If you want to save for your child’s college expenses, a 529 College Savings Plan is likely your best bet. But did you know that there are over one hundred 529 plans to choose from?

Today, all U.S. states sponsor at least one 529 plan. These accounts grow tax-free, as long as the assets are used to pay for qualified education expenses (which are wider ranging than people think). However, you don’t have to invest in your state’s sponsored plan. You can pick from almost any available program in the country. And not all plans are the same.

The 529 College Savings Plan system is one of the more confusing investment choices for parents. By allowing states to each set up their own plans, each state was able to decide if and how they wanted to incentivize parents to save for college. Some states offer tax deductions for saving. Others provide investment matches based on income.

But how do you know if the benefits from your state’s plan will be completely devoured by the high fees offered in the same program? When should you use another state’s plan instead of your own?

Don’t fret! To help you fix this tangled mess, I did the analysis for you. Let’s look at what you need to know when choosing the best 529 plan for your child!

*This post has been updated to reflect current fees, tax benefits, and investment match offerings as of May 28, 2018.

Table of Contents

What Is a 529 College Savings Plan?

A 529 plan is an investment account designed to help parents save for the cost of college.

Similar to a Roth IRA, contributions to a 529 plan grow tax-free. Meaning any increase in value from the investments is not subject to capital gains or income tax, as long as the account is used for qualified education expenses. These expenses include tuition to a traditional four-year university, community college, or trade school. It also covers the hefty cost of a laptop, textbooks, and room and board.

There are penalties if the funds are used for other purposes. Withdrawals for non-qualified expenses are subject to income tax and a 10% penalty on any gains.

This short video from SavingforCollege.com gives an excellent quick overview of 529 plans:

Why You Should Always Choose a Direct Plan

A direct 529 plan is one which you can purchase and set up yourself, usually online, without the help of a third-party. It takes just minutes and offers lower fees than an advisor-sold plan.

Every state offers a direct 529 plan option. However, many also provide advisor-sold plans which can be purchased through a financial advisor. No matter your state of residence, be sure to choose a direct plan.

Advisor-sold plans come with higher investment fees, usually including front-end load fees. These fees take a percentage of your assets when you first buy-in, ranging from 3.25% to 5.50%. But all you get for this added cost is someone else opening the account for you and giving you some advice on how much to save.

Overall, most 529 plans have very few investment options. And investing through an advisor doesn’t increase the options he or she gets to choose from. They just get to charge you more for it.

Opening a Direct 529 Plan

529 plans are straightforward to set up and allow you to choose age-based portfolios that regularly re-balance to preserve your investment as your child gets closer to college age. Many plans also have a few static index fund options if you want to manage your own asset allocation.

If you are concerned about how much you need to save, there are plenty of free calculators out there to help you determine your monthly savings requirements. You could also check out this post on the $50 college savings plan.

While a financial advisor may be able to provide some value in helping you set up a 529 plan, their value is very, very unlikely to equal the doubling, tripling, and sometimes even quadrupling of investment fees associated with these advisor-sold plans.

Why The Best 529 Plan May Not Be Your State’s Offering

Each 529 plan has different fees and underlying investments. You may be able to achieve better returns, or lower costs, by using an out of state plan.

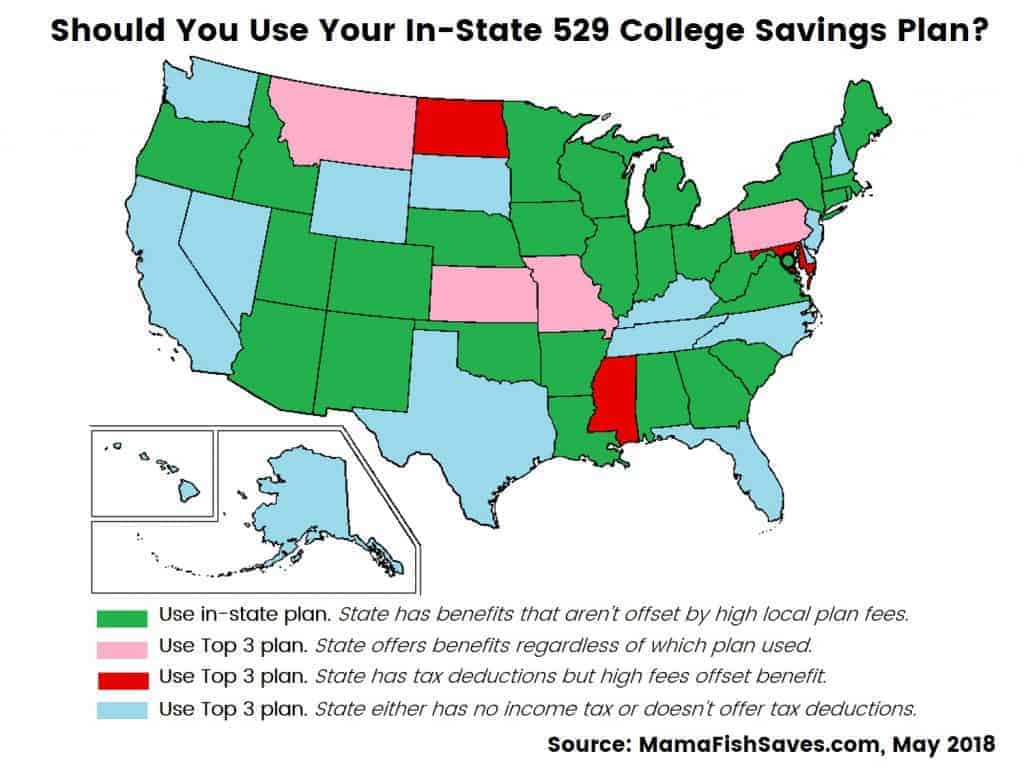

As of 2018, 35 states, plus the District of Columbia, offer state tax deductions, tax credits, or matching contributions to incentivize parents to utilize their in-state 529 plan to save for college. 5 of those states (Arizona, Kansas, Missouri, Montana, and Pennsylvania) are especially impressive. They offer deductions regardless of which plan you choose, in-state or out-of-state so that you can pick the best 529 plan for your family.

The remaining 15 states either offer no benefit or don’t have state income taxes. (As a lifelong resident of CT, NJ, or MA and having to pay city tax when I worked in NYC, I have no idea what it is like to live in a state with no income tax. I assume it’s fantastic.)

The thing is, most of these state income tax deductions don’t save families very much money. Let’s assume a couple filing jointly, with $100,000 in taxable income, contributes $100 per month for each of their two children. Using SavingforCollege.com’s tax benefit calculator, I found that the average amount saved would be $110 per year if the family itemized on their federal taxes, and $149 per year if they didn’t.

Since investment fees can quickly eat up $149 a year, I did a little analysis to figure out whether these tax savings were even worth it.

Testing 529 State Tax Deductions

For consistency sake, I stuck with the assumption I used to test state tax benefits for this test. A couple with taxable income of $100,000 a year invests $100 a month for each of their two children. I assumed they started saving the day their children were born, and that they invested until their children turned 18. Then I went digging through every state’s 529 plan offerings. I looked at management fees, enrollment fees, maintenance fees, and more. If a state offered a match at this income level, I included that benefit as well.

In each state’s plan, I took a moderate, age-based portfolio option to allow for consistency. However, when multiple age-based plans were offered, I always chose the one based in index funds instead of managed funds. This lowered fees and attempted to remove some discrepancy in manager quality.

Then I ran returns from age 0-18, with all fees and a standard gain of 5.50% annually in every state.* I also assumed the couple didn’t itemize on their federal returns and that tax benefits were reinvested into to 529 plan.

What I found was that of the 35 states (+DC) that offer a state-tax break, the tax deduction and matching benefits were worth the fee in 28 of the states (+DC).

Of the remaining 7 states that offered benefits, the hypothetical family would save more by investing in a Top 5 out-of-state plan. For three of the states, this was because the investment fees offset any tax benefit. But in Kansas, Pennsylvania, Montana, and Missouri, you would use an out-of-state plan as you get the tax benefits regardless of where you invest, and fees are lower elsewhere.

*5.50% is less than the long-term average stock market return of +7.0%. However, the age-based 529 portfolios have some allocation to bonds, which lowers the return. The portfolios also automatically get more conservative as your child approaches college age, which would protect your investment but lower the return. 5.50% seemed fair.

A Word About 529 Competition

For a long time, there was a severe lack of transparency when it came to 529 plans. Plan providers buried their fees in long offering documents while discussing in their brochures how the plans had the best interest of families at heart. This caused a distrust of 529s in general, especially as parents didn’t see the growth they expected. With the rise of the internet and a savvier investor, things have changed.

When I ran this analysis in 2017, 11 states changed an annual flat account fee or enrollment fee. As of 2018, only 2 of these 11 states continue the practice. (Both Washington and Wyoming created new plans this year, both of which have annual fees. Boo!)

In addition to the drastic reduction in account fees, asset management fees and expense ratios also fell. Looking at age-based investment options, asset-based fees fell in 12 states.

While the range of fees for similar investments is still wide, the margin is closing. High fee states like North Dakota, Montana, and Hawaii will have to lower fees if they want to attract customers. This article will be updated annually to reflect new fees, and I expect the 529 College Savings Plans to become an even more attractive option for college savings over time.

States With 529 Plan Matching or Other Benefits

The standard benefit states offer for saving in a local 529 plan is a tax deduction or tax credit. But 12 states offer additional benefits, particularly for lower-income families, for saving for college.

Check out Maine’s benefits to see what it looks like for a state to support its residents’ education!

- Alaska: Alaska has no state income tax or matching benefit. However, by selecting the ACT Portfolio in the University of Alaska College Savings plan, parents are guaranteed returns of at least the annual inflation of tuition at the state’s university. With college tuition rising an average of 6% a year, this is a great perk!

- Colorado: Colorado’s Direct Portfolio College Savings Plan offers two benefits.

First, the Matching Grant Program matches 1-1 any investments up to $400 for lower- to middle-income state residents. Residents have to submit an application each year and benefits can be extended for up to five years.

Second, the CollegeInvest 529 Scholarship offers a $2,000 scholarship to any full-time student and resident that has maintained a CollegeInvest account for at least two years and can prove an expected family contribution between $5,000 and $25,000. This is renewable for a total of 4 years. - Connecticut: The CHET program provides a $100 529 contribution to any family that opens a 529 plan and contributes at least $25 before the child turns one. The program will match an additional $150 of contributions made before the child turns 4. <– Our new home state! We took advantage of this for Baby Minnow!

- Kansas: The LearningQuest 529 Plan offers a 1-1 match, up to $500 a year per beneficiary, for families that make less than 200% of the federal poverty line. Families need to apply each year.

- Louisiana: The Louisiana START Savings Plan doesn’t offer a match. But the plan will offer a 2%-14% enhancement of savings, depending on income level, when it is time for the plan to be utilized.

- Maine: Maine’s NextGen College Savings Plan is the gold standard for matching funds. In-state residents are eligible for matching contributions every year, regardless of income. Benefits include:

– A $200 initial match per beneficiary upon account opening.

– A 50% match each year, maxing out at a $300 grant per beneficiary per year.

– A $100 grant if an account has six or more automatic contributions in a row. - Maryland: The Maryland 529 offers a $250 match when opening an account for single filers that make less than $112,500 a year or families filing jointly that make less than $175,000 a year.

- North Dakota: The BND Match program offers a one-time match of contributions up to $300 per beneficiary for residents and active duty military families with incomes below $80,000/$120,000 (single/joint filers).

- New Jersey: NJBEST 529 beneficiaries are eligible for a one-time scholarship of up to $1,500 for any NJ college or university. This does have some contribution requirements.

- Rhode Island: CollegeBoundFund Direct offers a $100 CollegeBoundBaby grant when an account is opened in the baby’s first year. However, this is not automatic. A request needs to be sent to the state treasurer.

- Tennessee: Eligible low- and middle-income families can receive $100 for a minimum $25 investment or $500 for a minimum $125 investment. Families can reapply each year to receive up to a max benefit of $1,500 per child.

- West Virginia: The SMART529 WV Direct College Savings Plan offers a $100 contribution if a 529 is opened in a child’s name before their first birthday.

The 3 Best 529 Plans on the Market

If you live in one of the 21 red, pink or blue states on the map above, listen up!

You will maximize returns for your child by choosing from one of the best 529 college savings plans on the market. These plans have low fees, flexible investment options, and are open to out-of-state residents without slapping on higher fees. Let’s check out the five states with fantastic 529 plans!

Illinois

Plan: Bright Start College Savings (Direct)

Plan: Bright Start College Savings (Direct)

Fund Manager: Union Bank & Trust Company

Maintenance fee: $0

Minimum contributions: No minimum contribution

Moderate, Age-Based Fund: IL Bright Start Index [Age-Based]

Total fee: 0.12% of total assets

Other benefits: N/A

Illinois offers a great, low-cost option for saving for college with an easy to use investment platform. With no minimum contribution, there are no excuses not to get started today!

New York

P lan: New York’s 529 Program (Direct)

lan: New York’s 529 Program (Direct)

Fund Manager: Ascensus College Savings (Vanguard underlying funds)

Maintenance fee: $0

Minimum contributions: No minimum contribution

Moderate, Age-Based Fund: NY 529 Direct Con Age-Based Mod Gr

Total fee: 0.15% of total assets

Other benefits: New York’s 529 Plan connects to UGift, a secure system for grandparents, family, and friends to contribute directly to your child’s 529 plan.

New York’s plan offers a diverse set of investment options with three age-based options and 13 individual static portfolios. With low fees and professional management and underlying assets from Vanguard, this is an excellent low-cost 529 plan!

Nevada

Plan: The Vanguard 529 College Savings Plan

Plan: The Vanguard 529 College Savings Plan

Fund Manager: Upromise Investment, Inc. (Vanguard)

Maintenance fee: $0

Minimum contributions: $3,000 initial contribution out-of-state ($1,000 in-state), $50 thereafter

Moderate, Age-Based Fund: NV Vanguard Mod Track [Age-Based]

Total fee: 0.16% of total assets

Other benefits: N/A

I love Vanguard, but they fall short when it comes to 529 plans. While fees remain close to Illinois and New York, the high initial contribution makes it a less compelling option for many families.

The Vanguard 529 plan is the one we currently use for Fuss Fish. While fees were slightly lower at some of the above providers, I liked the idea of all our investments being in one place. This got a bit blown up by moving to Connecticut and opening a CHET plan for Baby Minnow. Oops!

The Vanguard 529 is still a strong plan if you are going to make a significant contribution to start your child’s account anyway.

The Best Way to Save for College is to Start Early

There are a lot of college savings plans out there, and choosing the best 529 plan for your family can seem overwhelming. However, it doesn’t have to be. If you live in a green state, pick your in-state plan, set up an auto-deposit into the account, and let it do its thing. If you live in a blue or red state, choose whichever of the three funds above look best to you and do the same. The most important thing is to start early and not let the analysis paralysis of this confusing system prevent you from saving for your child’s future!

What color state do you live in? How are you saving for your child’s college? Let me know!

Wow. Great resource! Great advice. And as a visual learner, great map! I’ll be sure to share this widely.

Thanks Teacher Investor!! The map was fun, and the data is staggering. The difference between using the best 529 and the worst can be over 12% of your total value, and that’s assuming you use the lowest cost funds in each plan. If you use actively managed funds or advisor sold plans, it can easily get to over 20% of value lost!!

Thanks for sharing! Hope it helps some parents preserve their investments 🙂

Holy awesomeness! This is really going to come in handy when i set up baby 2’s 529 in August! Thank you!!!!

🙂 Thanks Budget on a Stick!!! And congratulations on baby #2!

The number of options in this system are out of control, and it’s too easy to fall in the trap of a bad plan. It was a lot of fun reading through every state’s rules and offerings to put it all together. Curious to hear if you pick a different plan than you have with #1!

Wow this is a lot of great information! Our baby is still young, but we’ve talked about this topic a couple of times. Mr. FAF and I haven’t put money into any college fund yet, but I realized we will need to do that soon.

The sooner the better 🙂 It is pretty awesome that 4 of the top 5 plans only require $25 to get started! We were very lucky and my in-laws gave us a check to start our son’s college savings as a gift when we told them we were expecting, which helped clear the high minimum of Vanguard.

Great stuff. I had calculated the tax savings of the 529 in Virginia, but never considered the cost of fees.

Virginia’s fees aren’t so bad compared to some states, but that $25 fee to open the account doesn’t help based on how much you are saving. Only VA and FL have fees to open the account (FL’s is $50!).

Thanks for reading!

I’m fortunate to be in a green state (Michigan) that had reasonable fees and provides a great tax deduction for up to $10,000 in contributions. It seems crazy to me that any state wouldn’t provide a deduction to encourage college saving!

Woo! Yay Michigan! Lucky you 🙂 There were definitely some states as I went through my research where all I could think was, “You really don’t want your citizens to go to college, do you?”

Interestingly, for all the hating on Wall Street in the media, the states where the State Treasury ran the plan had some of the most egregious fees. They were also the plans where fees and explanations were hardest to find.

Boo. We are in a red state (Maryland). With our current state income tax rate, we get an 8% return through state tax deduction. However, we only have ever contributed up to the deductible amount in a given year. Any overage, we’ve put into taxable investments to provide ultimate flexibility in the event we didn’t need all the savings or if one of them didn’t go to college (and now both of these things appear to be a reality at the moment). I’m not sure when you pulled the fee data, but MD has been reducing their fees.

I think you map is very helpful to other parents.

All the fee data is current, I pulled the most recent Disclosure Statements from the state websites. The killer part for Maryland is the $10 annual account maintenance fee. Only 9 states have plans with annual fees like that and none of the top 5 do.

Then, for the age-based plans I was using as a proxy to compare across states, Maryland is ~0.81% total fees. This compares to the top 5 under 0.20% fees for similar plans. I can send you more info on how I did the math if you are curious!

Glad you like the map! It was fun to make 🙂

Wow – thanks for doing all this great analysis – this is an awesome resource!

Excellent and informative post. Our family has also opted to use Vanguard for child savings. The biggest takeaway is to start early and the tip I recommend to families is to actually set-up a ‘baby-fund’ as they prepare a registry – think of it like a honeymoon fund, accept your using the money towards a 529 plan. This is one method to help reach the minimum contribution for Vanguard.

P.S. just came across your site tonight and look forward to reading/learning more.

Love the idea of a baby fund! Definitely a good way to get to the minimum contribution needed for Vanguard. Thanks for reading, Bridget, and for your kind words! 🙂

DC just recently awarded a new management company the contract to run its 529 plan. Does your analysis reflect this new plan manager and their fees?

Yes, DC switched over to Ascensus College Savings this year. This analysis uses the new plan manager and their fees.

The DC plan is a decent one and with the tax benefits, is definitely worth using if you live there. The one disappointing thing is that it has a $10 annual maintenance fee. Of the 48 states plus DC that offer 529 plans, only 9 have annual maintenance fees.

I live in WA. No income tax Yay! But talk about a lame 529! I need to start a Nevada 529 for my youngest son. Go Vanguard!

I live in MD, may move to TX next year and manage almost my entire portfolio with Vanguard. I’m trying to decide why most folks choose the Nevada plan over the New York one given that both have the same fund manager (Upromise) and investment options (Vanguard) while Nevada expense ration is 0.19% while New York’s is 0.16%, not to mention the low minimum contribution needed for NY. The $3000 minimum is fine for me, still though, why the Nevada plan over the NY plan if one had to choose?

Hi Riz! New York definitely has a slightly better plan, but I think for most people it is a convenience factor when they choose Nevado over NY. All my other investments are at Vanguard, so I’m willing to take the 0.03% fee to keep the boys’ 529s in the same place.