If this blog, in all its posts, newsletters, videos, and podcast appearances can teach you one thing, I hope it’s this.

You need a Family Emergency Binder.

Whether you’re a parent whose kids might need care, a DIY investor whose spouse knows little about your finances, or a person who’s aging and will need someone to settle their affairs. We simply don’t know what will happen. And we need to be prepared.

My husband and I created our emergency binder (lovingly referred to as the “hit by a bus” binder) when our first child was born. And it holds all the information we would need for a medical emergency, insurance claims, temporary separation from our kids, or death.

Unfortunately, I’ve seen and heard too often what can happen. A will and life insurance policy aren’t enough. You need to get organized. It can save your loved ones from being burdened by difficult decisions or months of paperwork.

So, today, I want to introduce you to my family’s emergency binder.

Table of Contents

Why We Created an In Case of Emergency Binder

As a healthy 28-year-old woman, creating an emergency binder – and thinking about disaster prep and estate planning at all – may seem a little strange. But pregnancy has an odd way of making the miracle of life, and the fragility of it, all the more real.

At the time, we were preparing for my husband to become a stay-at-home dad. This was a job he was over the moon excited for. (And he’s fantastic at it!) And I was becoming a sole breadwinner. I also managed all our finances (shocker, right?). I updated the budget, paid the bills – or made auto-pay pay the bills, and handled our investments.

Suddenly, sitting in a dingy, low-tech doctor’s office for my life insurance physical it hit me. What would life look like for my husband and soon-to-be son if something happened to me? The insurance policy would give him the cash, but would he know how to use it? Setting aside for the moment the struggle of grieving, planning a memorial service, sorting through our investments, and starting to take over the budget.

I was scared. And I needed to do something about it.

Making the Need More Real

The truth is, these thoughts were all too real for me. Both my parents lost a parent in their formative years. My mother lost her father – Baby Minnow is named for him. My father lost his mother – my middle name is hers.

Then, a few years ago, my neighbor’s 31-year-old daughter went to the hospital with leg pain. She was a combat veteran who did two tours in Afghanistan. Kate was the single mother to a three-year-old daughter. Due to complications in the hospital, she never came home.

And it wasn’t just deaths I was worried about. Emergencies take all shapes and sizes.

And it wasn’t just deaths I was worried about. Emergencies take all shapes and sizes.

My friend Liz almost lost her husband to septic shock several years ago. During that impossible time, she needed to lean on family to help out with their two young boys while she fought by his side. In her own words, “you don’t need to be worrying about how you’re going to pay the bills or whether the stock market is taking your investments.” You need an emergency plan.

Another friend, EJ, lost his home and all his possessions in the Tubbs Fire in California last fall. He and his wife had a young son. Nine months later, they still don’t feel fully settled. He told me recently that, “There are times when the loss will sting. You will remember something sentimental that you lost and have a moment of pain. I suspect this will continue for years.

I can hope and pray that nothing like this will ever happen to my husband or me. And I do. I want to believe that the John Hancock insurance calculator that spits out my life expectancy as 97 years is correct. But hope isn’t a plan. And I know there aren’t any guarantees.

Proper Disaster & Estate Planning

There are a few core elements to being well prepared for an emergency. Our In Case of Emergency Binder, while necessary in its own way, can’t replace these financial and legal foundation blocks.

#1. General Insurance

Proper insurance coverage includes health insurance, homeowners or renters’ insurance, and auto insurance. Make sure you’ve taken the time to understand your coverage levels and deductibles, so you are prepared if you ever need to file a claim.

If you are just starting to develop an emergency fund, the value of your insurance deductibles is a great place to start. That way, you don’t have to worry about affording your deductible after a car accident or other issue.

Pro-Tip from DadsDollarsDebts: Live in a place like San Francisco, Seattle, or New York City where property values are rising rapidly? Be sure to check in on property values every year or two. You want to be sure your replacement and coverage limits actually reach the value of your home if you experience a total loss.

#2. Life Insurance

#2. Life Insurance

If you have dependents or transferable debt (like a mortgage, some private student loan debt, and car loans) and aren’t financially independent, you need life insurance.

Term life insurance is most often the best option as it is low-cost. My life insurance policy is through USAA, but we got my husband’s policy through Bestow. Bestow was amazing because it’s quality, low-cost, term life insurance, but because he’s a relatively healthy individual, he didn’t need a health exam. The whole process took about 10 minutes and was a weight off of our minds!

Quick Note: In many cases, stay-at-home parents need life insurance too!

Stay-at-home parents provide childcare, cleaning, transport, and so many other services to a home. When we considered coverage levels for Jeremiah, we thought about how long the boys might still need care and what the costs would be.

We also factored in a certain amount of time where I would want to step back with a job or business to grieve and spend more time with the boys. If they ever lost their dad, being dropped in daycare soon afterward, when they had never been before, seemed like too much.

#3. Disability Insurance

Most people think about life insurance, but we forget (or don’t know about) disability insurance.

The U.S. Census Bureau says that 1 in 5 Americans will become disabled at some point in their working careers. And if you think that is just construction workers and miners, think again. Fewer than 5% of disabilities are from work-related incidents.

And the average worker with that faces a disabling incident misses 2.5 years of work. Could you cover your expenses for six months without income? For a year? If not, you probably need long-term disability insurance.

The easiest and cheapest way to get long-term disability insurance is through an employer. It will provide you with a certain percentage of your income for a number of years or until retirement. You can also get a self-purchased plan, but these can run from 2%-3% of your income, so the employer-subsidized plan is an excellent choice if you have the option.

#4. A Will

There are some common misconceptions about wills. So, let’s break a few down.

First, if you have children under 18, you need a will. If you don’t have one and something happens to you and your spouse, a local family court judge will decide where your child ends up. It may not matter who they know best or who can keep them near their home. Financial stability and blood relation is often the deciding factor.

Second, complex wills with trusts can be expensive. Sometimes $1,000 to $3,000 when set up by a lawyer. But there are ways to get the type of will most families need for a very reasonable cost, if not for free.

My favorite online will resource is Trust & Will – which has a simple system to walk you through every step of the process so you feel in control and knowledgeable as you go. Customized wills start at just $69 and, as the name implies, you can also get complete living trusts through their system, starting at just $399. If you don’t know which you need, Trust & Will has a short quiz based on your family structure and assets to recommend what is best for you.

If you’re looking for a quality, free option, check out Tomorrow.me, which lets you create a legally binding will quickly and easily. When you’re finished, just print it out, bring it to your local library, post office, or UPS store and get it notarized. Easy as pie.

#5. Updated Beneficiaries

Some financial accounts, like retirement plans (401Ks, 403Bs, IRAs, etc.) can’t be assigned in a will. Same with life insurance policies. These things transfer immediately upon death to the listed beneficiary. You want to make sure these are kept up to date and have a secondary beneficiary.

As an aside, I would not recommend leaving these assets to minor children. Some parents list their primary beneficiary as their spouse and the secondary as their children. However, if your kids are under the age of 18, they can’t legally manage or inherit the assets. In most cases, the funds are turned over to a conservator in your state. Which can make it hard for their guardian to access funds for day-to-day childcare expenses.

Why A Will Isn’t Enough

If you have the five things listed above, you have the main pillars of a robust disaster and emergency preparedness system for your family. But without one final step, you could still leave your family in quite a mess. Even with all that protection.

The core elements listed above won’t give anyone permission to seek care for your child when you’re away from them. If they break their arm or get strep throat, you may have to get all the way back to them before they can be treated.

It also won’t tell anyone in your life how to find all the information about your various policies and wishes. Including who to call, how to make insurance payments to keep policies active, or where to start. One missing payment on a term life policy could render it invalid if you pass away before correcting it. A risk when you’re in the hospital with a medical emergency without leaving instructions for someone else to step in to help.

There are sad stories of individuals who knew their parents had a will but couldn’t find it. Or knew it was in the safe but had no key or code to get into the safe.

Plus, if you’re a DIY investor like me, your family won’t know how you manage your assets and how best to make them last. My husband has asked great questions – like where he should withdraw money from first. And whether I think he would need to hire a financial advisor or invest himself.

The core components are building blocks of an emergency plan, but it doesn’t bring it all together. That’s what an emergency binder is for. To fill in the gaps.

Building an In Case of Emergency Binder

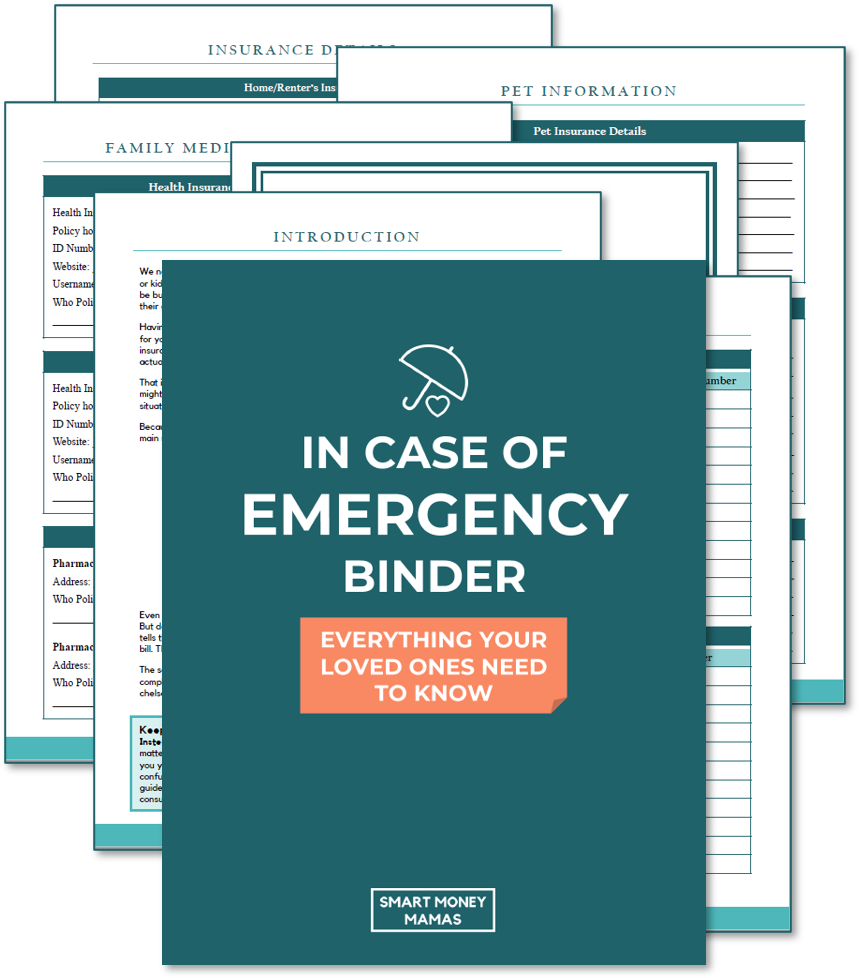

Putting together our emergency binder took a lot of research. The way it looks today is drastically different than when I first started to compile it three years ago. The information is far more organized and is way easier to update.

In its development, I spoke to over 30 people who had been through tough situations – including doctors, nurses, military members and estate attorneys. At every turn I felt like I was adding things, updating, perfecting. But now, it’s our golden resource. The answer to so many questions is, “It’s in the binder.”

Here’s What Our In Case of Emergency Binder Looks Like

While all our information could technically live in one large binder, I have it separated into two.

Our first binder is “Basic Information.” It lives on a shelf in my office since we need it more often. The front page is a contact sheet with emergency numbers and frequent contacts. And it was a go-to for updating all our addresses and doctors after the recent move. It includes things like:

- Household Contact Numbers

- Key Personal Documents: Birth certificates, marriage license, social security cards, copies of passports

- Medical Information

- Childcare & Pet Care Details

- Insurance Documentation & Details

- Basic Financial Information: Properties, regular bills (including what’s on auto-pay), cash accounts, and credit cards

Our second binder is “Need to Know.” This is the super-secret binder that lives in our safe. It only has information someone would need if one of us died, so it only comes out after a major life event or once a year to be updated.

It includes things like:

- Where to Find Original Documents & Keys

- Employer Information

- Social Media, Email, & Website Logins

- Investment Details (Including a strategy description, trusted professionals to turn to, and what to do with life insurance money)

- Memorial Service Preferences

- Letters to Loved Ones

The letters to our children, each other, and their designated guardians if we were gone were possibly the most emotionally draining things we’ve ever written. But there are things my boys aren’t old enough to hear yet that I would want them to know. And if they had to be raised by someone other than Jeremiah and me, there’s so much I want to say to that person. Exchanging letters with my grandfather after his cancer diagnosis taught me we don’t always take time to ask the little questions.

What to Consider

Dealing with any kind of emergency creates stress and emotional exhaustion. When most of us see one of these incidents, like a friend losing a parent or their home, it’s a momentary thing. We send our condolences, offer to help, and move on with our lives.

But things don’t end there for the people in the middle of it. Settling these experiences often takes dozens of phone calls, rebuilding, and recovery. If you want to save your loved ones heartache, make your information as clear and organized as possible. Make it easy for them to know what to do next, so no energy has to be spent searching or making yet another decision.

As you compile your own binder, ask yourself whether it feels at all chaotic. If it does, you need to make it more clear. Because if it is confusing to you, whose information it is, it will be complete gibberish to someone else.

It’s Time to Get Prepared

As I put together our binder and perfected it, I looked for resources to guide me through the process. Some books told you what you needed but didn’t give you a place to compile the information. There were spiralbound workbooks – but what were you supposed to do when the information changed? Buy a new book? Write crucial details in pencil? I knew it wouldn’t stay updated if I couldn’t easily replace the pages.

So, slowly, I transformed our binder into a printable workbook. At over 100-pages (don’t worry – some are dividers and duplicates!), it has 15 sections, each with a custom divider cover to keep things organized. (Some of these sections, like Military Information, I created just for others with the help of experts.)

Now, when I need a new sheet for my kid’s medical info – like when we just changed pediatricians – I print one and swap it out. It keeps things so much neater and makes updating way easier.

For those who want to start their own family emergency binder, you can now buy a copy of the In Case of Emergency Binder workbook. And start protecting your family today.

But if you’re not ready to take the plunge on the workbook, be sure to download our free Financial Emergency & Estate Planning Checklist to help your family protect what matters most.

Is your family prepared for emergencies? Do you have a complete disaster plan? Drop a note in the comments and let me know!

On June 14, 2018, my Wife didn’t like the way I looked as I was leaving the house to drive to 7:00 PM home showing (been in real estate for 45 yrs).

She drove me and 1/2 way there I had what my Dr. called a “sudden death” heart attack. As you can tell, she didn’t drive around the block a couple of times- she got me straight to the emergency room and the high voltage paddles brought me back.

I am at Mayo Clinic as I right this. Seeking the best treatment. BUT, could my wife and children really have taken “the business of our lives” and ran with it? I don’t now.

I have a second chance to make it easier for them

and with your In Case of Emergency guide I hope to do exactly that.

Thank you, thank you, thank you!

Chuck, I am so glad that your wife took quick action and that you are now getting the best treatment. Sending many best wishes for your quick recovery.

I sincerely hope the ICE binder makes things easier for you and your family in the future (though let’s hope they don’t need it for a long, long time!)

Such an important topic that so many avoid – great job breaking it down into bite sized bits.

I really need to get on this, Chelsea. We’ve been noodling over the details of an estate plan & trust but think we just need to get going on it and fix it later when we change our minds.

Downloaded the checklist for now and think we will get the binder, too.

While all that is very prudent planning and gray advice, I don’t think it is ok for either partner to not know what to do with a life insurance payout or their overall portfolio should the other partner die. It’s not ok to opt out of family finances, both partners need to be aware of every significant transaction and how to monitor all the family assets on their own, on at least an annual basis. Even if it isn’t their thing. Just having a binder won’t completely make up for a lifetime of ignorance by an uninvolved spouse. It will help a lot but much better if they stay involved while you are still around.

My wife prefers me to make investing decisions but I won’t make a move without her understanding and agreeing to it. She needs to know what we are doing and why, it’s likely someday going to be up to her since she will probably outlive me!

I completely agree! My husband and I have regular money meetings and make investing decisions together. I would never recommend one spouse opt-out. But when one person does the majority of the hands on money management, there will naturally be things the other doesn’t understand. And with something like a life insurance payout – that’s a lump sum payment of a size most individuals won’t have handled before. Having a clear, laid out plan of what to do is important when grief will likely make the situation harder to handle, no matter how much you know.

Over the past few years, in addition to our money meetings, my husband and I have instituted a “Fire Drill” month. One month of the year, he handles all of our finances as if I’m not around. Manages the budget, updates our net worth, pays estimated taxes if need be. It feels silly, especially since he is aware of what’s going on, but it’s a way to make sure he can find weak spots where he doesn’t understand and can make decisions confidently if something did happen to me.

Honestly, one of my favorite parts of selling the Family Emergency Binder PDF is the number of couples who email to tell me one spouse WAS completely in the dark, but having to fill out all the information sparked conversations they hadn’t had before. And that they finish the process both feeling more informed.

Ok, I should have known you had that covered, my bad. But I do think there are many couples where only one has a clue on the finances. I’m sorry I was judgy on that with you, you clearly aren’t that kind of couple. Great post, and important, people die too young every day.

Thanks for so much for this information! Would you happened to have an digital version of the binder? Do you think that’s a good versus a paper version? Just trying to imagine what would happened if there’s a fire or flood crisis.

Hi Ann! Yes, our Family Emergency Binder is a fillable PDF that you can complete digitally and save that way, or print afterward. There are pros and cons to physical and digital versions, we actually save ours both ways.

I’ve been searching for something like this. Is this one fillable? That’s what keeps stopping me…I don’t want to hand write everything and have to rewrite when things change.

Yes! It’s completely fillable