Welcome back to the Roadmap for Financial Health! If you are new to the Roadmap, we recommend you start at Step 0.

Retirement. That blissful time on the far horizon when you can whittle away your time napping in a hammock by the water, playing golf, or reading a good book by the fire. The problem is, if you truly want to enjoy that time of your life doing what you please, you have to start planning for it today.

With an average U.S. life expectancy of almost 80 years old, your 40 years of working life will likely need to cover 15-20 years of retirement, with the possibility of that savings having to last 30-40 years.

Table of Contents

How to Get on Track for Retirement

Saving for retirement requires discipline and is much easier to accomplish if you start early, stay consistent, and know your money. Follow these simple rules to get you on the right track:

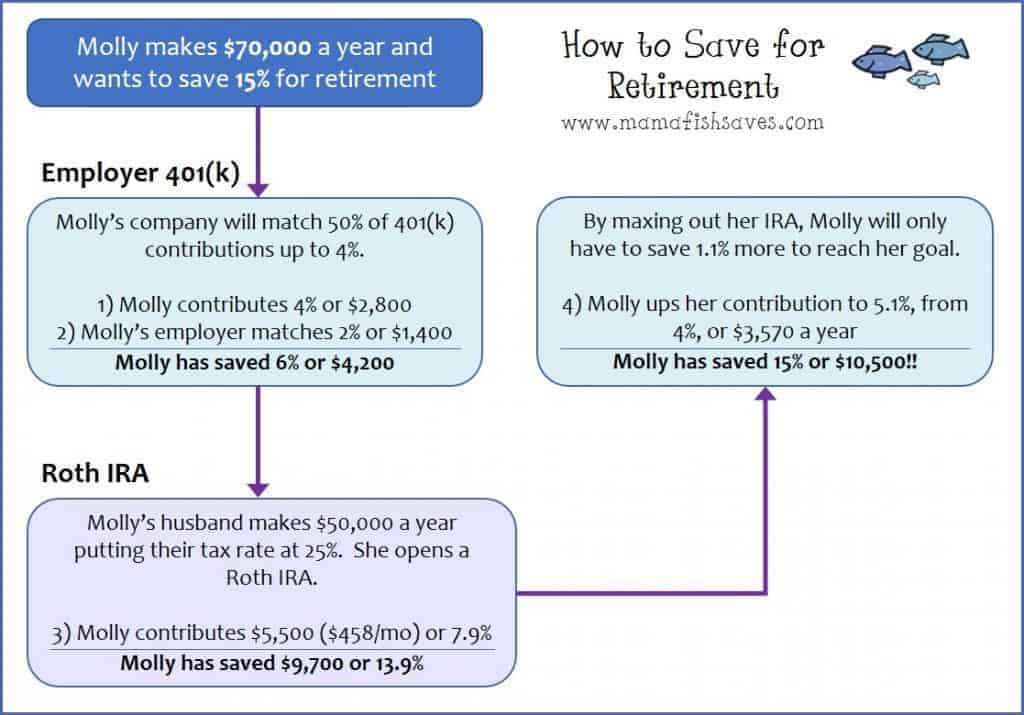

- Employer 401(k): A 401(k) allows you to contribute to your retirement savings tax-free, up to a certain limit. Be sure to contribute to your employer’s 401(k) in the amount that maxes your employer’s match, if offered. If your employer will match 50% of your savings up to 4% of income, contribute 4% and automatically increase your savings level to 6%.

- Open an IRA (Individual Retirement Account): There are two types of IRAs, that we will discuss more in this post, but both offer tax-advantaged savings to help you save for retirement. Open a low-cost IRA at Vanguard, Fidelity, or Schwab (Vanguard typically is the lowest cost) and contribute as much as you can up to the IRS max.

- Save at least 10% of pre-tax income for retirement, with an ideal target of 15% or more. If you make $50,000 a year, you should be targeting $7,500 (15%) of annual retirement savings. If are just starting saving for retirement, you should aim to save more than 15% until you are on track. Check out the free Mama Fish Saves Retirement Planning Calculator to see if you are on track for a comfortable retirement!

- If you are still paying off debt and can’t save 10% towards retirement, save as much as you can and plan to work to catch up later. You’ll have more money to put towards retirement when you aren’t being pulled down by interest.

- Do not touch your savings until you actually retire. The hardest thing about saving for retirement is watching that balance get bigger but not tapping into it. When you have >$100,000 sitting in your retirement accounts you may be tempted to borrow from your 401(k) or IRA to get a new couch, buy a house, or pay for your child’s college. This can quickly move you from “On Track!” to “Needs Attention” and can also lead to some nasty negative tax implications if you take a straight distribution or don’t pay the loan back on time.

- In general, if you can’t afford a house without tapping into your retirement, you can’t afford it at all. And while you and your child can borrow money for college, when retirement rolls around you certainly won’t be able to borrow money to support you.

What is the Deal With Employer 401(k) Match?

If you are lucky enough to have an employer that offers a 401(k) with match, your retirement savings just got a little easier. Employer 401(k) match is as close as you can get to “free money” and not contributing enough to get the full value of that match is tantamount to finding $20 in your pocket and deciding to throw it away.

Read up on your company’s 401(k) plan and if you aren’t clear how it works, reach out to your HR representative. Some companies structure match in a very straightforward way, e.g. contribute 2% of income towards retirement and we will match it, while some companies have more confusing structures, e.g. they will match 25% of your contribution from 0%-2% and 50% from 2%-4%. Make sure to understand how to get the most out of your match.

Notes about your employer 401(k):

- You can’t contribute to your 401(k) directly, contributions have to come out of your paycheck. You may need to speak with your payroll department to change your contributions.

- Employer 401(k) plans usually have much higher fees than IRA accounts can offer and less choices for investment. This is why we recommend committing money to an IRA after contributing enough to your 401(k) to maximize your match.

- The IRS has left the maximum employee contribution for a 401(k) at $18,000 for the third year running. This does not include the contribution from your employer, just your contribution.

- Because this limit is much higher than the IRA limit, if after covering your match and maxing out your IRA you still are able to contribute more to retirement we recommend increasing your 401(k) contribution. While fees will likely be higher in your 401(k) than they would be in a private investment account through a low-cost provider, the tax efficiency of a 401(k) will more than offset the higher fees.

What is the difference between a Traditional IRA and a ROTH IRA?

A Traditional IRA and a ROTH IRA are both savings accounts that offer tax advantages to help you save for retirement. The difference between a Traditional IRA and a ROTH IRA is when you take the tax benefit and who is eligible to use each account.

- Traditional IRA: Contributions to a Traditional IRA are deductible when you put the money in, and taxes are deferred on any earnings from the investment until you withdraw the funds in retirement. There are no income limits on a Traditional IRA and the max annual contribution is $5,500.

- ROTH IRA: In a ROTH IRA, you don’t get a tax deduction when you originally contribute the money, but the investment earnings are distributed tax and penalty free in retirement. You are only eligible to contribute to a ROTH IRA if your annual income is less than $132,000 for a single filer or $194,000 for married couples.

- A ROTH IRA is also exempt from the minimum annual distributions after age 70 ½ that most other retirement accounts, 401(k)s and Traditional IRAs, are bound by.

So which is better?

It really depends on your priorities but the short answer is that if you expect your tax rate to be the same or higher in retirement and you are eligible, go with a Roth IRA. If you expect your tax rate to be lower, go with a Traditional IRA. If you are currently in a low tax bracket and early in your career, you would expect to gain wealth and see your

tax bracket increase over time, making the Roth IRA a better choice. If you are already in a high tax bracket or are close to retirement, the tax deductions from your IRA contributions will be a solid benefit today and your tax rate may well be lower in retirement, making the tax burden on your earnings less impactful.

What Funds Should You Purchase in Your 401(k)/IRA?

When you contribute to your 401(k), and even more so when you open an IRA, you are going to have a range of investment funds to choose from. Some people will even have the option to use their 401(k) as a brokerage and purchase single company stocks.

The best thing you can do, if you have less than a million in investments, is to put your retirement savings into Target Date Retirement funds or create a simple three-fund portfolio. Target date funds will automatically manage your asset allocation (percentage of higher risk stocks versus lower risk debt, we will discuss in another post soon) depending on how far you are from retirement, and will also give you great diversification across all types of companies in the market.

Some banks, like Fidelity, have two options for target-date funds: index and actively managed mutual funds. Be sure to choose the index target date fund as the fees will be lower and improve your return over time.

If your 401(k) provider doesn’t offer target-date funds, and most providers do today, pick a broad-based index fund with low fees. If you are still a long way from retirement, look for funds that are 80-90% stocks, 10%-20% bonds. As you get closer to retirement, you’ll shift more of your savings into safer bonds, but with 20-30 years until retirement, the upside potential of stocks offsets the greater volatility.

While you may be tempted to invest just in the markets you think have most growth potential (be it oil & gas, technology, consumer) or invest in single stocks you heard are growing (Google, Apple, Goldman Sachs), the fact is that over time the average investor gets drastically lower returns investing themselves than if they put their money in an index fund and left it alone. The average investor is prone to panic and sell as things are going down, and then get excited and buy as things are moving up. History tells us no matter how hard we try, most of us do the exact opposite of “Buy Low, Sell High”.

Molly’s Retirement Savings

A Word on Social Security and Pensions

Some retirement calculators allow you to add expected benefits from social security and pensions to your retirement savings, lowering your personal savings needs to live comfortably in retirement. If you are under 45, we would potentially recommend haircutting social security by 20% to 30% for safety. It is possible the program will look very different in 15-30 years than it does today.

If you are under 45 and eligible for a private or state pension, we would think about attributing only part of your expected pension payments to your retirement calculations. Private pensions are being pushed out rapidly, with many retired steelworkers and coal miners seeing their pensions cut as the companies they used to work for get into financial trouble and are forced to recut the retiree benefits. State pensions may seem safer, but many states are well underfunded for their pension needs as well and may not be able to make full payment in the future.

A little story on social security. The Social Security Act was passed in 1935 and guaranteed retirement pensions to all Americans over 65. In the past 83 years, not much has changed. The retirement age to gain full social security has only increased from 65 to 67. So what is the problem with social security? You may have heard that the government has repeatedly raided the coffers of social security to fund other things, which has left the fund-strapped for cash. The reality is, this is largely a myth, and while social security has enough cash today, the program’s biggest problems are changing demographics.

First, all the beneficiaries of this great government support deal are sticking around longer. When the Social Security Act was passed in 1935, the average life expectancy was 61.7 years meaning the government offered a pension for 3.3 years on average. Today, the average life expectancy is 78.7 years and the government is trying to cover support benefits for 11.7 years – over three times longer! Second, the baby boomers (ages 53-71) are just starting to hit the social security program, drastically increasing the number of recipients and tipping the balance towards a higher percentage of retirees versus workers.

However, even under the current system, the expectation isn’t for Social Security to disappear completely. But payments could be 20% to 30% lower than current rates.

Do your future self a major favor, and start committing to saving for retirement today. And as that nest egg grows and you get tempted to stick your fingers in the cookie jar, think about what it would feel like to have to live like you did in college when you’re 70. Kraft mac & cheese or filet mignon?

How are you saving for retirement? Have questions about your 401(k)? Let us know! Your question may be the same as many others!

Read the next step on the Roadmap to Financial Health here: Step 5 – Save For Your Dreams.

This is a great summary!

I’m not counting on Social Security. I wish there was a box you could check with SS for ‘nah, I’m good, giving it to someone who needs it.’.

The increase in Social Security age is what got me started on the ‘FIRE’ path. 3 of my 4 grandparents passed away around age 72. 5 years to be retired?!?! Yes we have greatly improved medical technology, but my grandmother had no indications and died very suddenly of an aneurysm. The technology only works if they can diagnose and fix the problem.

I currently contribute more than the match to my 401k, and am working towards maxing it. I target a full Roth contribution but have had a few years where other things (saving for a house, unemployment) got in the way. I’m determined to not get ‘distracted’ moving forward.