What would you do with your life if you didn’t have to work for money? What sacrifices would you be willing to make in the near term to allow you to retire years before the “traditional retirement age” of 65? These are the types of questions that have driven the FI/RE, financial independence/retire early, movement. People are making the powerful decision to harness the power of saving and investing to allow them to retire early. And you can too!

Table of Contents

What is FI/RE?

FI/RE is a two-step process. First, you have to build enough investments and sources of passive income that you no longer need to work to live happily. You become financially independent (FI), meaning you don’t need to depend on anyone else for income.

Second, you get comfortable enough with your personal wealth and passive income sources to actually retire early (RE). Depending on the age people achieve this second stage of FI/RE, they may continue to do certain things to earn money like starting their own businesses or consulting in areas where they are passionate. (Some are starting to call this FIE – Financial Independence, Entrepreneurship) But they no longer hold a traditional job and are in full control of their schedule.

While my family isn’t fully financially independent yet, we’ve saved enough to put our retirement on “coast mode”. This means our retirement assets are large enough that we just need to give them some time to grow and that, in the meantime, we can pursue some other goals. For me, this means a two-year break from the traditional workforce while I build my online business.

How much money do you need to achieve FI/RE?

This depends entirely on your needs! The first step to setting FI/RE goals is determining what your budget would look like if you no longer had a job. Spoiler alert, you need a lot less than your current income.

Currently, you would be paying income taxes, Social Security, and saving for FI/RE. Once you achieve FI/RE, those expenses mostly go away. Also, before attaining FI/RE, it is recommended you are completely debt free, even including your mortgage. This means all cash flow is just for your expenses.

Once you achieve FI/RE, most of your taxes become capital gains, which are a lower rate, you don’t have to pay Social Security, and you are no longer saving – you are living off what you already saved! Some expenses might be higher, like healthcare, but chances are they don’t offset your lower budget from the removal of the other items.

Determining your personal FI/RE needs

The best way of learning how much you need to achieve FI/RE is to first look at your historical budget. How much do you spend a month, on average? Add a cushion you feel comfortable with for health care expenses and other potential lifestyle inflation, then multiply by 12. That is the amount of income your net worth and passive income ventures need to generate annually to achieve FI/RE.

Once you have your retirement spending number, most people use the 4% rule to determine their net worth needs to generate that level of income.

The 4% rule is a rule of thumb to determine how much you can safely withdraw from retirement funds each year. Backtesting has shown that over 30+ year periods you can withdraw 4% a year, every year, without running out of money. A 3% rule is considered even safer, there are moments when the 4% rule fails, but 4% works the majority of the time.

Finally, take your retirement spending number, subtract your annual passive income generation, and divide by 4%. That is your target savings to achieve FI/RE.

Example: So, let’s say you need $60,000 a year to live in retirement. You have no sources of passive income, like rental property, so all your income will come from investments. To generate $60,000 a year with the 4% rule, you would need to develop an investment portfolio of $1,500,000.

Can you achieve FI/RE on any income?

You can certainly achieve FI/RE on any income. If you live happily on the amount of money you make today, your FI/RE savings goal could be much lower than someone with a higher income and more expensive tastes.

However, I’m not going to lie. Saving for FI/RE requires a lot more frugality and is a lot harder for families that have lower incomes. There is generally a lot less fat in their budgets, so saving 50% of their take-home pay can be near impossible without a lot of sacrifices. They can still retire early, but maybe not as early as their high earning peers.

Mr. Money Mustache, the FI/RE and frugality guru, breaks down savings and years to retirement in a straightforward way on his site (see the chart here). How quickly you can achieve FI/RE is more dependent on your savings rate than your income.

If you can save 25% of your take-home pay consistently, you could retire after 32 working years – assuming you are starting with no savings. That may not sound very FI/RE worthy, but if you started working at 22 after college, you could retire by 54, over a decade before the traditional age. If you can up that to 50%, you can retire in just 17 years, or at age 39.

Chasing FI/RE over time

Let’s say your family is saving 25% of your take-home pay and you are aiming to retire in your mid-50s. That means you are saving 25%, even when you get raises, change jobs, or receive bonuses. No income is exempt from your savings goals!

Over 30 years, your income is likely to change quite a bit. You’ll gain skills, receive promotions, and make career moves to increase your income. If you can stay as close to your initial budget as you can, avoiding lifestyle inflation from your higher paying jobs, you may be able to achieve FI/RE even faster. If you’re 5% raise goes straight into savings, suddenly you’re saving 30% and you could cut four years off your target retirement date!

Achieving FI/RE with kids

There are some crazy doubters out there that think high savings rates and early retirement are impossible for families with kids. If this is you, let me assure you that this is not the case. Mr. Money Mustache is probably the most famous FI/RE achieving parent on the web, but there are plenty of examples.

While kids may add some extra costs to our budgets, they are typically only as expensive as we allow them to be. Also, having kids is a significant motivation for many who want to achieve early retirement. I know that for me, I hadn’t even discovered the FI/RE movement until Fuss Fish was born and I was looking for a way to be home with him more. Plus, one of the most exciting parts of FI/RE for me is raising kids that understand the potential and power of financial freedom. Maybe our kids will be able to make choices early on that allow them to lead lives they love, without being tied to a desk for 40 years.

When it comes to FI/RE, it is one thing to chase early retirement to get your boss off your back. It is another to pursue retirement so you never have to miss one more skinned knee, vacation day, or hockey game. Use your kids to motivate you for FI/RE and start saving today!

How can you get started pursuing FI/RE? What are the best resources to help you on your way?

There are many great books, blogs, and tools out there to help you get started with your FI/RE journey. Here are some of the first stops you should make on your journey!

1 – Track your net worth

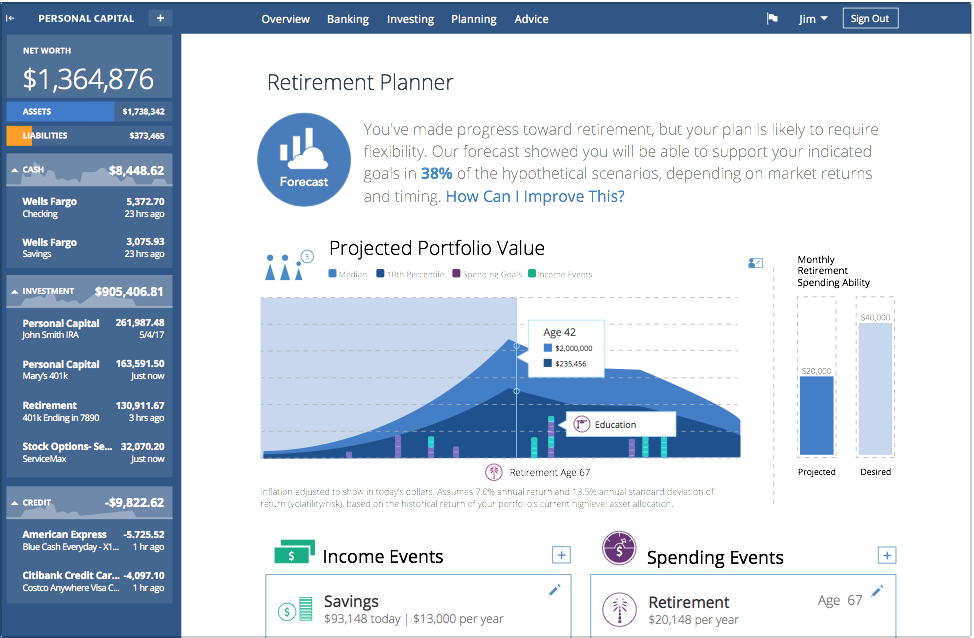

For me, the first step was setting up my Personal Capital account and beginning to track my net worth. Personal Capital lets you set annual retirement spending targets and savings goals, then determine what age it expects you will be able to retire. I love logging in every couple months and seeing my retirement savings progress for the year. The retirement planner is also excellent, particularly the ability to customize income and spending events. When I am toying with different retirement ages and savings levels, I always pop into the retirement planner to see how it impacts our goals.

2 – Find your community

2 – Find your community

While FI/RE is an incredible goal, there likely aren’t many people in your life who will understand what you are trying to achieve. Luckily, the FI/RE community is amazingly supportive and can help you with new ways to save, the best simple investing methods, and creating sources of passive income. Here are a few excellent communities and blogs that discuss FI/RE.

- Mr. Money Mustache – Possibly the most popular FI/RE blog on the web, MMM retired in his 30s and has created a cult-like following of other frugal families and FI/RE pursuers. Be sure to join his forum if you want to be surrounded by other like-minded thinkers!

- Mad FIentist – Looking at the science of financial independence, the Mad FIentist helps simplify tax codes and investment strategies to make sure you are set up in the best possible way for retirement. He also has a great FI spreadsheet for tracking FI/RE progress!

- Think Save Retire – Steve retired from his 9-5 at only 35 years old and now travels the country with his wife in their Airstream. His posts about all aspects of financial independence and minimalism are fantastic. Plus, their pictures from their travels are excellent and definitely great motivation of what you can do with your time once you achieve FI/RE.

- #WomenRockMoney Community – I, of course, have to include my own group for women looking to improve their finances and reach financial independence. This community is just for women and includes weekly live events with me, discussing different money issues and doing Q&A!

3 – Build your knowledge and wealth

There are many books out there that talk about the virtues of financial independence. Some of these books can help you kick into gear with your FI/RE prep, help you come up with new sources of passive income, and help you get family members on board. Below are some of my favorites. (These are Amazon links, but be sure to check if you can get them at your local library!)

- How I Found Freedom in an Unfree World by Harry Browne

- I Will Teach You To Be Rich by Ramit Sethi

- Your Money or Your Life by Vicki Robin & Joe Dominguez

- unWorking: Exit the Rat Race, Live Like a Millionaire, and Be Happy Now! by Clark Vandeventer

- The Simple Path to Wealth by JL Collins

FI/RE is a lifestyle. It requires focus, determination, mindful spending, and a commitment to freedom. Some people are happy working and living their lives around a job. If you aren’t, don’t allow years of financial independence to slip through your fingers. Set some goals and start saving now!

What do you think of the FI/RE movement? Would you like to retire early? Do you know how much you’re saving and what your long-term retirement goals are? Share your story in the comments!

Both of my parents retired before the traditional age, and were able to due to good saving and investing habits, and a not expensive life style. I am also targeting FI/RE. There are some jobs I’d like to do that pay less than what I make now. I also live in an expensive area for real estate. I’d love to have the flexibility to live somewhere less expensive even if the job pays less, because I’m FI.

As you said in your step 4 post and social security being very different in 10, 15 years, I know my life will be different so I have a hard time doing a long term plan. Do I stay near my parents (who live in different states), my siblings, my friends, am I married with kids? For now, the plan is to save, advance my career to increase earnings, and spend time with friends and family when I can.