Welcome back to the Roadmap to Financial Health! If you are new to the Roadmap, we recommend starting at Step 0.

Step 3 on the Roadmap has to be, by far, the least fun segment of your journey but it is also the segment that offers the most stress reduction once you’re past it. Step 3 is focused on paying down your high-interest debt so you can achieve a debt-free lifestyle. In this post, we discuss how to determine your monthly debt payment goal and what debt you should pay down first. We will also go through an example of why every dollar matters.

Anyone who has ever been in debt knows how hard it can be to dig yourself out of that hole. Creditors want you to keep your debt outstanding for as long as possible because that is how they realize the maximum profit. The discipline it takes to pay more than your minimum monthly payment every single month until you are debt free when that big, bold number on your credit card bill is showing you that you could pay less and take that money to Target may be one of the hardest things in your financial life. If you are going to do it, you need a plan, and you need to be fully committed. So where do you start?

Table of Contents

How Much Should I be Spending on Debt Repayment?

In Step 1.2 on the Roadmap to Financial Health, we talked about how to build a strong budget that prioritizes your spending. If you haven’t already set up your budget jump back to Step 1.2 and gain an understanding of your financial situation. It is highly unlikely that you will be able to power through to a debt-free life if you don’t start tracking your expenses and prevent the overspending that got you into debt in the first place.

If you have a budget, your Monthly Income minus Monthly Obligations, Minimum Debt Payments, and True Expenses is the cash you have available to pay down principal on your debt. However, it is also the money you have available for your Quality of Life spending, like Hulu, restaurants, and manicures. In a perfect world, you would eliminate all your Quality of Life spending until you were out of debt, but the reality is that is a good way to make you unhappy and cause a detrimental spending binge down the road.

Think hard about how much you can limit that Quality of Life spending to allocate the most money possible to debt reduction. If you love dining out and you find yourself at a restaurant 3-4 times a week, think about the absolute minimum number of restaurant meals you could be happy with. Do you need to eat at a restaurant once a week, or is pizza or Chinese food twice a month (once midway through the month and once at the end of the month to celebrate your discipline) enough?

Tightening your belt certainly isn’t going to be fun, but it is going to feel great when you’re out of debt. An excellent source of motivation is to write the total amount of your debt payments down on a sticky note and stick it to your computer. Every day focus on the amount that will be freed up each and every month for your savings goals or hobbies once you don’t owe it to your creditors.

What Debt Do I Pay Down First?

There are two main schools of thought on how to pay down debt. The first is the avalanche method which suggests paying down the debt in order of highest interest rate to smallest. Mathematically, this is the optimal way to pay down debt as it will result in the minimum possible interest expense.

The second method, which is called the snowball method and was made popular by Dave Ramsey in Total Money Makeover, recommends paying down your debt with the smallest balance first, then moving to the next smallest, until you are debt free. The benefit of the snowball method is completely psychological. Ramsey believes that the feeling of accomplishment you get from paying down that first small debt will give you the drive you need to stick to your debt reduction plan in the long term.

Which method is better really depends on you. In general, both methods will get you paid off in about the same amount of time, but the avalanche method will save you some money in interest.

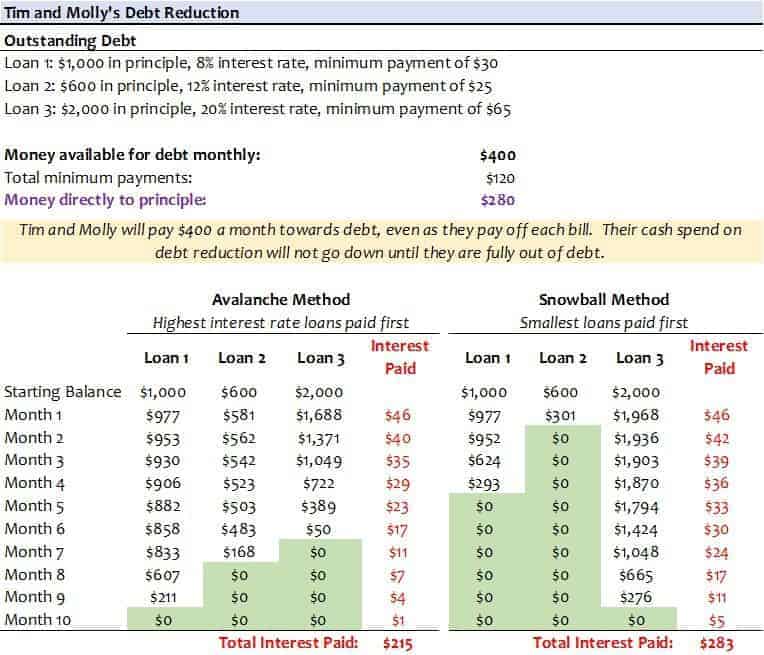

To illustrate the difference, I created this example of a fictional couple, Tim, and Molly. Both methods get them out of debt in 10 months, and while they spend $63 more in interest with the snowball method, they also get to get rid of their first loan six months sooner than with the avalanche method. That could be a very empowering milestone!

Cost of Allocating Less to Your Debt

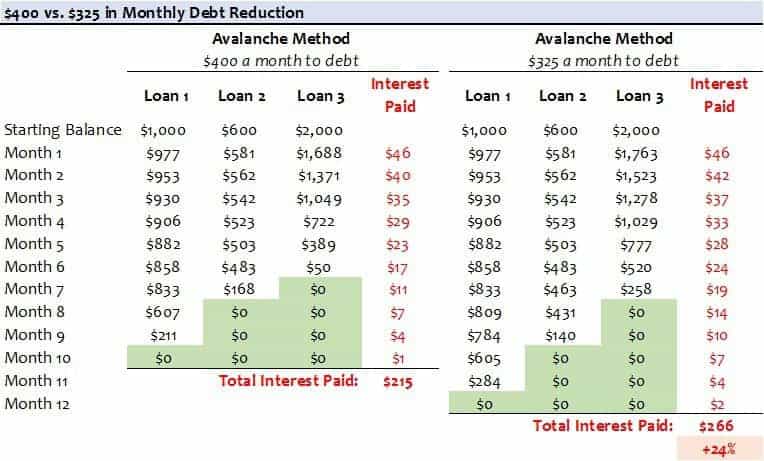

In the example from Tim and Molly, they are spending $400 a month to reduce their debt. Now we don’t know what the rest of their finances look like (because I haven’t made them up), but if you or your spouse is thinking that $280 a month for principle looks high, think again.

It is tempting to add just one more date night a month to your quality of life, or a little more spending money for you and your spouse, but the impact on your interest cost can be significant. What if Tim and Molly allocated $325 a month to their debt instead of $400? That $75 might get them one extra dinner at a restaurant once a month, but as you can see below, they also stay in debt two months longer and pay 24% more in interest. And for month 11 and 12, the Tim and Molly that put $400 towards their debt early on have $400 they can do whatever they like with, while the $325 Tim and Molly are still tied to their creditors.

Keep in mind that this fictional couple has a relatively modest amount of debt. If you have more debt than Tim and Molly, that 24% higher interest is going to cost you a heck of a lot more than $50 and allocating $75 a month less to your debt will definitely extend your debt free date more than two months.

Summary

- Determine how much cash you can put towards debt reduction each month.

- Decide what pay down method works for you – avalanche or snowball?

- Start paying down your debt as fast as possible and stay focused on the end goal: Not having your cash locked down by creditors.

Now you have the knowledge to reduce your debt; it’s time to make your plan! Have other questions on reducing your debt? Let me know!

Read the next step on the Roadmap to Financial Health here: Step 4 – Prepare For Retirement Early.