When I was pregnant with Fuss Fish, it seemed like every single person on the planet wanted to sell me something. Every Facebook ad, Pinterest post, and mom blog had something I absolutely needed to buy. It was like the marketers could smell my desire to do everything right for my baby boy. Mostly, I ignored the pee-pee teepees, wipe warmers, $50 teethers, and baby shoes as the normal result of capitalism. But when I got a flyer in the mail from Gerber Life Insurance at six-months pregnant, my blood started to boil. And the more I read about it, the more frustrated I got.

When I was pregnant with Fuss Fish, it seemed like every single person on the planet wanted to sell me something. Every Facebook ad, Pinterest post, and mom blog had something I absolutely needed to buy. It was like the marketers could smell my desire to do everything right for my baby boy. Mostly, I ignored the pee-pee teepees, wipe warmers, $50 teethers, and baby shoes as the normal result of capitalism. But when I got a flyer in the mail from Gerber Life Insurance at six-months pregnant, my blood started to boil. And the more I read about it, the more frustrated I got.

The flyer I received from Gerber said something along the lines of “Isn’t your child’s future worth $1 a week?” What a ridiculous question. Obviously, my child’s future is worth significantly more to me than $1 a week. But that doesn’t mean that $1 a week should go to Gerber. Life insurance for kids is a scam and selling it by asking parents if they value their child’s future is absurd. So today, I’m going to break down why your child really doesn’t need life insurance.

Table of Contents

What is Gerber selling?

The Gerber Life Insurance Co. is the name of the game when it comes to life insurance for kids. They started offering whole life insurance policies (also known as IUL, indexed universal life) for children in 1967. They continue to have the majority of the market. Their pitch to parents is threefold.

- In the tragic, awful case that your child passes away, your Gerber insurance policy will cover the funeral costs and other expenses.

- Buying a policy today protects your child’s ability to get affordable life insurance in the future.

- A whole life insurance policy is a savings vehicle that your child can access later in life.

The third point is the bring ‘em home top seller benefit for Gerber and other whole life insurance policies for kids. Parents imagine their kids borrowing from their plans for college, their first home, or any other major expense they might need. They jump at the chance to cheaply save for their child’s future. Here’s my step-by-step of why you probably want to avoid the leap when it comes to whole life insurance.

1 – Your child doesn’t need life insurance

I’m a huge proponent of life insurance for parents. For most families, life insurance is a necessity to protect your spouse and kids if the worst happens. But your child really doesn’t need the insurance part of whole life insurance, and it isn’t just about mortality rates.

As cold as it might sound, from a financial perspective, your child is a liability, not an asset, and we should only insure assets. An asset is any source of financial value for your family. That is why parents should have life insurance to replace their income, cover any childcare expenses, and pay down debts. Alternatively, your child doesn’t have an income to replace and probably hasn’t racked up much student loan debt. So, there is nothing to insure.

But what about funeral costs?

All in, funeral costs average $4,500 to $8,000 for a child. However, most funeral homes will offer services at cost for parents dealing with the sudden passing of a child, which can lower the cost to below $1,000. While these costs are high, especially considering the average American family can’t handle a $500 unexpected expense in cash, it isn’t as severe when you factor in the likelihood of having to face this horrible situation.

According to the actuarial tables from the Social Security Administration, there is a 0.41% probability a one-year-old child will not survive until their 18th birthday. This means 99.6% of the time you will pay $1,385 over 17 years for an $10,000 life insurance policy you will never use. You are better off saving up an emergency fund that you can use for any emergency, not just the low, low probability something happens to your child.

2 – Most people can get cheap life insurance as adults

The second pitch insurance companies make when selling life insurance for kids is that it preserves your child’s ability to get insurance as an adult. If they develop an illness that could be viewed as a pre-existing condition before adulthood, they still get to keep the whole life insurance policy you purchased for them as kids.

However, the vast majority of people can get cheap, quality term life insurance in their 20s and 30s when they reach an age that they need it. Value Penguin estimated the average cost of a 20-year, $250,000 term life insurance policy to be $27.88 per month for a 30-year-old applicant. Alternatively, a friend of mine is currently paying $50 a month for a $200,000 whole life insurance policy for her young child.

The most cost effective way to handle insurance for your child is to wait until they actually need it, and choose a cheaper term life policy over an expensive whole life one.

3 – Whole life insurance policies are terrible investment vehicles

Gerber offers policies from $5,000 to $50,000 in their Grow-Up Plan and I wanted to use the cash value built in those vehicles to show how ineffective whole life insurance policies are for saving. However, this proved hard to do.

Outside of this article from Slate in 2016, which quoted a cash value that grew to – get this – only 54% of premiums paid by the time your child turns 18, I couldn’t find any real numbers on the cash value of a Gerber Life Insurance plan. I tried calling the company for an estimate but they said I would have to officially apply for the insurance and wait 10 business days for the welcome packet. I even had three friends with Gerber plans check for their cash value with no luck. They didn’t have the original paperwork, and a cash value table wasn’t shown on their online portals.

Luckily, a friend of mine who has a whole life insurance policy for her daughter through LSW FlexLife offered to share the numbers behind her policy.

Illustration of the value of a whole life insurance policy

Ok, who is ready for some data? I wanted to dig into how much a whole life insurance policy is actually worth as an investment. To get some real data, I borrowed my friend’s life insurance policy for her daughter.

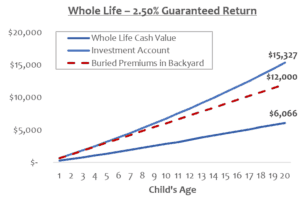

My friend’s policy is for a $200,000 death benefit with a $50 monthly premium. Like most whole life insurance policies, in addition to the death benefit, it has a growing cash value that the holder can either borrow against or surrender the account for that payout. That cash value has a 2.5% guaranteed minimum return but can have a higher value if the S&P performs better than that. However, her return is capped at an average of 11%. So how does it break down versus just investing in a standard account?

The guaranteed minimum return is worthless

Whole life insurance policies offer a guaranteed minimum return on your “investment” to theoretically protect you from cycles in the market. In our example policy that minimum return is 2.50%. But, to offer that generous 2.50% there are fees involved that reduce your actual return.

By the time my friend’s child turns 20, she will have paid $12,000 in insurance premiums. The guaranteed cash value of her child’s policy will be only $6,066 or 51% of her premiums. Alternatively, if she had directly invested the $50 a month in the market at a 2.50% return, her daughter’s account would be worth $15,327. More than double the value!

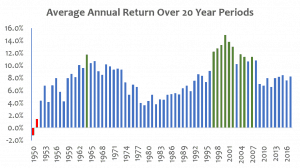

This means you are giving up 50% of your value for protection in times when the market returns less than 2.5%. So how often are you getting the benefit of that guarantee? I went back all the way to 1930 and looked at S&P returns. In that period, there were only 2 times since 1930 where the 20-year return was below 2.5%. And those two times were -1.2% and +1.5% annual returns. Not -50%. The data says the guaranteed return is pretty worthless.

The maximum return cap could actually hurt you

Alright, twice since 1930 we have seen a return of less than 2.5%. So how many times have we seen a return of greater than 11%? 10 times! 10 out of 69 20-year periods, or 14.5% of periods, had a return above 11%! So now, not only is your child’s whole life insurance policy not really protecting them from downside, it is stopping you from getting the full return of the market!

Even in cases where the market does well but doesn’t exceed 11%, you still lose out. In an illustrated case highlighted in this policy where the S&P returns an average of 6.9%, the policy has a cash value of $13,372 when the child is 20 years old. This is 44% less than a traditional investment account with the same 6.9% return. As an investment, you give up $11,000 in value with this policy.

You have to pay to borrow less money

And finally, if your child wants to access their significantly lower cash value and not lose their life insurance, they have to pay to do so. The only way to take money out of a whole life insurance policy permanently is to surrender it for cash, which cancels the policy. Otherwise, you have to borrow from your policy. For the example policy, my friend wasn’t sure of the cost to borrow but she thought it was 3.5%. If she’s right, she’s relatively lucky. Gerber charges 8% to borrow from their policies! More than most student loans and mortgages!

So if you shouldn’t buy life insurance for your child, what should you do?

A whole life insurance policy for your child provides unnecessary life insurance, protects their ability to buy cheap life insurance which they will very likely still have in their 20s and 30s, and significantly impacts your investment returns. In some cases, you may get the value of your premiums back, but you’ll still lose out on the incredible value of compound growth had you invested that money for your child in the market.

If you want to save for your child’s future, excellent! Set up an automatic withdrawal from your bank into a 529 plan or general investment account. Invest the money in low-cost index funds and don’t touch it until they are adults. If the worst happens, you can use the money in their account as you would have used life insurance proceeds. But, if your child is one of the 99.6% that happily blows out their candles on their 18th birthday, you will have saved much, much more for their future.

Do you have a life insurance for your kids? How are you preparing for their future? Let me know!

I don’t have life insurance policies on my kids. I have the same opinion as you…they’re essentially worthless to me. I have 6+ months expenses saved in an emergency fund instead to cover any number of situations related to us or the kids.

I always wondered how the numbers broke down for these child whole life policies, so I found this super interesting. I’m staying the course for sure…life insurance on me and my husband and a good emergency fund.

So glad the numbers were interesting! They make it so hard to get the real value of these plans, it is incredibly frustrating.

Thanks for reading and sharing your strategy!! Sounds like yours is the same as ours. 🙂

Wow! I have heard a lot about Gerber Insurance when my daughter was younger. Glad I decided against it!

They do a great job of getting their materials in front of you when your kids are young!

I think we have insurance for the kids through my husband’s insurance. But when I had my kids, Gerber tried to call and say we should get it and I was like, “Nope!”

Many adult life insurance plans offer small riders for your kids. My policy through work (which they pay for) has a $10k policy for my son if anything every happened it him. Definitely good call on Gerber!

That’s a great point and statistic you have… there’s a 0.41% chance of your child not making it to 18.

I’ll take my chances 🙂

This is an interesting article with some great information. When I have kids I will certainly have something to think about.

One of my favorite myths from the insurance industry dispelled! In my day job, I’ve had employees tell me that it’s bad luck to buy life insurance for children (it invites death into the family). Cultural differences aside, I can see (and did) buy very small term life policies for our children when they were young through our employers (because they were so cheap – like a couple dollars a year). Unfortuantely, we had a nephew die very early (around age 2.5) in a freak accident and those funeral costs were a huge burden to my sister and her husband and an extremely difficult time. Of course, like you mentioned the chances of this happening are very slim. But a little term life (if the rates are good) can give parents a little comfort. Whole or Universal policies? Forget about it! Don’t give them your money! You made some great points in your post. Cheers!

I’m so very sorry to hear about your nephew! I can’t imagine the difficulties your family must have faced.

I agree that a small term life policy for kids, for a few dollars a year, could be worth it if you can’t set aside a sufficient emergency fund. My company includes $10k of insurance for children in our policy, but I know I could add a child rider to my USAA policy for $2-$3 a month.

Thanks for reading Mrs.Need2Save! And I really appreciate you sharing your family’s story.

These are great points, both about the better chance of ROI through other avenues, and about the STRONG possibility that you’ll never even need the life insurance for its intended purpose. I don’t have life insurance for my kids, and don’t plan to get any – but I do need to look into a 529.

I hate talking to Insurance people period, something in me feel that most of them are scamming us one way or the other! You’ve raised good points.

I agree with you, kids don’t need life insurace! You perfectly explained the reasons why is better to invest for their future in different ways!

It’s so sad that people would take advantage of a new parent. Probably the time in their lives when cash is short. Thanks for sharing this with people.

I remember seeing the ads for this when my kids were little. I always thought it would not be worth it in the end.

I personally believe kids should not have a life insurance. There are always a better alternatives to invest your child’s future and you explain that perfectly in your articles.

I remember being sold that bill of goods early on and paying for several months. I am definitely glad that we didn’t keep paying and ended up cancelling the policy. They are definitely preying on parents fears at a very opportune moment.

I have two little ones and this has never been marketed to me at all in the UK. Quite sad to have to even think about it. Lets hope all of our little ones thrive and have long and happy lives.

You have a point here! Kids should not have life insurance. I’d rather put the money in a savings account under their name so they can use it for her future.

I have life insurance for my son from work, free of charge. However, I have always heard the Gerber one was a scam.

I wouldn’t get my kid life insurance either. I don’t think it’s reasonable and it’s not something that I would invest on when I can invest on my child’s actual health instead.

This is something to ponder on. We have a lot of expenses as it is and it would might not be financially smart to get a life insurance for your child.

You’re right. While child deaths are sad they are rare and paying such a huge amount of money that does not need to be paid is like you said a rip off. These insurance companies ought to be ashamed of themselves!

This is full of information, new information. I do agree with you, child insurance seems like a scam.

What’s really strange, is that somehow I have 5 kids and I have never even heard of life insurance for kids! Term for me and my wife, well and the goldfish. I don’t know what we would do without him …..

Ha! That’s great! Maybe they are being less aggressive with their marketing. Or maybe you’re just better at staying off the grid…

I remember when our kids were born we were flooded with offers for life insurance. I always considered it an unnecessary scam and your post just proves it. All new parents should be forced to read it.

We were flooded too! Total insanity. I really do hope this reaches more parents. I hate thinking about young families wasting money on something thinking it will provide some huge benefit to their kids, only to be disappointed after paying in for 20 years.

I was also offered a lot of Life Insirances for both my daughters and I didn’t take any of them. Turns out my decision was right. Thanks!

I agree with you. Kids don’t need life insurance. I would’t get life insurance for my kids either. Instead, we invested in their education savings plan.

I was opened by this idea on insurance for kids and it makes me think it seems you’re right. Hmmm.. thanks for posting!

Thanks for sharing. I don’t plan to get for our 2nd daughter now & looking into alternatives (investing, putting the monthly premium into their savings account, etc.)

I plan on writing a post later this summer once I get it all figured out and plan to link to this post as well. very solid research that I never looked at before!

So glad it was helpful, Josh! I look forward to reading about your new plan this summer. Congratulations again on your 2nd daughter!