When you have kids, finding an easy college savings plan can be difficult. College is so expensive and, as a generation laden with student debt, we don’t want our children to struggle as so many of us have. Luckily, automating your college savings with only $50 a week can successfully prepare your youngster for a college experience without loans! Let’s walk through the plan so you can get started today!

When you have kids, finding an easy college savings plan can be difficult. College is so expensive and, as a generation laden with student debt, we don’t want our children to struggle as so many of us have. Luckily, automating your college savings with only $50 a week can successfully prepare your youngster for a college experience without loans! Let’s walk through the plan so you can get started today!

Table of Contents

How Much Do You Need to Save?

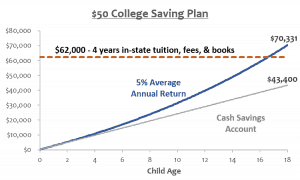

The $50 College Savings Plan assumes you are saving for in-state tuition, fees, and books. According to College Data, the average cost of tuition and books at an in-state college was $10,880 in the 2016-2017 school year or $43,520 for a four-year degree. While that number sounds high, it will only get higher as our little ones get older. Assuming 2% annual cost inflation and that your child is still a baby, by the time your child turns 18 a four-year in-state degree will cost $62,145.

Over $62,000 is significantly more than most people have saved for retirement and may be more than the down payment on your home. However, don’t get scared off by that large number! Saving for college can be easy if broken into more digestible $50 increments.

How To Do the $50 College Savings Plan

The $50 College Savings plan is all about simplicity and consistency. Here are the 5 key components of the plan.

1 – Save $50 every week (or ~$200 a month)

Every month, make saving for college a priority in your budget. Put away $50 every week, or about $200 a month, into an account specifically for your child’s college. $50 a week might seem high, but if you are the average American household (total income of $54,000), this is less than 5% of your income.

If money is tight, there are lots of easy ways to make $200 a month on the side. 2-3 hours a week driving for Lyft, transcribing audio online, or sign your credit card up for a Upromise account that gives cash back directly into college savings plans. And remember, if you are the average American household (total income of $54,000), this is less than 5% of your income. There are probably places to make cuts that prioritize your child’s education!

What if you want to pay for more than in-state tuition? If you want to fund room & board as well tuition and books you will need to save $80 a week. And, if you want to give your kids a full suite of college options, you will need to put away $150 a week, or $600 a month, to cover all expenses at the average private college.

2 – Open a 529 Plan

529 plans are special saving and investing accounts to save for college and can be used for any trade, college, or graduate school expenses. 529 plans offer incredible tax benefits to incentivize parents to save for college. While contributions to 529 plans are not tax deductible, your savings grow tax-free! This means all your capital gains (the returns on your investment) aren’t taxed when you take money out to pay for higher education expenses. 33 states (+DC!) also offer state income tax deductions for contributions to 529 plans.

However, even if your state does offer tax deductions, it may not be enough to offset the higher fees associated with your in-state plan. If you are opening a 529 plan for the first time, check out this post on picking the best plan for your family, based on where you live. I looked at over 100 529 plans, and narrowed it down to the top choices for you!

3 – Keep money invested, not in cash

Saving for college is one of the many times compound interest can work strongly in your favor! Assuming a 5% annual return on your investments (adjusting for inflation the long-term return of the stock market is 7%), $50 a month will allow you to comfortably achieve the college savings goal. However, if you keep your savings in cash, you will end up with over 35% less in savings when your child is ready to go to school!

I recommend a diversified, low-cost index funds. Some 529 plan providers, like Vanguard and Fidelity, have specified low-cost funds for saving for college that manages your asset allocation as your child gets closer to college. For instance, Fuss Fish’s 529 plan is invested in Vanguard’s age-based plan.

4 – Start Early!

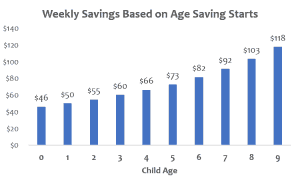

The $50 College Savings Plan assumes you start the first month your baby is born. Because of the compound interest benefit, the earlier you start the easier it is to save. Below shows how much you have to save each week to get the same benefit as starting when your child is zero, from baby to age 9. Waiting until age 8 means you will have to save double every week to grow your child’s college fund!

Another benefit of starting saving for college early is that by adjusting your budget for it early you soon won’t even miss the $50 a week. If you wait until middle or high school to start saving for college, not only will the dollar values needed be much, much higher, but adding a new category to your budget when you kids are older and need money for allowance and sports, adjusting to that expense will be harder.

5 – Automate, Automate, Automate

Every additional minute it takes you to move your college savings into your child’s account increases that likelihood that you just won’t do it. You’ll forget one month, then two, and suddenly you will be 6 months behind. Figure out how much savings needs to come out of each paycheck, or how much you need to save a month, and set your 529 plan to automatically pull that much money from your checking account.

Start saving today!

Start the $50 college savings plan today to put your child on the right foot for an education. Time is money and college is already expensive enough! If you were lucky enough to have your parents pay for your college education, think about how valuable that was when you graduated debt free and how great it would be to offer that to your children. If you had college debt (and maybe still do!), you know the real drag that can be post-graduation and will be motived to find that extra $50 a week for your child’s future. Save consistently, invest in low-cost, diversified funds, and automate any part of the process you can to ensure your savings reaches your goals!

How are you saving for your child’s college? What questions do you have about preparing for college expenses? Let us know!

Do you think college is worth the cost? I say this because I have 3 sisters who are 11, 13, and 15, who are looking to go to college. I try to advocate that they look to start a business or something (a blog would be fun :))

I came out of college and got a solid job. Higher education is essential, but one has to know there are other options.

Thanks for sharing, saving done consistently adds up in the long run!!

Hi Erik! I do think state college, at minimum, is worth the investment. My husband and I plan to stress the importance and viability of a career in the trades or entrepreneurship for our kids but I think by the time our children are grown a college degree will be what a HS diploma is today. Just a necessity.

Thanks for your thoughtful comments!

We use 529s and started much too late. We plan on cash flowing now. It’s so important to have the open discussion with your children about cost, career, college choice, etc along the way so they understand all of the reasons behind one big decision.

We really like the idea of a college compact. I hope to have an open discussion through high school about cost, college choice, goals. College is such a huge decision for teenagers who often can’t think an hour in advance! Thanks for sharing Brian! Sounds like your kids are starting off with some awesome guidance.

We have 529s for both our boys but just started the automated payments. It makes it so much easier than consciously doing it! My parents paid for college for me and I want to be able to do the same thing for my kids.

That’s great!! Your boys are very lucky! Automating definitely makes things easier 🙂

I love this! I need to get started with some sort of plan. Thanks for the guidance!

Thank you for sharing this informative plan. I’m not too familiar with US college plan so I felt like i learned something. xx

Thank you for the good tips! Saving is so incredibly important for the future!