 4: Go to FinCon!

FinCon is the last week of the quarter, so won’t exactly help my revenue goals. But, I am so excited to hang with other personal finance bloggers and network with potential freelance clients. I really think it will help me take my freelance income to the next level.

I didn’t get to go to FinCon last year because I was having back issues from my pregnancy and couldn’t travel. This year, however, Jeremiah and I are going down together for a whole six days in Orlando, FL without the boys. I’m 70% delighted and 30% on the verge of tears. #momlife

? Goal 2: Increase Email List to 2,000 Subscribers

This is a carry-over from Q2’2018 – eek! But I think adding 110 subscribers a month is more than doable.

Step 1: Create landing pages for top opt-ins and share on Pinterest

While I love my Freebie Library, I think it makes it harder to drive traffic to specific opt-ins. So, my new Pinterest VA is going to make some pretty pins focused on a few of my stronger freebies. Then I’ll make a landing page with just an opt-in box, an image of the freebie, and a short description to increase conversions.

Step 2: Add content upgrades to more posts

When I first started my blog, I created content upgrades to go along with posts much more often. I’ve gotten out of the habit, but I plan to do it a lot more in Q3’2018.

Step 3: Make the $500 30-Day Savings Challenge Evergreen

My most popular opt-in over the first year was a 30-day, $500 savings challenge. This was a long-form opt-in that I ran twice. Once in July 2017 and once in January 2018. Both times engagement was high, and opt-in conversion was pretty good.

I hope to get this set-up as an evergreen, possibly with a tripwire, for the beginning of September.

???? Goal 3: Improve Work-Life Balance

When I shared my summer 2018 goals, I noted that I’ve developed a bad habit over the course of my career of being a complete work-a-holic. This is an even harder thing to balance when you work from home. We have some really fun family activities planned for July and August, so I want to make sure I’m not worrying about work straight through all of them.

Step 1: Have a set work schedule.

Towards the end of June, I got a lot better at this. But I still have work to do. I choose 4 days a week that I plan to work. Then the other three days my computer stays in my office or backpack.

Step 2: Set up my work days to be as productive as possible.

Anyone else sit down to work sometimes and spend the first hour just messing around on the computer? I’ve found that I need to have a quiet place to work, have eaten a good breakfast, and have a plan every time I kick off a work day. My goal is to exercise in the mornings, have breakfast with the boys, then get to work.

Step 3: Take breaks from my phone.

Working in finance for over seven years has made me like Pavlov’s dog. Every time my phone vibrates I instantly need to pick it up because the text message, email, or Twitter notification must be urgent. To get rid of this awful habit, I plan to have technology detox times. At least one whole day a week and every evening through dinner and bedtime for the boys.

Final Thoughts on Q2 and My Q3 Plans

I only achieved 25% of my goals for Q2. But I still grew my freelance income, got in a good rhythm for working even while living with my in-laws, and am excited about the work I am doing. It’s a good feeling.

I know that to reach my goal of generating $12,000 a month in revenue by December 2019, there is a long way to go. But I have a firm, stubborn belief that I can do this. It is going to happen.

Readers, other bloggers, freelancers – Drop a comment below and let me know what you think of this report and my goals! I want to know if these reports are helpful and if you have any suggestions for me moving forward.

I love your transparency. Building a business is HARD. Anyone who tells you it’s easy is probably trying to sell you something. Keep up the good work, and remember that most businesses lose money at first. You have to keep going to see the “compounding interest” of results

Thanks for sharing your details. I agree with Liz- building a business is tough stuff! Pinterest is a hard nut to crack- it seems very moody, lol! Your baby is so cute, my baby loves strawberries so far.

I read the whole post and found it fascinating, thanks Chelsea!

Thanks so much, Peti!

You are killing it! And I think that goal of 4 days on / 3 days off is an excellent idea. My mom has worked from home since I was a kid (and my dad does some as well), and the two of them have a REALLY hard time stepping away from work for an entire day.

Thanks! I am definitely working hard to stick to that schedule. I know it is way too easy to get sucked into working all the time. Also, super cool that both your parents worked at home!

This is such a fantastic income report!! Really comprehensive and honest – but whoa, you are actually killing it! Give yourself credit, you work a ton, it shows, and rewards are coming your way!! ?

Thanks, Melissa!! That’s so sweet ?

You’re doing an awesome job! And thank you for choosing my post as one of the Rockstar Features :)!!

I’m just like you, I’m addicted to buying blogging courses. I’m nearing $2k now on courses!!