Whole life insurance has to be one of the most universally hated products by the personal finance community. However, despite the scorn, whole life insurance is still sold broadly by any financial advisors and insurance agents, driven largely by its very juicy commission rate. Buyers are led to believe the policy’s investment benefits outweigh the higher costs and they’re sold on the security of a permanent life insurance plan. As such, explaining the benefits of term versus whole life insurance is one of the most common questions I get from friends, family, and readers. To answer, as always, it is helpful to do the math.

This post may contain affiliate links. For more information, please see my disclosure.

Table of Contents

Whole Life Insurance vs. Term Life Insurance: Meet the Players

Before we dive into the math on whole versus term life insurance, it helps to know the basics of the products.

Whole Life Insurance: An insurance policy that, if kept up to date, pays a predetermined “death benefit” upon the passing of the insured. In addition, over time the policy builds a cash value from which the insured can borrow and which is also paid out to beneficiaries upon the passing of the insured.

Term Life Insurance: An insurance policy that exists for a certain period of time (the “term”), including increments of 10, 15, or 20+ years. Costs are much lower than whole life insurance, but the policy builds no cash value. If the insured does not pass during the policy’s term, it has no value.

The single biggest factor that sells most people on a more expensive whole life policy over a term policy is the ability of the whole life policy to build cash value. They stop viewing the policy as just insurance and start viewing it as an investment. An understandable but unfortunate trap.

I’m not going to dive into all my complaints about whole life insurance in this post. I covered it somewhat in my post on life insurance for kids and I want to focus on that supposed investment aspect. How does your cash value in a whole life policy grow and how does it compare to if you just purchased a term life plan and invested the difference in premiums? That is the math we are going to tackle.

Whole Life Insurance vs. Term Life Insurance: Doing the Math

When I was pregnant with my son, I took a meeting with a financial advisor as a favor to a friend. He was just starting his business and looking to make contacts. Unsurprisingly, he wanted to sell me on whole life. Now, I had no intention of buying such a policy, but I am incredibly detail oriented. I asked him to send me over a quote and a mockup of how the cash value would build over time. This mockup is the basis of this side-by-side comparison.

The Basics: Looking at the Quotes

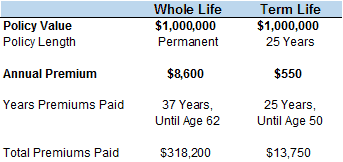

When I received these quotes (the whole life from the financial advisor, the term from USAA), I was 25 and pregnant. I’ve never smoked, I don’t drink, have healthy blood pressure and cholesterol and exercised regularly. According to Social Security actuarial tables, my life expectancy is 82. Based on a super fun calculator from John Hancock, my baseline life expectancy is 85 and my projected (based on health) is 97. Here are my life insurance quotes:

I chose to get a quote for a 25-year term policy as it would cover until our son, and potentially our second child, was out of college. We would have no debts (the house should be paid off long before that) and I would be at, or nearing, retirement. At this point, I hadn’t heard of the FIRE movement and wasn’t preparing for an early retirement! Silly me!

If you want help determining how much insurance you need, check out this easy calculator.

Comparing Investment Values

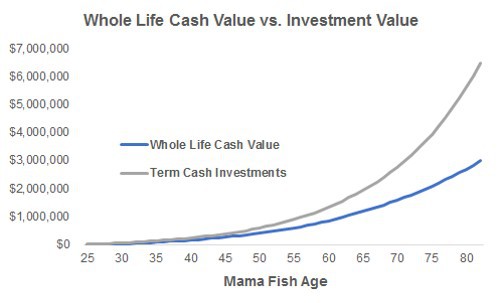

The mockup of the whole life plan the financial advisor sent over was very thorough. It included a cash value and death benefit value every 5 years from age 25 to 100. The projections were based on a 7.5% annual return in the S&P 500, which gave me a baseline with which to directly compare how the cash value would compare to buying a term policy and investing the difference in premiums.

I used the same 7.5% S&P return, a 0.10% mutual fund fee (higher than the actual fees on my current Vanguard three-fund portfolio), and I assumed any difference in premiums was invested each year. This meant $8,060 a year was invested from age 25 through age 50, then $8,600 a year from 50 to 62. Here’s how the cash values compared.

In every single period, the value of my investments (had I bought term and invested the difference in premiums) would have been higher than the whole life cash value. Higher fees, what the insurance company views as cash contributions versus the cost of a permanent life insurance policy, and functions of whole life policies that give you certain security on the downside while removing some upside means it always underperforms a long-term investment in the market.

If I lived to my expected Social Security life expectancy, 82, I would have almost $6.5 million in investments just from the difference in premiums. The cash value of a whole life policy would be only $3.0 million. If I lived until 97, as that flattering John Hancock calculator suggests, the difference rises to $18.9 million in investments versus a cash value of only $5.7 million. Ah, the beauty of exponential growth!

The truth about whole life cash value

We can see that the value of investments from premium differences outstrips cash value on a whole life plan, but there is actually a bigger issue. The cash value of your whole life insurance policy is NOT free money!

Many people imagine themselves using the cash value of their whole life insurance policy in retirement, but it isn’t like a traditional investment account. Your term investments you could access anytime. Yes, you may owe some capital gains tax, but that money is yours. To take your money out of a whole life plan, you have to borrow it! That means interest.

This policy I was quoted charged interest at the current market rate when you wanted to borrow. At the time their rate was ~3.5%. The interest would be deducted from the death benefit. The loans wouldn’t have a due date, but if I passed before I paid it off the amount would be reduced from the policy’s death benefit.

In addition, the loan is tax-free while I’m alive, meaning I don’t have to pay any tax on the cash value removed from the policy.

Using money from an investment account is your money and allows you to pay cash for your expenses in retirement. Borrowing from the cash value of your whole life policy means a loan, and most finance professionals agree that a traditional loan (from a bank or third party) is usually better than a whole life loan.

Comparing Death Benefits

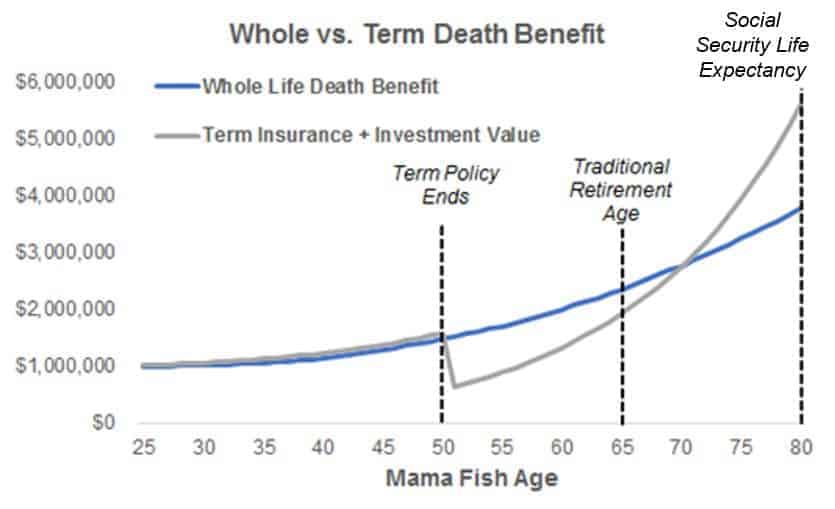

Now, I can already hear all the angry whole life policy salesman yelling at me that the above comparison completely ignores the insurance part of these policies. And they’re right! A whole life policy will pay out the policy value, here $1 million, and some amount of the cash value regardless of when you pass away (this increasing amount is known as the Death Benefit). After 25 years, that $1 million policy from the term policy goes away. But hopefully, they can hold their tongues for just a moment while we compare death benefits. Because it isn’t a pretty picture for whole life policies either.

To compare apples to apples, I included the value of the investments you would have from investing the difference premiums if you went with a term policy. This is because the whole life death benefit includes the $1 million of the policy plus some increase in value, and they show this growing benefit as a selling point. Here’s how it breaks down.

As you can easily see, sometimes the total death benefit is higher in a term policy, and sometimes it is higher in whole life. In fact, in 20 out of the 58 years shown here, whole has a higher death benefit than term. So what is better?

The worst happens

Why do we buy insurance? To protect our families and help cover debts, lost income, and funeral costs if we pass away unexpectedly while we still have dependents. Thus, the most important segment of the above chart is from the start of the policy until the end of the term policy. That is when you actually need insurance and a death benefit payout, or lack thereof, will have serious implications for your family.

Luckily, in that 25-year window, the payouts are relatively similar. The term policy payout plus your investment value is always somewhat higher. This is because the investment value we talked about earlier is higher than the growth in your whole life death benefit! On average across the 25 years, a term policy plus investments will net your family 5.9% more, or $70,000 on a $1 million policy.

It is important to remember that the reason term policies are so cheap is that the likelihood of you passing away in that window are very low. For me, according to those handy Social Security tables, there is only a 3.6% chance I die between the ages of 25 and 50. If that 3.6% chance occurs, I certainly want my family to be protected. But while thinking of depressing things like how my family would fare without me I like to remember that my life expectancy is still over 80!

The end of term

You can easily see in the chart that from the end of my term policy, age 50, until age 70, whole life’s death benefit is winning out. If I kick the bucket during that period my family would get a higher total death benefit from whole life insurance by an average of over $500,000. But who’s counting?

Given that my trusty Social Security table says there is a 17% chance a woman who lives until 50 will die before she turns 71, how much value should I put on this higher whole life death benefit? In my opinion? None! Zip! Zero!

I don’t buy life insurance to pad an inheritance for my spouse and kids or build a legacy. I do it to protect my family from the worst. For us, the worst would be something happening to me while the kid(s) are still in the house, we still have a mortgage, haven’t completed the kid(s)’ college funds, and haven’t fully built our retirement savings and achieved financial independence. By age 50, all those concerns are gone! Maybe my husband would be comforted by an extra $500,000 in the bank, but he would probably buy a boat. He certainly wouldn’t need that money for anything crucial.

Plus, statistically, my husband and son are going to be stuck with me well past 70.

Stayin’ alive, stayin’ alive, ah, ha, ha, ha…

Social Security expects an average 25-year-old woman to live until 82. With constant advances in medicine, life expectancy only seems to increase each year. Who knows, maybe I live to blow out an inferno of candles on my 90th birthday like my grandmother!

Over time, the growth of your investments had you done term life insurance and invested the difference in premiums overtakes the $1 million policy value of whole life. From age 70 on, the net worth of your investments by doing term far surpass the death benefit value of the whole policy. Potentially by millions.

Why Whole Life Isn’t Worth It

Mixing insurance and investments is generally a bad idea. It leads you to believe you need life insurance permanently, which most people don’t as they build net worth and retirement funds over time while at the same time reducing dependents. It also means underperforming “investments” within the whole life policy that actually reduce your potential net worth over time. Keep your investments, and use insurance in the amount you actually need, for the time period you actually need.

What do you think of whole life insurance? Do you believe the “investment” aspect has value? Drop a note in the comments and let’s chat about it!

Disclaimer: Please note that not all whole life insurance policies are exactly the same and investment and cash values are based on a static S&P 500 assumption of 7.5% returns. The number of years you pay premiums (before the cash value of your policy takes over those fees), exactly how the cash value builds and other assumptions based on market returns may differ – for better or worse – in any policy you look at. This is just meant to be illustrative.

Wow, I knew that Whole Life often wasn’t the best decision, but this analysis is eye-opening… I’m amazed at the cost! I’ll go ahead and keep my money in the market with a Term Life policy for coverage 🙂

My work only offers a term policy and I’m cool with that. It is super cheap and by the time I retire, hopefully I’ll have enough of a nest egg, that it can be the insurance for my family ?

“Buy term and invest the rest” is a better plan, as long you actually invest the rest. The math clearly favors term, just as evidence supports high income earners using traditional rather than Roth retirement accounts.

Roth and whole life do force additional “savings,” but at a price I wouldn’t be willing to pay. If a failure to save enough is the problem, there are better ways to fix the behavior than less-efficient investments.

Best,

-PoF

Totally agree! I hate the “well most people aren’t disciplined enough to actually invest,” argument. We all have our failings, but I would rather educate and work to improve than turn over huge amounts of my investment value over time.

Oh dear I should know this…my husband picked out a plan for himself but I can’t recall what he chose. I actually think he took a look and selected Whole Life (at the time, we didn’t know what we were doing and had no idea what any of it meant.) I’ll ask him tonight – this is excellent advice. Mixing insurance with investment sounds like a bad idea.

Very nice write up. Sadly many medical schools and residencies both have financial wealth advisors who come by once a year or so and keep saying the benefit of whole life. Of course they want you to sign up for their services and get a fat commission.

Term life insurance and reinvesting the rest will almost always beat whole life plans.

By the way, nice blog!

ID

Thanks InvestingDoc! That is terrible about the financial wealth advisors that come into medical schools. It must be hard for young doctors to question “professional” advice that is sponsors by their educators.

This is very helpful for someone like me who has been focusing on FI, and building net worth, but with zero knowledge of insurance. As I’m approaching my 30s, I am starting to look into insurance as part of my financial planning.

Can you and would you still buy tern insurance after the 50 year old Mark?

Thanks MAO! You can still buy term insurance after the 50-year-old mark, but it gets more expensive. However, whole life gets more expensive as well so the comparison typically holds.

If you have achieved FI you probably don’t need life insurance though. Your assets would support any family members who needed it after you passed and you wouldn’t have debts to cover. If you are approaching 30 and not there yet though, term insurance can help to protect you in the years you might need it.

That was a great way to compare the 2. Thank you for that, I’m already a hater of whole life but some of my colleagues are not convinced. This is a good way to show them direct comparison number, which unfortunately most “Financial Advisors” won’t do.

This article is almost 100% wrong. Whole Life is NOT an investment. There is NO sub accounts. That is Universal or Variable Universal Life. If you do the math….term is ALWAYS more expensive than whole life. Please do not be deceived by the ignorance of this article. I love term insurance and it has it’s place but do not underestimate the power of Whole Life insurance. By the way not all insurance companies are created equal. Do your due diligence!!!!!!

You don’t get both the death benefit and the cash value. You get the death benefit minus the loan. Also, that loan only becomes taxable if the policy has a gain and is surrendered. The loan isn’t taxable at death, it is paid off with the tax free death benefit. Don’t get me wrong, I’m no WL fan, but it’s bad enough to avoid just the way it is. We don’t need to make it sound any worse than it is. We just need to show how bad it is.

Thank you for the clarification, White Coat Investor! I’ll make the changes first thing tomorrow. I really appreciate you pointing out the error.

Thank you for this! I’m an insurance agent and can’t stand cash value life insurance. I sell against it and only offer term! Dave Ramsey may just be on to something.

I’ve been an ins agent for 35 yrs (and still am). I’ve read the pros and cons for years. Here is where I net out. Dave Ramsey is right, in that, for most avg income Americans term is the best value. I disagree w Dave that perm life ins is ALWAYS bad. Permanent life ins is not an investment but it is a conservative savings acct and depending upon the plan can be a ‘guaranteed’ life plan. For many business owners and wealthy people perm life offers tax breaks and tax benefits that make it a wise buy. For some families it is not a bad idea to have mostly term but some perm life. Like church denominations, they claim to be right, and many are good but may not be right for you. I recommend church…find one that is a ‘fit’ for you. Get a wise life agent who loves term but also offers perm when needed.

Completely agree, Barry!