When people picture investing, they picture a red-faced Gordon Gekko screaming trades over the phone or a chaotic stock market floor where you could just as easily lose your life savings as watch it grow it each and every day. But please, please, let’s change the picture. Investing doesn’t have to be complicated. In fact, for the vast majority of us, it shouldn’t be. You can invest and build wealth, reflecting your unique tolerance for risk, with just three funds.

Table of Contents

What is the three-fund portfolio?

The three-fund investment portfolio is a simple, low-cost way to achieve strong diversification and solid long-term returns by investing in index funds. Index funds offer you full market diversification and guarantee you market returns, something the vast majority of actively managed higher cost funds can’t beat. It is a methodology made popular by Bogleheads, a community of investors that developed around John Bogle, the founder of Vanguard.

Vanguard is the largest index fund manager in the world and it has very low investment fees. As I use them exclusively for my investments, I am going to build up a three-fund portfolio using their funds and current fees. However, Fidelity and Schwab also offer low-cost index fund options and you may want to consider that route.

1 – U.S. Stocks

You can’t start an investment portfolio without U.S. stocks! Warren Buffett, well regarded as one of the best investors in the world, actually states that a 90% S&P 500, 10% bond portfolio would work for most families! To get diversified U.S. stock exposure, you could go one of two ways.

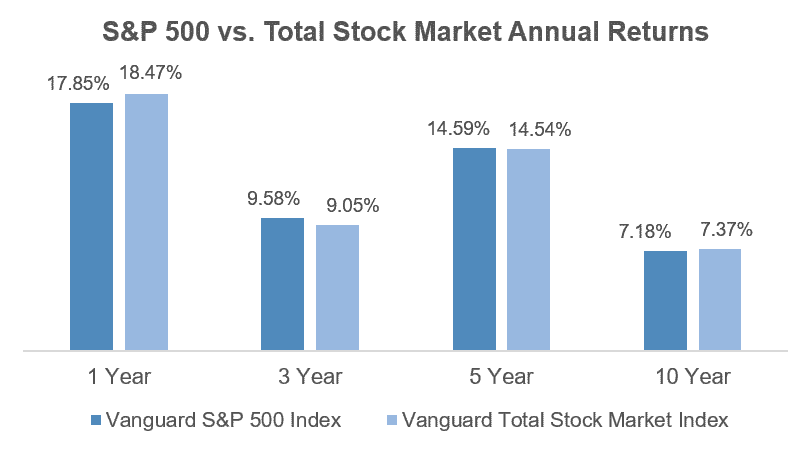

Vanguard 500 Index Admiral Shares (VFIAX, 0.04% expense ratio): This index fund tracks the S&P 500, which is approximately composed of the 500 largest publicly traded U.S. companies. Investing in an index fund such as this guarantees you get the market return, which is impressive when over 90% of actively managed funds fail to do so.

Keep in mind, to get the lowest 0.04% fee, you need to have at least $10,000 to put in this one fund. If you don’t you could consider the Vanguard S&P 500 ETF (ticker: VOO), which has the same 0.04% expense ratio and no investment minimum.

Vanguard Total Stock Market Index Admiral Shares (VTSAX, 0.04% expense ratio): The S&P 500 only includes the largest publicly-traded U.S. companies, meaning you don’t have exposure to the thousands of other smaller companies in the market. If you want exposure to the whole market, with somewhat greater diversity and the potentially higher growth of the smaller names, you should invest in the total stock market index.

Similar to the S&P Index Admiral Shares, you need $10,000 to invest in Vanguard’s Total Stock Market Index. However, there is a Vanguard Total Stock Market ETF (ticker: VTI), with the same 0.04% expense ratio and no investment minimum.

Over time, the return differences between the S&P 500 and Total Stock Market Index have been pretty minimal. This is because even the Total Stock Market Index is heavily tied to those largest companies, as it is still allocated based on each company’s size in the total market. Both are well diversified and equally low-cost, so you can choose which fund is best for you.

2 – U.S. Bonds

If you’re young, and comfortable with volatility (major swings up and down in your investments), you may be happy with just stocks. However, if you want to add some asset class diversity and stability to your portfolio, the next step is to add bonds. Bonds lower long-term returns than stocks, but are typically more stable and are negatively correlated to stocks, which is ideal for diversification (when stocks go down, bonds usually go up). While there are a lot of bond funds, here I have a clear favorite.

Vanguard Total Bond Market Index Admiral Shares (VBTLX, 0.05% expense ratio): The Total Bond Market Index is over 60% U.S. government bonds with the remainder being “investment grade” corporate bonds. Investment grade means rating agencies have determined that the companies issuing the bonds are in good financial standing and are likely to pay the lenders (anyone who owns the bonds – so, you!) back.

Once again, if you don’t have the $10,000 for an Admiral fund, you could purchase Vanguard’s Total Bond Market ETF (ticker: BND) which has the same 0.05% fee and no investment minimums.

Note: If you are using other bond funds or other index fund providers, be sure to check the portfolio’s composition. Funds named “high yield” debt funds, or that have credit ratings below Baa, offer greater current yields and long-term returns, but nothing comes for free. These companies are riskier and as such their bonds are more volatile. High yield debt is also more closely correlated to the stock market, reducing your diversification benefit. That is why high yield’s other name in the market is “junk.”

3 – International Equity

As mentioned above, Warren Buffett thinks most families can stop at a two-fund portfolio. John Bogle, the founder of Vanguard, agrees. However, both note this is a preference for simplicity over a historically tested recommendation. Some investors, Buffett and Bogle included, believe you already get international exposure through the U.S. stock market as most large publicly-traded companies are global businesses generating profits overseas.

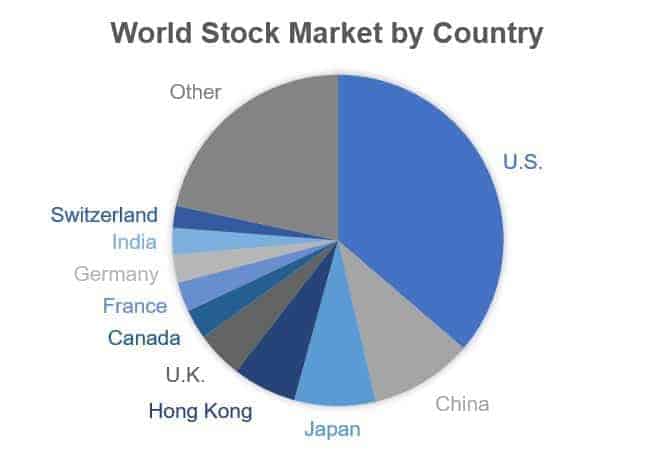

While it is hard to argue with investment superstars, there are many that see the benefit of investing in international stocks. For one, we live in a global world. To think U.S. stocks will perform better over the long-term than other developed markets is nationalist at best, and short-sighted at worst. As of late 2016, the U.S. stock market represented 36% of the total global market. Are you willing to have no direct exposure to over 60% of the market? If not, you can add some international equity to your portfolio for the classic three-fund balance!

Vanguard Total International Stock Index Admiral Shares (VTIAX, 0.11% expense ratio): This fund gives you exposure to both developed and emerging stock markets all over the world, excluding the U.S. Similar to the other examples, if you don’t have $10,000 to invest in just your international allocation, there is a Vanguard Total International Stock ETF (ticker: VXUS) with the same 0.11% and very similar investment exposure.

Keep in mind that while certain international markets, like Europe and Japan, are well developed and liquid (easy to trade in and out of without impacting pricing), adding an international fund can add volatility to your portfolio. Investing in emerging economies is risky, as you could face government intervention, major changes in macroeconomic conditions, and large swings in pricing simply due to the markets being smaller and less liquid. You are also introducing currency risk, which you don’t have directly when all your investments are in your home currency. Because of this, while the international markets are over 60% of the total global stock market, most investors keep their international exposure below their U.S. exposure.

Summary: Why use a three-fund portfolio?

One of the most common questions I get about the three-fund portfolio is, “is a three-fund portfolio really better than just using a Target Date Retirement fund?” So before the question starts popping up here, I figure I’ll just answer it!

For an investor who wants a complete hands-off investment portfolio where they could just set up their auto-deposits and forget it for 20 years, no, a three-fund portfolio may not be better. Your three funds with grow at different rates, with stocks usually growing faster than bonds, throwing your asset allocation out of balance. If you’re a hands-off investor, you won’t want to go in periodically to fix this imbalance, so as you approach retirement you’ll actually have a higher allocation of stocks than you started with. This is risky and the opposite of the typical strategy of shifting to safety as you approach retirement.

Alternatively, the three-fund portfolio does have some benefits for the DIY investor who is willing to be a little hands on. You certainly don’t need a finance degree to manage a three-fund portfolio, and there are some major positives to consider.

- You will pay lower fees. With Vanguard’s current fees, you could build a three-fund portfolio that had 65% U.S. stocks, 20% bonds, and 15% international stocks for 0.05% versus the current cost of a Vanguard Target Date Retirement fund of 0.16%. While both fee structures are very low, especially considering the fees associated with actively managed funds, the savings still make some difference over the long-term.

- You control your asset allocation. With a Target Date fund, the auto-rebalancing across asset classes is determined by the fund manager, not you. If they suddenly decide they want to be in more international equity, you’re along for the ride. Where this impacts most people is the slow shift towards greater bond exposure as you approach retirement. While this does increase portfolio stability, it lowers returns. If you are more comfortable with higher risk exposure, either from preference or personal situation, a three-fund portfolio allows you to keep your investments directly in line with your goals.

- You’ll outperform the vast majority of actively managed funds. According to Bill Miller, the famous investor who ran Legg Mason Capital Management from 1991-2005, beating the market every single year, once called his streak “maybe 95% luck.” The truth is that over 91% of surviving funds underperformed the market since 1982. That number climbs if you include the funds that failed. Since we can only see the successful managers in retrospect, buying the market virtually guarantees you beat most professionals over the long-term.

- Other benefits: Tax efficient, simple, easy to manage, no fund manager risk, and more!

You can choose to make things as complicated or expensive as you want when it comes to investing. But three funds. That’s all it takes to build your wealth. Not a finance degree, endless day trading, or years on Wall Street, but the ability to pick a simple, low-cost investment plan and stick to it long-term.

Is your investment portfolio more or less complicated than the three-fund system? What questions do you still have about building and managing a three-fund portfolio? Drop a comment below and let’s chat!

Love it. My portfolio is very similar. I just use a ratio of 4:1 of the S&P 500 and an extended market to replicate the total stock market. For years, I have kicked around the idea of adding different value tilts. I almost added a small value and REIT index fund. I have decided against it because I do not want to under perform the market. There is no need to make it more complex.

I toy with making it more complicated as well, but always decide to just stick with the three-fund. I have some alternative investments through co-investment at my job, so I figure in my IRAs and taxable investments I should stick to a simple strategy to ensure I perform in line with the market.

I use the 3 fund portfolio (VTSAX, VTIAX & VBTLX) for my retirement account. It’s so much easier than keeping track of individual stocks. I started out with the investors shares which require $3,000 to start and then had the funds transferred to Admiral shares once the balance met $10,000. I use Vanguard and they make the process so easy.

Isn’t it awesome when you get to switch to Admiral shares? Love the double celebration of (a) having that much saved up and (b) getting lower fees! Vanguard does make things really easy as well, part of the reason I love them.

I’m a big fan of simplicity and the 3-fund portfolio makes a lot of sense to me. Right now, I’m keeping it simple with a few funds: international, large cap, small cap, bond, and dividend growth. So far so good, and if I need to change, I can 🙂

Thanks for sharing your thoughts Chelsea.

I’ve got the Vanguard 3, as I love the simplicity of it too. My current 401k plan does not offer Vanguard options so I’m in some different funds with Fidelity but I kept it simple with low fees there too.

It is tough when 401(k) plans don’t offer the lowest fund fees, especially if you have 401(k) management fees on top of the fund fees. In my husband’s old 401(k) – which had very few options – we just did a 100% S&P index fund allocation and balanced it elsewhere because that was the only true low-fee option. Managing asset allocation across multiple accounts is when Personal Capital really shines!

We got the Vanguard trio too! (and then we added emerging market too and bumped it up to admiral recently.) Your description of fear about the stock market perfectly describes what my mom thinks I’m doing. She thinks we’ll lose all our money and jump off a building or something…;(

Interesting about your moms fears! If I remember from your site, she is from China, right? Investing in the stock market there is very risky – as so many people do so with leverage against their house or other assets. Hopefully you can help her understand your strategy over time!

That is true. You don’t need to have dozens of different funds in your portfolio. Just a low expense ratio S&P500 fund will do the trick and watch it grow over time. Just have to be OK with the market swings from time to time. But historically, it always goes up over time. Greater returns for those who are patient. Vanguard is the way to go for mutual funds.

About “Tax efficient”

That can be expanded on. For those who have both tax-advantaged accounts (e.g. IRA) and traditional taxable accounts., Asset placement, in addition to asset allocation, is important. With a single “all in one” fund you have no control over that. With three individual funds, for each of three asset classes, one can put each class in the mos appropriate account, taxabl vs. tax-advantaged.