With the U.S. stock market continuing to hit new highs, I have been asked by some readers if they should wait to invest in the stock market. Interest rates are rising, we are over eight years into a bull market, and some pundits are starting to call for the next downturn. People are worried about investing at the peak of the market, so they are holding off. But they really shouldn’t be. In today’s post, I’m going to break down why you should still be investing in peak markets.

Timing the market is just as hard as picking stocks, but that is exactly you’re doing if you are holding onto cash and waiting for a market downturn. You’re betting that the pullback will more than compensate you for the lack of return while your money sits in cash. You’re also betting that you’ll have the discipline to put the money in when everyone else is taking it out. So, what is the problem with making that bet?

Table of Contents

You could be wrong

In every market, it isn’t hard to find a Chicken Little. Someone running around telling you that the sky is falling, the market is going to crash, and you need to get out now! Eventually, one of them will be right. But none of them know when that is.

On August 26, 2014, the S&P 500 closed above 2,000 for the first time. At the time, plenty of people were there to say that valuations were too high, the underlying economy wasn’t strong enough, and we would see a downturn in the near term. Some claimed that even if the economy improved, stocks would have to drop by about half to see normal rates of return in the next cycle (source). But if you had listened to the naysayers and pulled your money out of the market in August of 2014, you would have missed out on 7.8% annual returns (9.8% if you reinvested dividends) between then and now.

Then, in February 2016, when the bond markets were under significant pressure, many people thought we were seeing the beginning of the next market downturn. If you had listened to the naysayers and pulled your money out of the market in March, you would have missed out on a 17.8% return (19.7% if you reinvested dividends) over the following year.

If you hold onto your cash long enough, eventually you’ll see the market decline. That’s how cycles work. But just because you were eventually right, doesn’t mean you didn’t miss out on a lot of growth in the waiting. Which brings me to my next point: time is money.

Time is money

I have written about dollar cost averaging and why I love it as an investment style. Investing on a regular basis, without concern for price, is a great way to create discipline in your investment methodology and get your money to work in the market quickly. Every day your money sits in cash, you are losing value. Your checking or savings account doesn’t compensate you for inflation, so the $100 in your checking account today is worth less next year.

If I had $100 to invest a month, I would invest it every month instead of waiting until I had $1,200 at the end of the year. However, if someone handed me $1,200 today, I would invest it all now instead of bleeding it in over 12 months, even though traditional DCA would recommend bleeding it in. And, according to Vanguard, the majority of the time I would see better performance.

Vanguard looked at rolling 10-year periods in the US stock market from 1926-2011 and backtested the performance of lump sum investing versus DCA. In other words, would you do better investing a certain sum of money today or bleeding it in over 12 months? What they found was that regardless of asset allocation, 65%-67% of the time you would see stronger returns putting the money in the market today than trying to smooth things out by leaking it in over time.

The reason for this is that the long-term trajectory of the market is up. The more time your money is in the market, the better you do.

So, what about the 35% of the time where it is worse? What if you are the unluckiest person in the world and this really is the market peak?

History says now is almost always better than later

Investing is a long-term game and in most cases, time heals all wounds. The secret is to hold strong through market cycles and not take your money out of the market as things get bad. However, it is incredibly hard to keep running forward when the herd is scrambling out. So, to provide some motivation for you to invest and hold strong, I took a look at the last ten market cycles. How would you have done if you invested your money on the peak day before the market turned?

The Great Recession

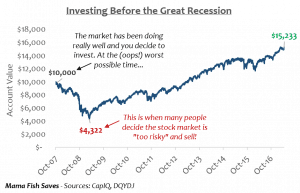

On October 9, 2007, the S&P closed at 1565.15. This would be the peak day before the worst recession the U.S. economy has seen since the Great Depression. For my illustration, I assumed you invested $10,000 on that exact day. Every year, for the next year and a half, you watch your hard-earned investment go down. Most people would take this as a sign to sell. But this is what would happen if you didn’t.

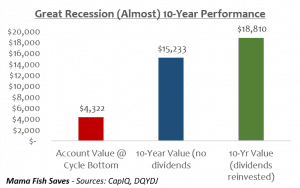

In March of 2009, your $10,000 would have fallen to $4,322 in value. A greater than 50% drop would be a pretty big gut punch. But by holding steady and recognizing that the market naturally rises over time, you would have recouped your whole investment by August 2013. By now, you would be up over $5,000. Your average annual return would be 4.7% with a total return of 54.7%. Not the 7% long-term average, but well above the 0% of your checking account and the 1%-2% annual inflation rate. And this is forgetting one very important thing. Dividends.

Many stocks in the S&P 500 pay dividends, so either you would have been receiving some cash payout on your $10,000 investment along the way, or you could have chosen to reinvest the dividends over time. (Reinvestment is exactly what it sounds like. Instead of getting a quarterly dividend check, your fund provider would just deposit that money right back into your investment account.) Had you chosen reinvestment, your account value would be $18,810 today for a 6.5% annual return! Almost in line with the long-term average of 7%!

Every recession since 1950

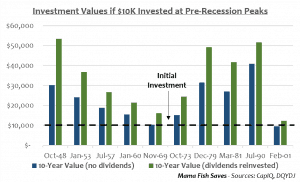

For the Great Recession, it seems like you would have done quite well, even if you invested on the worst possible day before the downturn. What I wanted to know, was does it hold true in other cycles as well? This 10-year time span between cycles isn’t typical. Usually, a cycle happens every six to nine years, so if you invested right before a downturn you could potentially see two declines over your investment period.

To find out the answer for our unlucky investor, I looked at investment returns during the 10 recessions prior to the Great Recession. The National Bureau of Economic Research tracks market recessions and contractions since the mid-1800s and the Bureau of Economic Analysis measures recessionary periods based on gross domestic product (GDP). Here’s what I found.

In only 1 out of the past 10 recessions, starting in 1948, would you have seen your $10,000 investment lose money over a 10-year period, and only then if you had chosen not to reinvest the dividends. On average for all recessions, including the Great Recession, if you managed to invest your $10,000 at the exact peak before a downturn and left it invested for 10 years you would see an average annual return of 7.1% without dividends and 11.6% if you had dividends reinvested.

This means, on average, even if you had the worst recession market timing possible, your $10,000 would more than double to $21,659 over a 10-year period. If you chose to automatically reinvest your dividends, your $10,000 would more than triple to $32,906! You would have to fight through seeing your account balance fall through one, and sometimes two, recessions. But if you did, your money would be worth a whole lot more than if you had just buried it in your backyard.

Don’t let your money sit idle

Millennials came of age during the Great Recession. We heard how our parents saw their 401K and retirement savings decimated. We faced tough job markets at graduation. So today, many of us have an intense distrust of Wall Street and the stock market. But too many of us have let the memory of the bad keep us from seeing the truth of the good.

We have the opportunity to learn from a severe cycle that happened early in our lives. Our parents’ retirement savings were only decimated if they panicked. If they let that fear settle in and took their money out of the market in the darkest days of 2008-2009, they never had a chance to benefit from the strong market recovery over the past eight years.

Investing in a peak market, when you know what the troughs look like, isn’t easy. But if you can have the discipline to invest for the long-term, the sooner you get your money invested in the market, the more wealth you’ll have in the future. Your money works for you, don’t let it sit idle!

What is your investment strategy in a peak market? How do you use downturns to your advantage? Let me know!

This article is not intended as personal investment advice, but as my opinion of why I invest through the cycle. Past market performance does not guarantee future performance. For more information, please see my disclosure.

I have never thought about investing in peak markets, but it does make sense. Doesn’t look easy, but looks like it would be worth it!

What an in-depth article. Sadly, I have never invested my money. I know I should, but I’m always a bit worried. I’ll reread this and reconsider. Thanks for the push.

Why not start investing today?

Great idea, Jim!

I’m going to keep contributing to my 401k and IRA, though I’m just getting the company match until I build up a decent enough emergency cash account.

It makes sense, inflation and the government probably will continue to have people pump money into the stock market over time. The question is what will happen when more people start retiring and are drawing down their balances…

Thank you for making this article, easy for me to understand ???? Good information, backed up by a lot of research/facts.

While I feel like I have a firm handle on my personal finances (budgeting, retirement plan, college plans, etc.) I’m more of an amateur when it comes to really investing. This is a phenomenal post-I love how simply you broke out the research about investing at the absolute peak. Those are some great returns, even for the worst time in history.

I’m with you Chelsea! I don’t like to try to time the market but it is getting really hard for me not to pull some/all of my money out of the market right now. I keep thinking it is due for a correction.

Same Kim! This article was 80% sharing some data/information and 20% reminding myself not to move some money to cash!

That is a good way to look at the market. Like you said stock rises and falls all the time and over time your profits will increase again x

I have been looking into doing some investing. Thanks for the great information. It has really helped me.

Even if you do end up investing at the peak, it’s not as though you invested all of your money in a lump sum on the day of the market peak. You invest on the way up, you continue to invest on the way down, and you’re investing at the trough, too. In the end, dollar cost averaging ensures you don’t miss out on the highs (or the lows).

Cheers!

-PoF

We just continue to invest peak or trough. In order to stay the course I keep 1-2 percent of money as play where I Time the market. It’s essentially play money to remind me it doesn’t work.

When discussing this subject I usually point to 1996. The head of the fed even says we’re way too high (“irrational exhuberance”). The p/e was even higher then now. So what happened? 2 more years of gains. We didn’t see a drop below hat point for seven more years. You never know.

If you are going to invest in the market you have to look at long term gains and not get panicked with short term losses. But that’s very hard when you are staring at your money.

This is a really brilliant post, I know next to nothing about investing. Bookmarking this for reference.

Really convincing argument! The “worst market timing ever” leaves average returns within ten years actually DOUBLING your money –

even if you don’t reinvest dividends! This is great for the newbs. I’ll suggest it to Mad Fientist for his guide!

Thanks, Vigilante! I was really surprised at the numbers when I did the math! Would be awesome if the Mad Fientist could take a look 🙂

Great post! We think we’re in a peak market now but the Dow may rise another few years before a big dip. I saw an article that referenced a few indicators used as barometers, that seem to portend we’re not near a drop. But who knows? Dang, why did my crystal ball have to shatter!

It’s still better to invest and allow your money to grow. It’s not like you’re going to invest all your money anyway. I wouldn’t call it much of a risk.

I think it takes a lot of thought but it’s also a good risk. It’s better to grow your money instead of just letting it sit in the bank. This is a very informative post, it’s perfect for understanding the market more.

Wow, so much I learned from this! So I don’t know much about investments but definitely something I’ll ahve to look into soon!

I like to go by the saying “Its time in the market not timing the market”. Great post going over the history of the markets.

This article speaks to the very discussion we have been having for a few weeks, if not months. We (especially me) are so scared to invest cash we have sitting in the bank because we are afraid of an imminent market crash. I am so thankful for this article because it has finally convinced me that the money sitting in our bank account right now is doing nothing for us. My husband has been trying to tell me this, but I just couldn’t understand how investing in the market right now was a good idea. Thank you for this.

Pingback: The Sunday Best (5/14/2017) - Physician on FIRE

Great analysis and article. I’m paid in quite a lumpy way and while I employ a bi-monthly regular DCA strategy with those after tax accounts, I have to admit that when those big lumps hit, I have a hard time dropping it in all at once so I tend to do it over time even though the data shows otherwise! I keep trying to channel my inner warren buffet zen approach. Articles like this are great to help combat those emotions with real data!

Thank you! I also get paid in a lumpy way and it is so hard to dump that money in all at once! Running data like this keeps me in check 🙂 Good luck staying as zen as Warren Buffett! He’s the master 🙂

Excellent article – people really need to grasp these points. For people who are still building their investments, IMO, the best way to dollar cost averaging — invest the same dollar amount every single month regardless of what the market is doing. It’s proven rather effective!

Thank you, Brad! DCA is awesome as a regular plan if you can stick to it through the cycle. But if your sitting on a chunk of cash from a bonus or windfall, it is best to get it in the market asap! Sometimes we just need a push 🙂

Indeed. And sometimes that is admittedly very hard.

Personal testament: When I sold my company a few years ago I was faced with how to deploy 7 figures of cash. I did what both you and I think is smart: I put it all in the market (beyond our cash reserves). I then watched the market creep down to showing paper losses of hundreds of thousands over the next months. I held steady though and now everything is well *up* hundreds of thousands from when it started. It can be hard, but it is smart. Not everyone gets this level of cash at once, but regardless of the amount, the story applies to anyone in this position.

Great article! It can definitely be scary but if your time horizon is 20-40 years away from retirement it really makes sense. I do like having extra cash sometimes in case there is a big drop then you can swoop in and buy at a discount.

Dips can be a great time to rebalance your portfolio or add a little extra cash you may have lying around. Leaving too much cash around for buying dips is definitely trying to time the market though, so you have to be careful, and recognize you usually won’t win versus just investing it.

Set it and forget it. I have no intentions of decreasing my auto deposits into my Roth or traditional until they are fully funded for FIRE.

When the time comes and a down turn hits I may have to pull some money out of savings to dump more money into a low market just to get some extra returns.

Set it and forget it is the joy of good investing! One of the only times in our lives where laziness actually wins the game! And I’m with you, if a downturn hits, I may have to bring our emergency fund down a little closer to bare bones and get that money in the market. Then we can tighten our belts on the budget for a couple months to get back up to snuff (without reducing our DCA commitments).

I remember a few years ago not wanting to invest idle cash because I thought the market had “peaked” when the Dow was at about 16,000. Shame on me!

Oh no! I remember a lot of people thinking that had to be a peak! Hopefully you learned your lesson and are investing regularly now 🙂

Honestly, I should be following this advice and simply investing more into index funds instead of just hoarding cash. However, I’m justifying “trying to time the market” by calling my cash savings for a “down-payment on a property”.

Basically, if I reach enough for a down-payment on a rental property, I’m going to invest in that – however, if the market corrects by 20-30%, I’m planning on putting most of my down-payment savings into index funds.

Essentially, I’m trying to time the market, which is a terrible & stupid idea. However, I really do want to get into real estate at the same time.

Also, did you factor inflation into your 10 year post recession returns graph? If you look at inflation each year, its really low – a few %. However, over the course of 10 years, it becomes significant and something we should consider!

It is hard to weigh your goals in situations like that. You don’t want to have money in the market for less than 3-5 years so if you have near term goals sometimes you have to hold cash. But when you are weighing uncertain investment ideas, it can feel like you’re doing the wrong thing.

We have been talking to a small business about a potential investment for a few months, which means we are sitting on some extra cash. Having that cash there is driving me nuts, since I know I need it liquid if the deal goes through, but also know it is a small local business and it might not happen. So difficult!

I didn’t factor inflation into the 10-year-returns for this analysis. I thought about it, since higher inflation periods like the late 70s and 80s appear to have higher market returns but it is more uniform on an inflation-adjusted basis. Either way, including inflation would just further prove the point, as the money lost holding cash would increase.

Thanks for reading and taking the time to comment, Akash!

This is such a great read. It can feel hard to invest when everyone keeps saying that the market *must* be going down soon. However, if you’re in it for the long haul then that shouldn’t matter!

Thanks, Michelle! Investing is a long-term game, but short term fluctuations make it way too easy to forget that. Hopefully seeing the data helps some people stay focused!

Something doesn’t add up here. What kind of dividend were you assuming to get an 11.2% annual return for the past 10 years??

The S&P 500 hasn’t had a dividend yield over 3% in more than 20 years (currently below 2%). If the return without dividends annualized at 4.7%, and assuming an average of around a 2% dividend yield over the past 10 years, then back of the envelope would suggest closer to a 7% annualized return over this period. Not bad, but not 11.2%.

It assumes you are reinvesting the dividends, not just taking the payout. The compounding gets you to 11.2%. To be fair though, I didn’t do the math on the reinvested dividends return personally, I pulled it from the site Don’t Quit Your Day job (link below). I read his methodology and it seemed sound.

https://dqydj.com/sp-500-return-calculator/

If you still have questions/concerns, let me know! Thanks for reading 🙂

You’ve made a very compelling argument. I wanted to play around some myself, so I tried the calculator mentioned above; https://dqydj.com/sp-500-return-calculator/

I entered Oct 2007 & May 2017.

Total S&P 500 return = 55.2%

So $10,000 * 1.552 = $15,520, just as your chart shows

Total S&P 500 returns with dividends reinvested = 89.6%

So $10,000 * 1.896 = $18,960.

Your chart shows $28,810.

Did I do something wrong? Or is your chart off? How did we get such different results?

Brian – My chart is off. Thank you so much for catching and working out the math yourself, I really appreciate it! Sometimes you need another set of eyes 🙂 The post has been updated to reflect the right values.

When I went back to my spreadsheets, I had created a formula for 10,000*(1+return) to calculate the value. But in the Great Recession example, which I did first, I had already added the 1 manually before doing the formula for other recessions. I have double checked and all other time periods were calculating correctly.

Thank you again for following up on this!! You rock!

Great points! Trying to time the market or pick the winner is a fool’s game. Get some index funds and DCA. Investors need to have a purpose for investing their cash. If it is for the long term, then knowing the market will come back up should help stomach those downturns. If money is needed in the short term, probably need to be looking to safer investments anyway.

Totally agree, Nick! Investing without a goal is a recipe for failure. You have to think about your goals, risk appetite and timeline anytime you invest.

Pingback: The 7 Personal Finance Articles We Loved This Week

“Invest You Must” thanks for sharing and good luck in the Rockstar Finance bracket!

This is really reassuring. I sat on a sizeable lump sum for a few months because I was leery of investing at the wrong time. Last month I bit the bullet and did it.

?

Bookmarking this to read again from time to time to steel myself against the inevitable 🙂