Social Security is an important government program that acts as a retirement safety net for many Americans today. 70% of current American workers believe Social Security will be a major income source in retirement, while 25% believe it will be their primary source of income. A hefty amount of faith in a government insurance system. But how much weight can the Social Security safety net actually hold? Let’s cover the basics of understanding Social Security payments.

Table of Contents

Understanding Social Security payments

There are numerous factors that impact Social Security, but the biggest by far is dollars paid into the system. Some people still believe that Social Security is an automatic government support program. That just by reaching retirement age they will be given enough to live on. However, the system is really “pay-to-play” in most cases. Here’s how it works.

Social Security taxable earnings determine your benefit levels

Each paycheck you receive has 6.2% withheld for Social Security. Your employer also has to pay 6.2% on your behalf, for a total pay-in of 12.4%. (If you’re self-employed, you have to fund that whole 12.4% yourself. Ouch.) This amount is withdrawn up to a max income level of $127,200. The income level off of which your withholdings is determined is used to calculate your potential Social Security benefits.

When you apply for Social Security, the Social Security Administration analyzes your entire earnings history. The process looks like this:

- Restate all prior years income in today’s dollars. (Adjust for inflation)

- Input all years without income as zero.

- Take the 35 years with the highest earnings, including zeros if you have less than 35 years of income, and take the average.

- Divide your average annual earnings by 12 to get the Average Indexed Monthly Earnings (AIME).

- Plug the AIME into the Social Security benefit formula to calculate the Primary Insurance Amount (PIA). The PIA is the amount you receive if you apply for benefits at your full retirement age, age 67 if you were born after 1960.

As of 2017, your PIA is determined by:

- 90% of your first $885 of AIME, PLUS

- 32% of your AIME over $885 but less than $5,336, PLUS

- 15% of your AIME over $5,336 up to the max of $10,600

Note: An important thing to keep in mind is that not all earnings are Social Security earnings. If the majority of your income comes from rental properties or other sources, or if you retire early without 35 years of earnings history, your Social Security benefits in retirement could be meager. Independent savings become even more important. Then again, if you have regular income and assets from other sources, you may not need the government safety net!

Example:

Since the first four steps of the formula are relatively straightforward, let’s jump ahead to step 5. Let’s say you started working at 22 with an $35,000 salary and saw a steady 2% raise every year. You stopped working at 60 but waited until 67 to apply for benefits. Your 35 highest earnings years would average $54,116 or $4,510 a month.

You would receive:

- 90% of $885 or $796.50, PLUS

- 32% of $3,625 (your total AIME of $4,510 minus the $885 of income factored in for the first step) or $1,159.88

For a total Primary Insurance Amount (PIA) of $1,956 per month in Social Security payments.

Other factors impacting Social Security payments

While your PIA is the amount you could expect if you applied for Social Security at your full retirement age, other factors could raise or lower your expected payment.

Age applying for benefits

You become eligible for your full PIA at your full retirement age. However, you can choose when you apply for Social Security benefits. If you apply early, your monthly payments are permanently reduced (they don’t step up when you reach full retirement age). Alternatively, if you wait beyond the full retirement age, you could raise your benefits for the long-term.

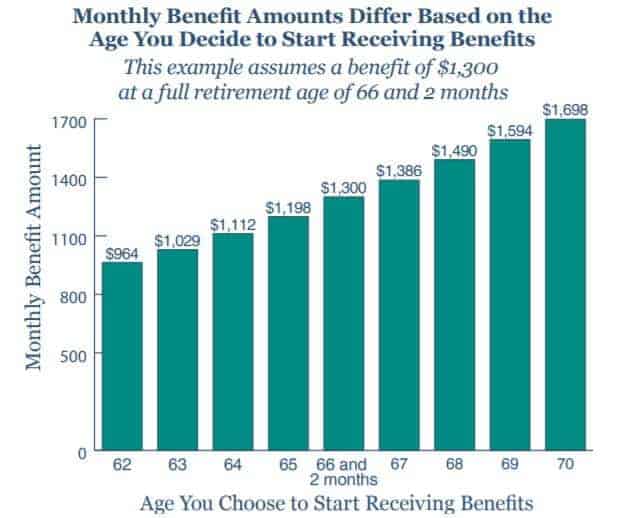

The below chart from a piece by the Social Security Administration shows how payments can be impacted by the age you apply for benefits. This assumes full retirement age is 66 and 2 months, with a PIA of $1,300 a month.

Applying for benefits four years early would lose this person 25% of their monthly benefits while waiting two extra years could increase benefits by 15%!

Spousal benefits

If you are a stay-at-home parent or haven’t had sufficient work experience to qualify for Social Security benefits, all may not be lost! If you are married, you are eligible to receive up to 50% of your spouse’s benefit, in addition to their payment. (There are max family payouts, so if you have a child or dependent already receiving benefits from your spouse’s Social Security “account” you may not receive the full 50%.)

If you have work experience but your individual payment would be less than the spousal benefit, you will be paid both your benefit and a spousal benefit to get you up to the equivalent of 50% of your spouse’s.

Working in retirement

If you choose to claim Social Security benefits before your full retirement age and continue to work, your earned income may reduce your Social Security payments. However, this reduction only lasts until you hit your full retirement age, and then your earned income will not impact your payments.

For 2017, the earned income limit is $16,920 per year (or $1,410 an month). For every $2 you earn over that limit, your Social Security payment is reduced by $1. Keep in mind; this reduction may not be permanent. Once you reach full retirement age, Social Security will recalculate your payment upwards to account for any reduction that was occurring due to the earned income test. It can take up to 15 years to recoup those losses.

This adjustment is based on employment income, not all income. Rental property income, dividends, capital gains, inheritances, etc. do not reduce your Social Security payments.

Underfunding of the Social Security system

A frequently heard fear-mongering myth is that the Social Security system is going bankrupt. While the system is somewhat strained, current projections don’t believe it is broken. Instead, a gap will occur around 2033 when benefits will have to be reduced or taxes raised, but benefits won’t go to zero.

The 2017 Social Security Trustee report, an exciting and jauntily written piece, projects that benefits can be paid in full through 2033. After that, benefits will either need to be cut by 23% or taxes raised to 10.2% from 6.2%, or some combination of the two, to keep the coffers balanced. In all likelihood, we will receive some Social Security payment in retirement. But if you wish to be conservative, cut today’s estimates by 20%-25%.

Estimate your payout

If you want to try to determine your unique benefit, the Social Security Administration offers this handy benefits estimate calculator. Keep in mind this assumes you keep working at the rate you are today until retirement, and it may not be able to find you. I got a very comforting, “I’m sorry, we could not verify the information you provided,” message!

Range of Social Security benefits

In 2016 the average retiree received $1,341 in monthly Social Security checks. However, the range stretches from $0 to $2,639 a month as of 2016. If you have less than 11 years of work history where you made $14,175 or more in Social Security earnings, you aren’t eligible for any benefits. Alternatively, if you made an average of $127,200 a year, after adjusting for inflation, for 35 years, you could receive the max payout of $2,639 a month. (Less than 7% of workers made that income in 2016, and even less can do so for 35 years.)

The average 2016 monthly payment comes out to $16,092 a year. Compared to the 2016 Federal poverty line of $12,060 for a single person, you can’t exactly be expecting to live large on your Social Security check. The average person won’t retire in poverty. Barely.

Social Security as a cushion, not a retirement plan

Social Security isn’t like saving for retirement. Even if the program doesn’t have to make cuts to benefits in the future, the payouts are a lot lower than if you had saved yourself. This is because Social Security isn’t just for retirement support, but also for disability and widow/dependent support. What you pay in determines what you get out, but you don’t receive all your value back.

For instance, if you earned an average of $127,200 a year for 35 years – what you need to achieve the max SS payout – you and your employer would have paid ~$15,773 every year into SS on your behalf. At a conservative 6% long-term investment return, below the long-term S&P 500 average of 10% with dividends reinvested, you would have $1,757,638 in your account upon retirement. Using an 4% withdrawal rate to protect your savings for the long-term, you could withdraw over $5,800 a month! Over double the max Social Security payout of $2,639!

While Social Security will likely still be in existence when we retire, it isn’t enough to live on comfortably. If you want to fulfill your dreams of kicking back in relative luxury in retirement or at least maintaining your current standard of living, you need to start saving for retirement now. Check out my retirement savings calculator and make sure you’re on track for your goals!

Do you factor Social Security into your long-term retirement plans? How do you estimate what you could receive? Drop a note in the comments and share your methodology!

To me the most important question is whether or not I believe i can produce better returns than the deferred government plus up at 70. I’ll take the money. Second, I will have more in my 60’s and 70’s than in my 80’s. I think I will likely have more fun spending then than waiting since my health care plan is already funded. This is a no brainer.