Having an excellent credit score – 780 and above for FICO scores – is about more than bragging rights (Though, my husband does like the perk of being able to tease me that his score is higher than mine.) The benefits of a great credit score can actually add up to thousands of dollars over time.

Your FICO credit score is a score of creditworthiness developed by the Fair Isaac Corporation and is used by over 90% of top lenders in the U.S. These scores are calculated based on the information in your credit reports, collected by the three main credit bureaus – Experian, Equifax, and TransUnion. As such, your FICO score can vary somewhat based on which bureau’s data is used to calculate the score.

Overall, however, a FICO score can range from 300 on the low end to 850 on the high end. While we all know the costs of a low score, the benefits of an excellent score versus a fair or good score are typically harder to quantify. So, today, I want to share six ways an excellent credit score can help you build wealth.

If you’re looking for some new ways to take advantage of your score, or you need some extra motivation to start improving your score, here’s what you need to know.

Table of Contents

#1. Save Thousands with Better Mortgage Terms

Many people who claim to be debt-free, even in the Aha! Debt series, still have a mortgage. A home is one of the biggest assets in many American’s portfolios, but their mortgage is also the single largest piece of debt they’ll ever hold. (I know, doctors, your student loans might beat it…)

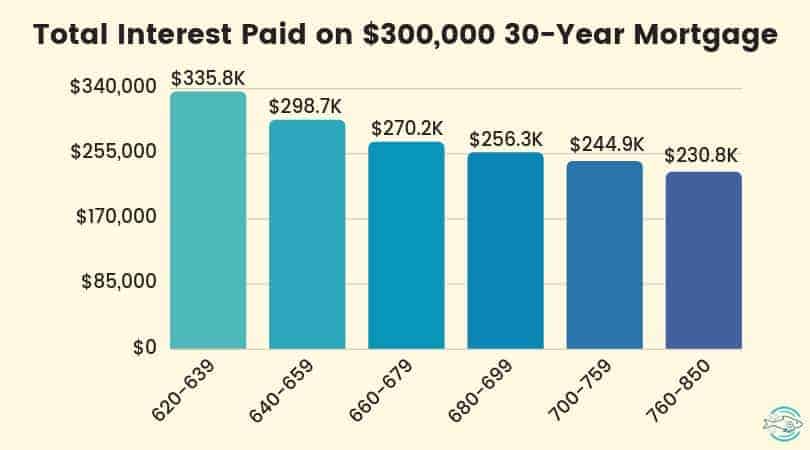

With mortgages being such a significant debt, it makes sense that a top-notch credit score would save you money here. But the savings are often undervalued in a low-interest rate environment. All rates sound pretty reasonable, so how much are you really saving?

Well, a lot. The median home price in the Boston metro area, for example, is $398,000. Assuming you put 20% down, the myFICO loan savings calculator estimates the mortgage rate for someone with an excellent credit score (760-850) at 4.282% versus 4.68% for someone with a good credit score (680-699). Now, that difference might seem small. But over the life of a loan, that extra 0.398% costs you over $27,000. If your score is only fair (640-659), you’ll pay over $72,000 more in interest than someone with excellent credit.

Keep in mind; this assumes you put 20% down. Put less than 20% down, and you’ll need a credit score of 780 or above to secure the best PMI rates. And only those with excellent credit get great terms like low closing cost mortgages and not needing to escrow homeowners insurance, property tax, and mortgage payments up front.

Saving on a mortgage is a long-term game. But so is wealth building.

#2. Great Terms to Refinance Your Student Loans

44 million American adults now owe over $1.5 trillion dollars in student loan debt, collectively. That’s a lot of joyful experiences to pay for, which might be why more and more Americans are struggling to see the value of college when faced with the bill.

Yet, those with excellent credit have more options when it comes to reducing interest rates and getting the best terms. Top refinancing companies, SoFi and CommonBond, offer the best rates but they also require excellent credit scores to qualify.

If you still have student loan debt and have great credit, it is worth checking your estimated savings with both SoFi and CommonBond (it doesn’t take a hard credit pull to get a quote!).

However, the true point here is for parents with teenagers. Whether or not your child plans to go to college, or if you have a fully funded 529 Plan set aside for them, make moves to start building their credit now.

Add your teen as an authorized user on one of your credit cards with a very tight limit, or encourage them to apply for a student card once they are 18. Explain to them smart credit card behavior, like always paying off their bill in full each month, so if they need to refinance student loans, get approved for an apartment, or more when they enter the workforce, they have a score that opens doors.

#3. More Affordable Homeowners Insurance

So far, we’ve only talked about interest rates. Which is a massive benefit for a great credit score. But even if you’re completely debt free, your shiny credit score pays dividends.

Unless you live in Maryland or Hawaii, homeowners insurance companies use the data from your credit report to calculate credit-based insurance scores. Insurance companies have found that those with top-notch credit are less risky clients, with fewer claims, cheaper claims, and more on-time payments. So, they offer lower premiums to those with higher scores.

And if you think these differences are probably minuscule, think again. Someone with fair or median credit pays an average of 36% more for homeowners insurance than someone with excellent credit.

These differences are on the rise, with the gap between premiums fair and excellent credit increasing from 29% in 2014 to 32% in 2015 and up to 36% in 2016. This can mean hundreds of dollars a year in savings!

#4. Access to the Best Credit Card Rewards

We’ve all seen the stories of people travel hacking thousands of dollars in vacations from credit card rewards. And reward miles and points have started to become a contentious part of some estate battles.

Even if you aren’t a mega spender or points cruncher, credit card rewards do have real value. The best rewards and travel credit cards offer higher rewards rates, valuable sign-up bonuses, and additional perks like travel insurance, concierge resources, and lower fees.

Take our JetBlue Plus card. When we signed up last year, we got 40,000 bonus JetBlue points after we spent $1,000 in the first three months. Now, that was money we were going to use anyway (we get 2X points on groceries!) and we paid the bill off in full each month. But JetBlue points have an estimated value of 1.4 cents, so just by getting this card and going grocery shopping, we earned $560 in travel rewards.

However, to get the JetBlue card – and other cards like it – you need an excellent credit score. When it comes to credit cards, a 720 score or above usually qualifies you for the top cards. Remember, though, that the higher your score, the higher your credit limit and lower your interest rate is likely to be. (You aren’t going to pay any interest on your card though, right?)

#5. Cheaper Auto Insurance

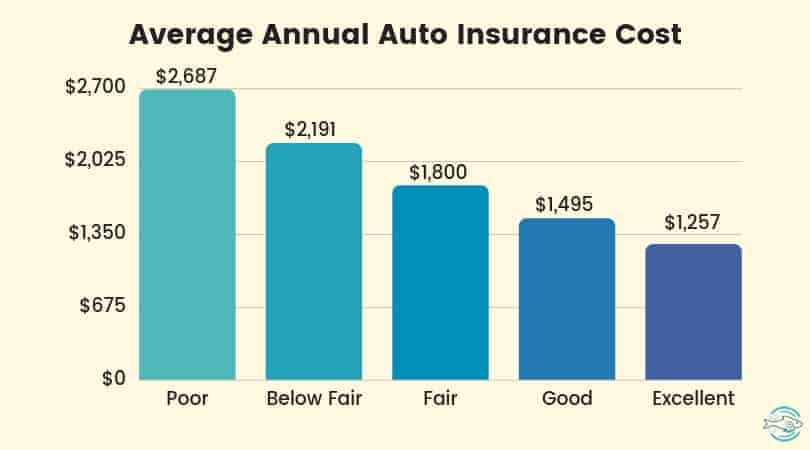

Remember those credit-based insurance scores? They aren’t just impacting your homeowners. Auto insurance companies use them too.

Our credit scores, rightly or wrongly, have become a measure of responsibility for adults. It’s a somewhat flawed system – just like SAT scores aren’t always a good measure of intelligence for college. But for insurance companies, it’s often the best source they have.

Unless you live in California, Massachusetts, or Hawaii, where the practice isn’t allowed, your credit reports factor into your car insurance premiums. Of course, your driving record, car, and coverage level have more of an impact. But credit history is still important.

According to insurance comparison tool, The Zebra, those with fair credit pay an average of $1,800 a year for auto insurance, while those with excellent credit pay only $1,257. An extra $543 a year can go a long way over time!

#6. Always Get Approved

Finally, one of the biggest benefits of a great credit score is something most likely to be taken for granted. With the best credit scores, you never have to worry about credit holding you back.

Almost a third of employers run credit checks on prospective employees (almost all finance and government jobs), as a strained personal finance situation can cause you to make bad decisions at work. Landlords run credit checks when you apply for an apartment, and your credit plays a role when you need to get a new car or want to put an offer in on the perfect house.

For many of our big life decisions, our credit score is peeking over our shoulder. And when you have an excellent score, your track record opens doors instead of closing them. No one will determine you aren’t responsible enough to do the things you want based on your payment history or credit load.

Get and Keep an Excellent Credit Score

To have an excellent credit score, you need a pristine history of on-time payments, a low debt-to-income ratio (start paying down that debt!), and a reasonable length of credit history.

Avoiding debt whenever possible, paying off your credit cards in full each month, and avoiding too many hard credit checks – like for new credit cards or loans – can help improve your score or maintain a high score.

Smart borrower behavior can save you thousands of dollars over time. And maybe you’ll get a smile out of the bragging rights, like Papa Fish.

Do you have an excellent credit score? What do you do to keep it top-notch? Share in the comments!

Great outline of the advantages a high credit score brings! As a real estate investor, getting access to lower rates (even a fraction of a point) can mean a huge difference in cash flow, and ultimately profit.

Fascinating that you can get cheaper car insurance too! I wasn’t aware of that one (probably cuz I live in CA).

Good post here on the benefits and advantages of a good credit score. My own experience was being able to negotiate for a lower interest rate on my credit cards and home loan. And like you said, most employers now run credit checks on prospective employees. I don’t object to that especially if they belong to the financial sector; however, I’ve seen it happen in the tech sector and other industries. A friend just got turned down after passing all the job interviews just because he did not meet the company’s minimum credit score requirement. It’s sad.