When was the last time you really looked at your 401(k)?

No, I don’t mean checking the balance. I mean checking your fund options, reviewing your asset allocation, and checking whether you were on track to retire.

My first job out of college I picked a low-cost (thank goodness) Target Date Retirement Fund, set my allocation, and never looked at it again. At the end of the year, I would update my contribution on the little form my employer sent. But that was about it. I didn’t seriously consider the account until I left that company and rolled my 401(k) into an IRA.

And, unfortunately, that’s how most people do it. Employer-sponsored retirement plans are the easiest to ignore, so they don’t get optimized. Even though they represent the most significant chunk of retirement savings for most families.

That’s what Blooom wants to fix.

Table of Contents

Summary

Blooom offers an excellent, 5-minute free analysis of your employer-sponsored retirement plan (401(k), 457, 403(b), 401(a), or TSP). They also offer low-cost ongoing management services which are best for hands-off investors who have a slightly higher risk tolerance.

What is Blooom?

Blooom is a robo-advisor for your employer-sponsored retirement plan. Typically, financial advisors can’t manage 401(k) or employer-sponsored retirement plan assets. Which meant you had to do it yourself. Blooom is filling that niche by managing the assets from within your employer’s plan.

Blooom offers two main services. The first is an entirely free 401(k) analysis. It takes 5 minutes and gives you an easy snapshot of the health of your account including how well your fees are optimized, your risk level, and your diversification. You can get this analysis with no obligation to sign up for Blooom’s paid service.

The second is the ongoing management of your 401(k). Blooom will select funds that give you the lowest overall fee while also managing your risk and diversification. This includes rebalancing your portfolio every 90 days to account for moves in the stock market and your changing risk as you approach retirement.

Blooom’s Free 401(k) Analysis

I wanted to see what Blooom’s free 401(k) analysis looked like in practice, so I tested it out.

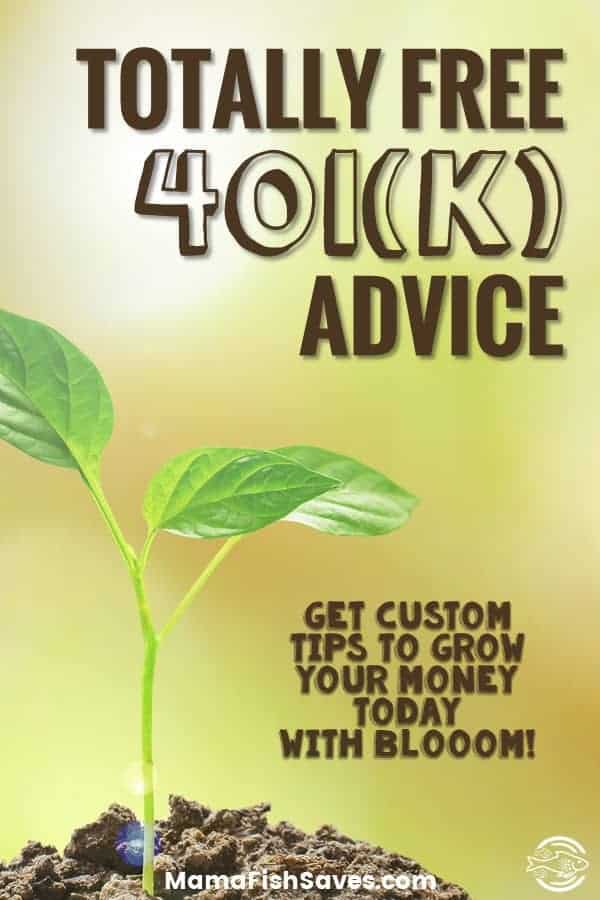

When you start your registration, all you need is your first name, date of birth, and target retirement age. The screen looks like this:

Then, you’ll have to create an account. Enter your email and a password.

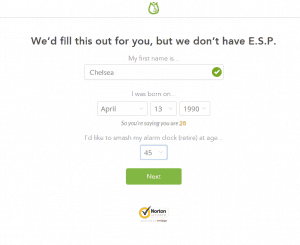

Now it’s time to get to the analysis! You’ll have to choose your employer’s retirement plan provider then sign into that account. Assuming your account has two-factor security, you’ll get texted or emailed a code to put right into Blooom.

Don’t worry; you’re not giving them control of your accounts. Their system has robust security, and right now they are only getting read access.

After signing in, the screen will spin for a few seconds, then pop out your analysis! They keep it simple, then go a little more in-depth on each component as you click through.

Here’s mine:

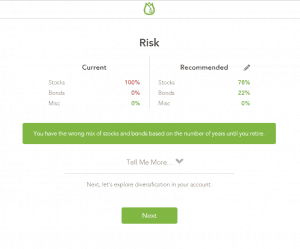

And an example of one page of the more detailed analysis of each component:

Blooom wraps up with a pitch of their ongoing management services. They show how much more they think your account could be worth at retirement age if you use their services, and how much not having those services costs you a day. It’s up to you and your 401(k) to decide if that is valuable to you, but we will discuss more of the merits and risks in the next section.

Pros and Cons of Blooom’s Analysis

Next month, when my contract is up with my old employer, I will be rolling my 401(k) assets into a Vanguard IRA. So, the reality is that I really just tested my 401(k) to review their services. Still, it was interesting to flip through and see where I stand versus optimized accounts.

? Pros of the Blooom 401(k) Analysis

- Very fast with excellent customer service. I had a slight issue getting logged in with my provider (Blooom’s system wasn’t triggering the security code), and someone hopped on and helped me in less than 5 minutes.

- Simple, clear overview of retirement plan health. This Blooom analysis isn’t going to give you a 10-page review of your accounts. But you really don’t need it. Blooom’s easy-to-understand and quick format make it easy to take action.

- Direct comparison of your account to well-managed accounts. It is helpful to see not only whether your account is healthy or not, but how far off it is from the average.

? Cons of the Blooom 401(k) Analysis

- Doesn’t take into account other assets. Blooom rates your risk and diversification only off your retirement plan. This is why I “failed” in diversification – I only own a total stock market index fund in my 401(k) as I have sufficient bonds elsewhere. You need to balance Blooom’s recommendations with other assets you know you own.

- Asset allocation runs a higher level of risk than most managers. Most people in their 20s and early 30s are going to be told their asset allocation should be 100% stocks and 0% bonds. While this should optimize returns in the long-term, it means accounts will see more volatility through cycles and might be too much for some users’ stomachs.

Bloom’s Ongoing Management Service

If you want entirely hands-off investing for your 401(k), Blooom can manage your portfolio for you for a fee.

How Blooom Charges Fees

Most asset managers, including other robo-advisors like Betterment and Wealthfront, charge fees based on a percentage of your assets. Instead, Blooom charges a flat fee of $10 per month. Which won’t change as your assets grow.

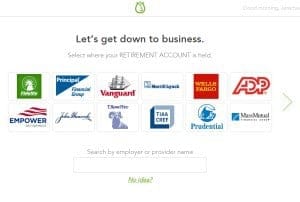

Here’s how the $10/month fee looks for accounts of different sizes:

At low account sizes, $10 a month is a steep fee. It isn’t until your account is $50,000 or more that Blooom fees start to go below the 0.25% standard set by Betterment and Wealthfront.

I will never, ever recommend you go to an account manager with over 0.50% fees. So, if you have a 401(k) with less than $50,000 on it, take Blooom’s advice from the free analysis and at least utilize their suggestions for reducing your fees. That is where most of the value of there service comes from in the long-term anyway since fees are the biggest determinate of success over time.

What You Get for $10 Per Month

Blooom’s pitch on their fees is that you pay less in retirement account management than you do for a Netflix account. Fair enough. But what do you actually get for that fee?

- Blooom will choose the lowest cost funds available to match your risk level.

- Blooom will rebalance your account every 90 days to match your target asset allocation (which you can change whenever you want).

- Blooom will adjust your asset allocation over time, so it matches your risk tolerance as you near retirement. (i.e., As you get closer to retirement it will lower your share of stocks and increase your bond ownership.)

- You’ll have access via email, chat, and phone to licensed and certified financial advisors. These people can talk to you about any aspect of your finances, not just retirement accounts.

Pros and Cons of Blooom Ongoing Management

Pros of Blooom 401(k) Management

- Low fees for large accounts. If your 401(k) account is substantial ($50,000 or higher), Blooom offers management fees lower than any other robo-advisor.

- Regular rebalancing. Quarterly rebalancing means you will be well prepared for any swings in the market and will have an appropriate asset mix as you approach retirement.

- Access to financial advisors. While smart investing algorithms are great – they certainly reduce cost – sometimes you just want the reassurance of a real person. Having access to advisors who have a fiduciary duty (they have to act in your best interest) can be a comfort.

Cons of the Blooom 401(k) Management

- They make recommendations based on limited data. Even when you move from the free analysis to ongoing management, Blooom doesn’t take any more data from you beyond your name, age, and target retirement date. This means their system is ultimately based on your years until retirement and doesn’t take into account your other assets and risk tolerance. If your 401(k) is your largest investment account, it might not matter, but if not you should speak to one of their financial advisors to help you pick a more personalized asset allocation.

Is Blooom Worth It?

Blooom’s free 401(k) analysis is absolutely worth it. It is five minutes of your time and can alert you to things you may not have thought of. For most people, your employer-sponsored retirement plan will be your most significant asset in retirement; you don’t want to miss fees or improper allocations that could diminish your net worth over time.

When it comes to Blooom’s ongoing management, it is going to depend on you. Personally, I’m a big proponent of low-fee self-management. But if your 401(k) is a large part of your retirement assets and you aren’t planning on signing in regularly to check on fees, rebalance your accounts, and adjust asset allocation as you approach retirement, a $10 a month fee could be worth it to you.