New Year’s Day is right around the corner and I don’t know about you, but I always look forward to the dawn of a new year. It’s a chance to have a fresh start, to set meaningful goals, create new habits, and maybe right some financial wrongs.

Whether you want to set a new beginning in your finances or you want to carry on all of the good progress you’ve already made, having a clean slate is always refreshing. And having a few good financial habits in place will help you set your New Year up for success.

Financial Habits to Develop to Help You Better Manage Your Money

Just like going to the gym for a week won’t make you a marathoner, reaching your big financial goals requires small, consistent, healthy habits. Budgeting for a few weeks or a month usually isn’t enough. You need to build good systems around your finances.

And that starts with reflecting on what you want.

1 – Know Your “Why”

First things first, you have to know your “why.” What is the reason you want to be successful in all things finance related? Do you want to model good money management for your kids so they can learn from your mistakes? Do you dream of spending more time at home with your family and less time working to pay off too much debt? Are you wanting to invest more so you can have a comfortable retirement?

Figure out your “why” and put it in writing. Keep it front and center, on a bulletin board at your desk or the front of your favorite planner. Anytime you need a little motivation, pull out your list of “whys” to remind yourself of what is most important to you.

2 – Set Financial Goals

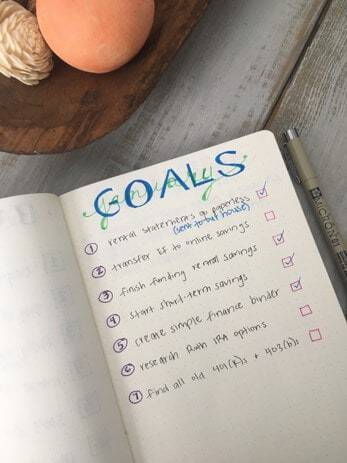

There is nothing wrong with dreaming big! But we have to put our dreams in writing if we ever plan to see them come true. Putting pen to paper and writing them down makes them real and reachable.

When you set your financial goals, be sure you set realistic goals you can actually keep. They should be SMART – specific, measurable, achievable, realistic and time-bound. Think about your long-term, mid-term, and short-term goals.

Once you have them in black and white, read over your list regularly so you know exactly where you are headed in your finances.

3 – Track Your Progress

Track your income. Track your expenses. Track your debts as you pay them down. Track all the things.

What gets measured, gets done.

Cross off your goals as you meet them. And remember to keep everything together so when you are discouraged or need a little inspiration, you can see a visual representation of your progress.

I have always loved using a bullet journal. It is always a fun way for me to chart my progress and color those little debt thermometers as payments are made. Little wins here and there really do add up! And it is always encouraging to look back and see how far you’ve come.

But a lot of people enjoy online budgeting and net worth tracking tools. Our favorite budget tool at Smart Money Mamas is You Need a Budget, which combines an easy to use platform with helping you improve your money mindset.

4 – Trim Expenses Where You Can

The beginning of a new year is always a good time to think about your spending habits. Is there an area in your budget where you consistently overspend? Are you willing to decrease $50 a month from your eating out budget to throw towards your saving goal? Can you decrease your monthly entertainment budget in favor of game nights at home to increase your debt payments?

Look at your budget and all of the categories you currently have. Cut back anything that isn’t a need and has become a phantom expense – something you do because you always have, but doesn’t really bring you any joy or align with your priorities. The more you do this, the more money you can put towards your oh-so-important financial goals.

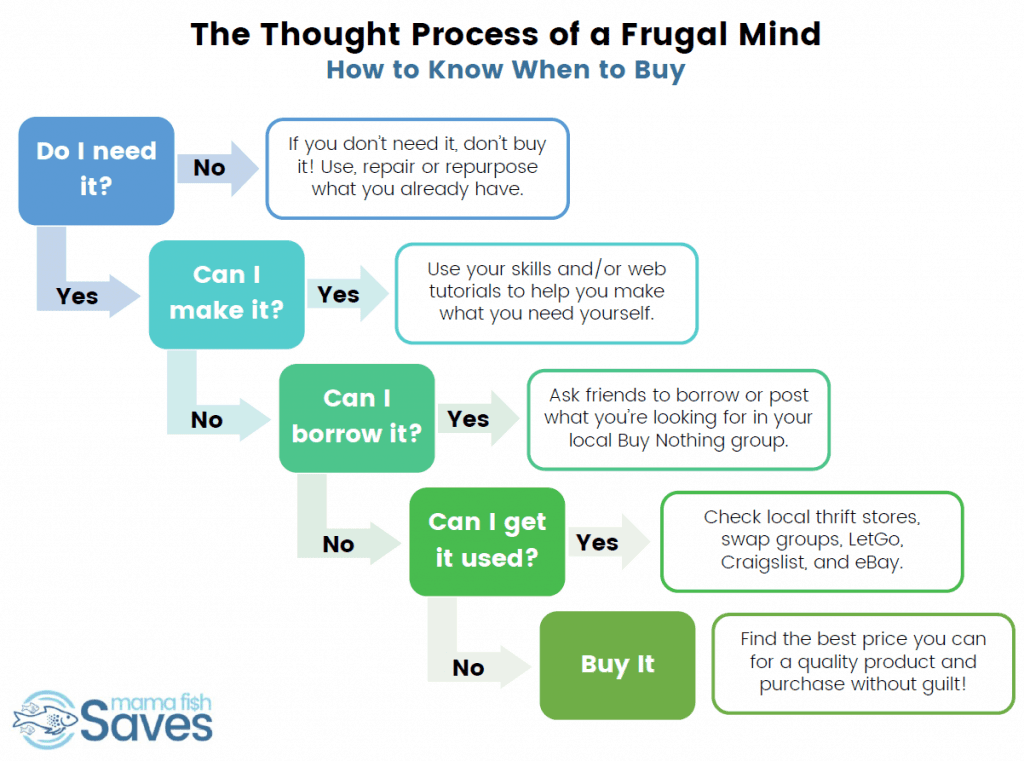

If you’re struggling with reducing your spending, review the steps of a frugal thought process. Print the chart and put it on your fridge. By developing a habit of thinking through the steps before making a purchase you’ll spend your money more carefully and thoughtfully.

5 – Save, Save, Save

No one likes to think of their car breaking down, their tires needing to be replaced, or having a medical emergency. But those things happen. It’s just a part of life.

Nobody ever said adulting would be easy.

Facing an emergency when you aren’t ready for it financially makes a stressful situation even more overwhelming. Which is why you need to beef up your emergency fund and savings accounts for irregular expenses. Whether it is for unexpected emergencies, that family vacation you want to pay cash for, or saving for a newer vehicle, you should always be intentional about saving a portion of every paycheck to help you meet your savings goals.

6 – Pay Off Debt

In order to get ahead with your finances long-term, it is important that hard-earned dollar funds your wallet, not your creditors’ accounts. Having a plan to pay down your debt in a timely manner is imperative to winning with money in the long run.

Find a method that will work for you. Some people love the debt snowball (paying down the smallest balance first). Others prefer the debt avalanche (tackling the debt with the highest interest rate first). Choose whatever will work best for you and make a plan.

Set a debt-free target date, dig your heels in, and make it happen one extra payment at a time.

7 – Invest For the Future

Many people have visions of a stress-free retirement, complete with restful trips to see family and vacations where they can finally see the world.

However you envision your future, it’s important that you start planning for retirement today.

Learn what you can about investing. Pick up a book, do a little bit of research, and start investing sooner rather than later. If you feel like you’re in over your head, consult a fee-only financial advisor.

Make investing a priority and remove the temptation to time the market by making your contributions automatic. Please, please, please make it automatic! It will protect you from yourself and make you take your investing goal seriously. Your future self will thank you!

8 – Have a Financial To-Do List

You might be wondering how having a daily to-do list will help your financial success. When you are intentional with your time, be it a daily to-do list or a weekly to-do list, you will also be more intentional with your money as well. You’re more likely to stick to a meal plan, save for upcoming events ahead of time, and let small expenses fall through the cracks.

Do one thing a day to better your finances. Just one thing a day!

Check your saving account balance regularly to make sure you are on target with your goals. Balance your checkbook to reconcile your income and expenses. Make an extra payment towards your next debt.

One little thing might not seem like a lot. But a lot of little things all added together will make a huge difference in the end.

9 – Never Stop Learning

You will never know everything there is to know in the wild and wonderful world of personal finance. But that doesn’t mean you should ever stop trying. Commit to always trying to learn more so you can better manage your money, improve your money mindset, and teach your kids to do the same.

Read a finance book every month or so, like The Next Millionaire Next Door, a follow-up to the classic book on how ordinary Americans can build wealth. Listen to fun personal finance podcasts. Or join us in the Smart Money Mamas Facebook community for regular discussions on how money touches our lives.

Whatever it looks like, always learn more. It will help you stay motivated and on track while also filling your brain with tips and tricks for winning with money.

Building Better Money Habits

We all set New Year’s resolutions that too often get forgotten by February. As we enter the new year, prepare yourself for financial success. A lot of progress can be made in a year and putting good financial habits in place now can benefit you for years to come.

Start incorporating these nine healthy money habits into your everyday life and make it a point to treat your finances with the priority they deserve.

What are your money goals for 2019? Share in the comments!