What is a mutual fund? If I had to guess, many people who read this post will actually own mutual funds but probably couldn’t explain what they are. So, in today’s definition download we are going to take a step back to the basics and build a financial literacy foundation by explaining mutual funds. We will discuss what mutual funds are, who manages them, what level fees are reasonable, and open-end versus closed-end funds. Off we go!

What is a mutual fund? If I had to guess, many people who read this post will actually own mutual funds but probably couldn’t explain what they are. So, in today’s definition download we are going to take a step back to the basics and build a financial literacy foundation by explaining mutual funds. We will discuss what mutual funds are, who manages them, what level fees are reasonable, and open-end versus closed-end funds. Off we go!

Table of Contents

What is a mutual fund?

OK Google, what is a mutual fund? “A mutual fund is an investment program funded by shareholders that trades in diversified holdings and is professionally managed.”

Whew, thanks for clearing that up Google. Guess I can make today’s post a short one!

Just kidding! Anyone have any idea what in the world that means? No? Ok. A mutual fund allows a group of people to pool their money together, which allows them to invest in large volume in a way they couldn’t do as individuals.

For instance, let’s say you had $5,000 to invest. You read our Definition Download on Asset Allocation and wanted to be sure you owned 90% stocks and 10% bonds in your portfolio for long term investing. You would need $500 of bonds. Well, a single unit of a corporate bond is $1,000. Even if you decided you would do 20% bonds and buy a single unit, all of your debt exposure would be in one company! What happens if that company does poorly?

As an investor in a mutual fund, you own shares, or units, of a much larger collective fund. Each share represents an equal slice of what the whole portfolio owns. Your share may only represent $0.50 of that original bond you wanted to buy, but you get to own hundreds of other things with your $5,000. This reduces your risk by diversifying what you hold.

Who manages a mutual fund? – Active vs. Passive Management

Mutual fund management is split up into two strategies: actively managed funds and passive or index funds.

An actively managed fund is just as it sounds – a team of investment professionals at an investment management company “actively” choose stocks and bonds to purchase on behalf of the fund to optimize returns. These managers choose stocks and bonds based on the risk and asset allocation parameters set out in the prospectus of the fund (detailed plan for the fund sent to all investors).

A passive or index mutual fund is invested automatically to reflect a given index. For instance, if Amazon is 1.9% of the S&P 500, in a passively managed S&P mutual fund for every $100 invested $1.90 would be used to purchase Amazon stock. A passively managed mutual fund will automatically reflect the underlying index.

What kind of mutual fund do you want? In general, a passively managed or index mutual fund is the best way to go as (1) over a wide variety of time periods index funds have outperformed the majority of actively managed funds, (2) fees are generally lower, and (3) index funds have less trading and turnover which can reduce tax consequences.

What are reasonable fees?

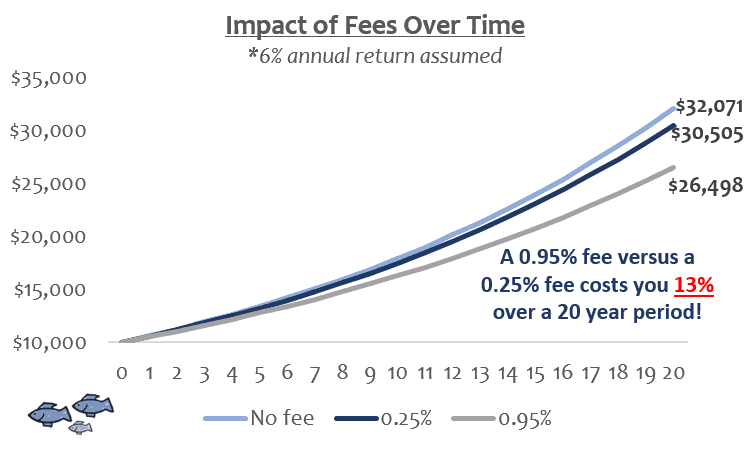

Fees make a massive difference for long-term investment returns, in a way that may not be clear by the small percentages you see as the fee cost when you flip through that list of potential investment funds for your 401k.

The number you are looking for is the “expense ratio”. This number gives the annual management fees for a mutual fund, expressed as a percentage of your investment value. These fees can range from 0.05%-2.0% depending on the fund provider, active vs. passive management, and the types of assets the fund holds.

Below you can see below the impact of a 0.25% fee versus a 0.95% fee on a $10,000 investment over time. The higher fee may not sound like much, it is still less than 1%, but over 20 years as you save for retirement that extra fee costs you over 13% of value growth or just over $4,000.

In general, you want to aim for funds that have expense ratios below 0.50%. The exception is if you have a high fee employer 401k plan in which you receive matching contributions. The value of the match and the tax deduction will likely offset higher fees. In this case, you should aim to choose from the lowest cost index funds the plan offers that meets your strategy and risk profile.

WATCH OUT FOR LOAD FEES!

Load fees are fees you get charged why you purchase a mutual fund (front end loads) or when you sell a mutual fund (back end loads). These fees can be as high as 6%-7% and can seriously impact your long-term returns. Vanguard, Fidelity and Charles Schwab offer a number of no load mutual funds (all Vanguard funds are no load), but your 401k provider may still offer many load bearing funds. These fees will not be included in the expense ratio. Be sure to look for any load fees before purchasing a mutual fund. Obviously, we would prefer no load fees.

Open-end versus closed-end funds?

The majority of mutual funds available in the market today are open-end mutual funds (~98%), but in choosing a fund you may see the terms “open-end” and “closed-end” so we will cover them quickly here.

Open-end mutual fund: An open end mutual fund has shares that are bought and sold based on their NAV price (Assets of the fund minus liabilities, divided by total shares) on a daily basis. Every night, the fund waits until the close of market when stocks and bonds stop trading, checks the value of all the stocks and bonds in its portfolio, and divides the total net assets by the number of shares outstanding from the night before. This is that day’s NAV price. When you put in a trade to buy or sell an open-end mutual fund, your transaction will happen at the next available NAV price, usually the price calculated that evening.

Closed-end mutual fund: A closed-end fund has a fixed number of shares outstanding, like a company, and are traded on an exchange like stocks. This means the price is entirely determined by supply and demand. If more people want to sell their shares in the fund than want to buy, the price will go down. Similarly, if more people want to buy than want to sell, the price will go up. One reason this is not a popular fund option is that the value of a share of the fund can differ significantly from the fund’s actual net asset value (NAV). You could end up paying much more per share than the investments in the fund are actually worth!

Summary

“What is a mutual fund?”: A mutual fund is a pool of money from numerous individual investors invested together to take advantage of greater buying power. A share in a mutual fund is a small, equal slice of everything owned in the fund. In most cases when buying a mutual fund, you want to look for an open-end index or passively managed fund, with no load fees and expense ratios below 0.50% with an asset allocation that aligns with your needs.

Did you learn something today you didn’t know before? Do you have a term or concept you would like defined in the next Definition Download? Let us know!

I didn’t know about the load fees, though one also has to consider Thanks for sharing that.

What funds do you suggest? Vanguard?

The load fees can be killer! A 5% front end load means every $1,000 you put in you only invest $950. That’s a tough hole to dig out in.

I personally love Vanguard and use them for almost everything. They are still the lowest cost provider, especially as you grow your investments and have access to the Admiral funds. However, other low cost providers like Fidelity and Charles Schwab have started to close the gap with Vanguard. Another example where competition is good – pushing fees down for the last several years.

Thanks so much for reading and glad you were able to learn something! ????

Glad I’m in Vanguard. 🙂 Load fees can sting. Thanks for the great overview!

Vanguard rocks!! Thanks for reading Brian! 🙂

I definitely am apart of the Vanguard community…great choices, low fees/expenses!

Thank you so much for those great explanations!!! This will be so helpful when I explain to my mom and a co-worker. They have been asking me lots of questions and while I’ve learned a good bit from reading finance blogs… this really breaks it down and gives me more ways to explain why index funds are the way to go! It also gives me more to look for than just the expense ratio!!

So glad it was helpful, Liz!

I love the Dilbert cartoon. There is so much truth there. Thanks for going to basics. Sometimes we forget that the majority of people don’t know things we consider simple.