It is well known that 529 plans are the best way to save for your child’s higher education expenses. 77% of parents who are saving for their child’s college expenses are using a 529 plan, according to the College Saving Survey by Savingforcollege.com. And with over 80% of parents wanting to pay for at least 50% of their student’s expenses, we all want to be prepared and start saving early. But what happens to your 529 savings if your child doesn’t go to college? Does a 529 plan make sense if you don’t know what your child’s future will hold?

It is well known that 529 plans are the best way to save for your child’s higher education expenses. 77% of parents who are saving for their child’s college expenses are using a 529 plan, according to the College Saving Survey by Savingforcollege.com. And with over 80% of parents wanting to pay for at least 50% of their student’s expenses, we all want to be prepared and start saving early. But what happens to your 529 savings if your child doesn’t go to college? Does a 529 plan make sense if you don’t know what your child’s future will hold?

Not all 529 plans are created equal and what is best for your family may depend on where you live. Check out this post on choosing the best 529 college savings plan to make sure you are getting the most bang for your buck!

Table of Contents

Remember that any higher education expenses count

When it comes to using a 529 plan, it isn’t just for a four-year college degree. 529 plans can be used for associates degrees, trade and vocational school, online colleges and graduate degrees. If your child wants to go to beauty school, become a mechanic, or train to be a world-class chef, chances are there are programs at home and abroad that are eligible for 529 spending.

If your child wants to start a business, you could recommend they take some courses at the local community college. They don’t have to pursue a full four-year degree, but a few business, risk management, and accounting classes will get them off on the right foot and generate some qualified expenses for that 529 plan.

Just because they are college age, doesn’t mean the money has to be withdrawn now

Plans change, especially for young adults that are just trying to determine what they want to do with their lives. You always have the option of keeping the account open in your child’s name to continue to grow in value. If they decide later in life that they want to pursue a four-year degree, that money will be there for them. If higher education simply isn’t in the cards, you do have some other options.

- Change the beneficiary of the account. Most 529 plans allow you to change the beneficiary of a 529 plan once a year, as long as it stays within a family. Change the beneficiary to a sibling, cousin, grandparent, or parent and let them use the value for their own expenses.

- This allows for a lot of flexibility. If your spouse is interested in getting their degree or maybe taking some secondary classes, the 529 beneficiary can be changed to them. They can use some of the account, and then have the beneficiary changed back to the original holder or to another family member once they are done.

- Save for future generations. You can allow your child to keep the account in their name and have the beneficiary changed to their children in the future. The extra 20-plus years of gains will be significant and leave a solid nest egg for your grandchildren’s education!

You’ll pay taxes plus a penalty for non-education expenses

Non-qualified 529 plan withdrawals are taxed as income at your marginal rate, in addition to a 10% withdrawal penalty. But remember, these taxes are only on the gains in your 529 account. The deposits you made to your account over the years were made with after-tax money, which means that principle can’t be taxed again.

If you really just want to withdraw the money for your child to use to start a business, buy a house, or simply want to take the money out for your own retirement you can absolutely do so. However, I would run through the math to make sure you are comfortable with the money you are giving up to taxes first. If the money is coming out for your child, be sure to explain to them the tax loss as well.

The Math – 529 Plan versus Traditional Investment Account for a Child That Doesn’t Go to College

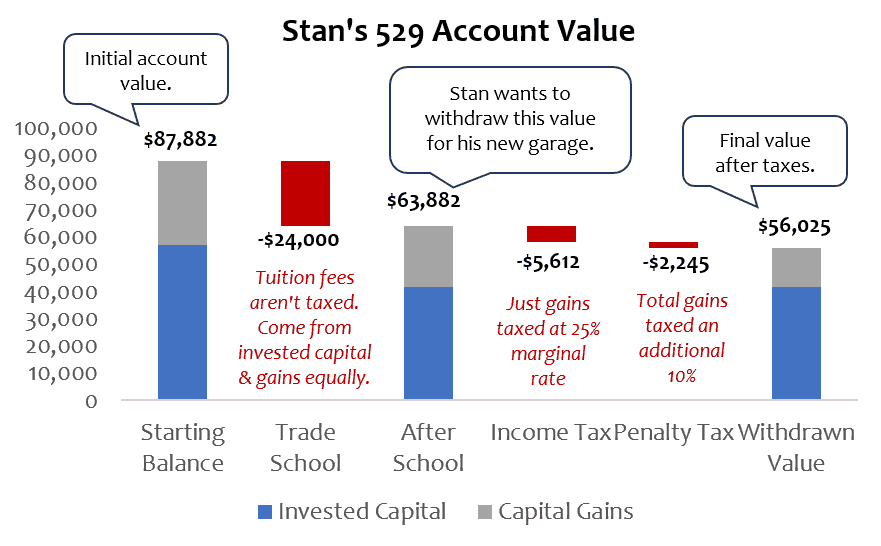

Stan’s parents have been saving for his college expenses since he was born. They put away $3,000 in a 529 plan every year and saw an average annual return of 5% with 0.4% fees. Stan’s parents have a household income of $110,000, meaning their marginal income tax rate is 25%.

Now that Stan is 18 and graduating high school, his 529 plan has $87,822 in it. However, Stan doesn’t want to go to college. Stan wants to become a mechanic and open his own small garage. He has found a technical school that offers full mechanic training for domestic and foreign cars. The program will take one full year and cost $24,000. After that, he has requested the rest of the money in his 529 plan be used to help him open his garage. Below is the step-by-step walk of the value of Stan’s 529 with his plan.

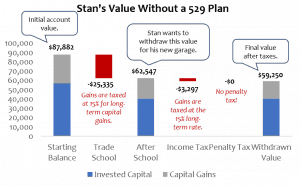

Now, if Stan’s parents hadn’t used a 529 plan and had instead started a traditional, taxable investment account to save for his future the withdrawals would have looked slightly different. His mechanic school would be more expensive since Stan’s parents would owe capital gains tax on the growth his account had seen, but the tax on the money for his new garage would have been lower.

With a traditional investment account, Stan would have just over $3,200 more for his garage than he does with the 529 plan. This makes sense as a 529 plan is built to benefit college expenses, not normal savings. Had Stan chosen to go to college and use the full value of his 529 plan for school, the 529 plan would be over $4,600 more valuable to him than a traditional, taxable account.

Should you use a 529 plan?

529 plans offer incredible benefits for a broad range of higher education expenses. The tax-free growth and high contribution limits make it a powerful tool. While Daddy Fish and I are far from certain on whether Fuss will go to college, we are aggressively saving in his 529. Our plan is to save enough for in-state college tuition, room & board in a 529 and keep any additional savings set aside for him in a taxable investment account in our name. The hope is that this blend gives us, and him, the best value for our savings.

It is impossible to know who our little people will grow up to be. When we start saving for their future we can’t know if they will want to be astrophysicists, firemen, teachers, or soldiers. But whatever they choose, the value of their 529 plan isn’t lost if they choose not to go to college. By starting to save early, they will have plenty of options.

Do you have a 529 plan for your child? Do you have a plan for the funds if they choose not to go? Let me know!

This post was proofread by Grammarly.

Hey thank you so much for this quick breakdown of 529. I have one for my child. They are up in the air between law school and becoming a chef I know to polar opposites. Great job and awesome blog

Luckily your 529 will work for both law school and culinary school! Polar opposite options but that’s just where teenagers should be. How are they supposed to know what they want to do for their whole careers? Has your child thought about taking a gap year and working in a kitchen or interning for a law firm? Might help them make a decision.

Glad you enjoyed the post! Thanks for reading and sharing!

I don’t have a 529 plan yet, been thinking about it though. My kid is 15 months old. I think I would take some of the money to travel with my kid is she doesn’t want to go to college. The rest I will save up for when she needs it for something else, like a business venture or renting or whatever could be useful to her.

Travel sounds like such an amazing idea if your daughter doesn’t want to go to college! Such a great bonding experience and a chance for her to learn more about the world. 15 months old is a great time to start a 529 plan! Saving for college is a lot less stressful if you give yourself more time.

Thanks for reading and sharing your thoughts!

This was so helpful! I had no idea how these worked. Thank you for writing this!

It is surprising how many people don’t know how they work when so many parents have them. Glad I could help! Thanks for reading 🙂

Very comprehensive post Chelsea. I didn’t know how they worked and now plan to utilize a 529 for my kids. If they don’t use it, I can keep it for the grandkids 🙂

Thanks for sharing.

This is a great explanation! I have read of someone else doing a 529 + investment account. J$ and another blogger also talked about getting relatives to gift into the kids 529 instead of so many physical gifts. I’d rather give my friends kids $ in a 529 than buy wrapping paper or magazines. 🙂

Getting family and friends to contribute to a 529 is a great idea! My son’s grandparents did that for him when he was born, it was what got us started 🙂

Ah! I am so glad I found this post! We’ve been debating about the best way to save for our kids’ college. My husband was very leery about doing a 529 because it can only be used towards college. You made some very good points in this article that have answered some of our questions. This is going to help us make an even more informed decision. Thanks!

So glad it was helpful! My husband had the same questions about starting a 529 for our son when I was pregnant. He thought it was only good for college expenses, and didn’t want to lock our son into a path before he was even born. A totally valid concern, but not necessarily the case with a 529!

Thanks for reading! Good luck making a decision for your family 🙂

I’ve always wondered about the “what ifs” of starting a 529 for someone that may not go to college. Thanks for this!

So glad it was helpful! Thanks for reading!

We have a 529 set up for my son and if he doesn’t use it we plan to use it for our next child. Hopefully it will become pretty apparent if they’re going to use it or not. If not, we may be in a bind trying to figure out if we should take the hit or roll it over to a cousin or not.

Lots of good points in your post and all helpful information. I also think it’s important to add that a 592 plan is a state run program. Which means that while they are very similar in what they accomplish and are for, they have a few differences between states. One example is the amount of time before the first withdrawal can be made from the account. People should just consult their individual state rules of the plan to make sure they understand how it works fully. Thanks for sharing!

Speaking of states, in some states you also get a state tax deduction for 529 contributions along the way. This may close the gap between 529 vs. Traditional investing returns if johnny doesn’t go to college. Check with your state to be sure.

Good point! I, unfortunately, don’t live in one of those states, but I definitely should have mentioned it! Thanks for bringing it up!