Creating a budget can seem like a huge undertaking, especially if you’ve failed at getting control of your spending in the past. Ideally, a budget will be there to help save money and give you a feeling of control over where your hard earnings end up. But to make your efforts successful, there are a few things you need to do right before creating a budget.

It is a bit comical to think about how I used to “budget.” Maybe you can relate.

After a long 8 to 10 hour day, I would sit down at the kitchen table. I’d throw a few numbers on paper and make many vows about all the things I would not be buying that month because it’s “not in the budget.”

Then, these promises to myself and my little scrap of paper on the kitchen table grew faint in my memory as the first days or weeks of the month went by. And in the end, I didn’t stick to my budget.

On a busy weeknight, my budget was an afterthought. I hadn’t set myself up for success. I hadn’t prepared myself mentally, put a system in place, or examined my family’s values. There were some essential things I had to get right if this was going to work.

Here’s what I learned that put my family on the right track.

Table of Contents

Bringing the Right Mindset to the Kitchen Table

Starting a budget with the wrong mindset can set you up for failure before you even start. Take time to reset and begin from a place of confidence.

1 – Forgive Yourself

Maybe setting a budget is a regular thing for you and your family. Maybe you’re just resetting after getting a little off track from the holidays or a recent vacation.

But it’s more likely that you’re setting a budget because of a serious need. You’re working to get out of debt, combine finances with a spouse, create retirement goals, or save for a new baby. You’re adjusting for whatever minor crisis life has thrown your way.

When that’s the case, thoughts of inadequacy or guilt can creep up.

“Why didn’t I save for this sooner?” or “How could I have put $5,000 on a credit card?” It is important to prepare yourself mentally and offer forgiveness. What has happened cannot be erased so don’t dwell on it. Give yourself some slack and forgive any previous money mishaps.

The important thing is that you are here to do something now.

2 – Create a Judgment-Free Zone

While I am not big on rules as a free spirit – creating a judgment-free zone has become a hard and fast rule for setting up our spending and saving priorities.

If you are budgeting on your own let that judgment of your own purchases go – it is part of the forgiveness – but also a part of being open to change. I have found that if I am heaping on the guilt and judgment for my purchases, I am not in the right headspace to consider a new way of thinking or living. So while I should acknowledge the past, if I dwell there I am stunting my own money mindset growth.

This rule becomes even more vital for budget success if you are budgeting in a partnership.

Over time, my partner and I have identified trigger words that are casting judgment when talking about money and setting a budget. Phrases like “Your debt…”, “Do you really need that…”, or “I am just trying to help you….” create a negative environment for our money discussions.

It’s important to acknowledge any differing values between you and your partner and work to compromise. Adjust your language to support a successful conversation with money. Phrases like “How can we tackle this…” or “How do you feel about this _______…” allow for a judgment-free zone.

3 – Face Your Fears

Facing your fears means acknowledging your struggles with money and what we tell ourselves is or isn’t possible.

A mentality of ‘I’ll never being able to afford _______’ or ‘ We’re too broke for _______’ can be limiting beliefs. And limiting believes can stunt your ability to see the bigger picture of your money.

I’m not always a big picture thinker and can have blinders on when it comes to long-term planning. This is why for many years I was only making the minimum income-based repayments on my student loans. I had convinced myself that I would receive loan forgiveness or be paying on them literally forever. And if that was my only debt, maybe it would be ok.

My limiting belief was that I would never make enough money to pay them off. This was not true and now that I have a payoff plan, there is finally an end in sight.

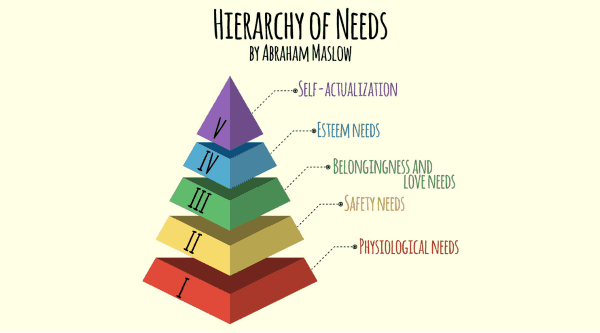

Prioritize Your Money Wants and Needs

If you could not tell, I am a huge believer that our mental states allow for success or failure with budgeting and money goals. So the first three steps help to get your head in the game before even looking at the numbers.

When it does come time to look at the numbers, looking at our value systems and prioritizing is the next step before budgeting. In order to look at the numbers you are going to have to pull open those tabs in google and look at the spending

4 – Identify Your Money Stress

What areas of your existing budget or money situation cause the most stress and anxiety? How many times a day do you think about them?

Here are some common areas of money stress:

- A non-existent or minimal emergency fund

- Debt of any kind – consumer or student loans

- Separate or combined finances with a partner and no shared goals

- Not knowing where your money is and whether you have enough for the bills

- Not knowing if you will ever be able to retire

It’s important to actually write out the areas of money stress and even more important to talk about them. Particularly if working with a partner.

While it’s unpleasant to sit with that stress, this creates some of the ‘why’ for your budget. Ideally, the budget will work to eliminate these stresses. But your budget can only help with these problem areas if you identify them.

5 – Identify What You Need and Stay Realistic

What are the non-negotiable needs for you and your family? What are all of the monthly bills and how much does this add up to? This includes cell phones, groceries, insurance, daycare etc.

Create another list with these essentials on paper or a spreadsheet. This is the very baby version of starting to budget and making sure your priorities line up.

It is also a good time to look at needs versus wants.

Getting your hair done or buying a face wash that keeps your skin looking good may be needs for your career or lifestyle. While some extremes may say to let this all go and use one bar of Irish Spring for the family, this may not be realistic. Which is fine, as long as you’re willing to make necessary trade-offs elsewhere.

Your needs list doesn’t have to be bare bones, but it does need to be realistic.

6 – Identify the Things You Want

We all have fun things we want. The expenses that make our lives more fun, but we could live without for the next few months.

These could be:

- A family vacation

- A few updated items for your wardrobe or your child’s

- Date nights on a regular basis (these could also be a need)

- A new piece of furniture

While these things are important if they bring value and happiness to your life, they still need to be in line with your financial priorities and budgeted for ahead of time.

For example, I think date nights are a need to keep our relationship healthy. More important for us than fancy coffee or a home improvement project. However, they also need a little fund or savings pot before they can start happening regularly. Especially when adding in the cost of childcare.

Thus, a list of wants in priority order is helpful for setting up a budget that reflects your values.

Creating a System and Routine

After identifying all of the stressors, needs, and wants in your financial life, it is time to take a break.

Seriously, take a break. I don’t recommend this all happen in one night. Take a breather or at least go on a walk before setting up a system.

My partner and I did all of the steps up to this point separately and wrote them down. Then we came together and shared our lists. It allowed us to have the space to identify our own values and mindset struggles. It also led to a great conversation where we could explore where we were on the same page and where we weren’t.

But once you know your goals and where you stand, it’s time to do something with all that powerful information.

7 – Track Expenses

In the previous steps, you probably spent some time in your checking account. Now it is time to track where all your money is actually going.

In the 21st-century, money is being sucked out of the account in a million directions. And when purchases can be made with the swipe of a card, it is easy to lose sight of all your hard-earned cash.

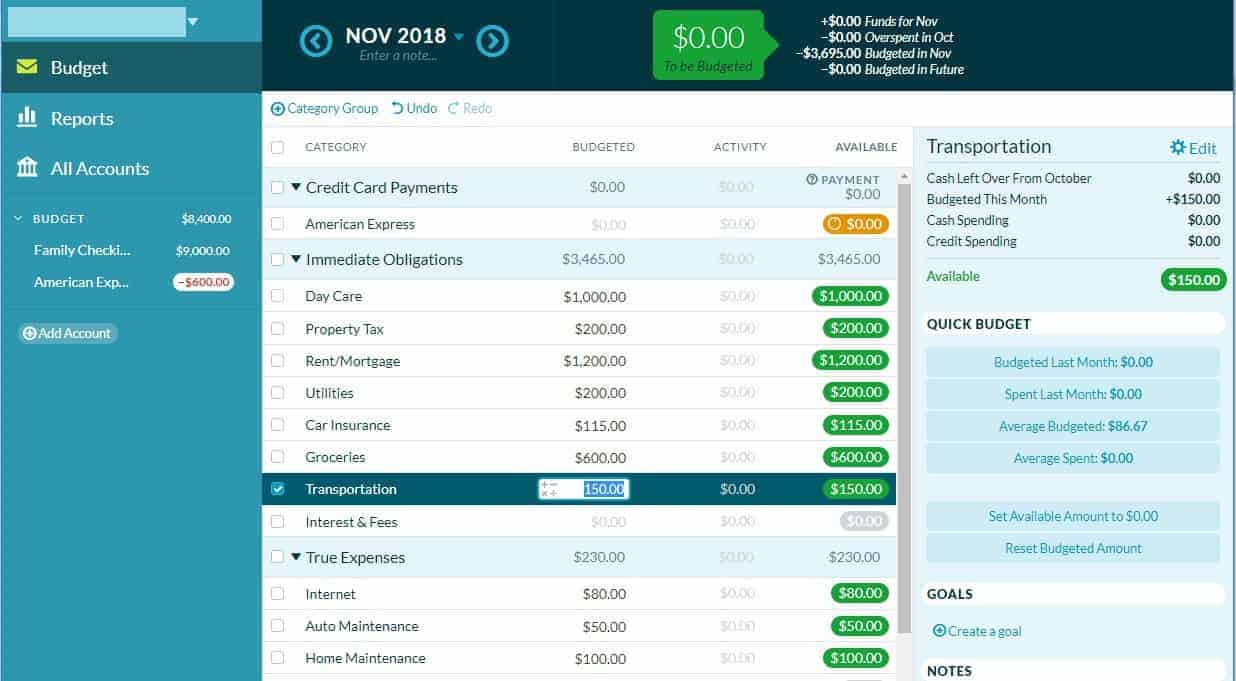

Thankfully, there is also an app for that. Choosing a budget tracker will depend on your needs and personality. You Need A Budget is a paid service but can help you reset the way you think about money and give you the tools to break the paycheck-to-paycheck cycle.

If you’re looking for a free tool, I personally love using Mint to track all my spending. Personal Capital can also be a good budgeting tool. All of these services allow you to link all of your bank and credit card accounts securely, so you can get a look at spending and saving habits without entering each and every transaction manually.

As you look at your last few months of expenses, this is the perfect time to break down how much you have spent on needs versus wants in the past. Are hundreds of dollars slipping away to silly Amazon purchases you make when you’re bored? What are you going to do differently now that you know your money goals? Use this information to come face-to-face with the gap between your income and spending.

8 – Set Some Goals & Time Limits

After analyzing the money stressors above, it’s a best practice to set some goals for yourself around your budget. This could be a debt payoff goal or a save for a family vacation goal.

But a goal without a plan is just a wish. Create sinking funds (little pots of money to build upon month-on-month) for specific goals or larger expenses. A vacation fund where you put $50 every month or a date night fund where you put $45 every month.

Whatever the goal or fund, it needs a time limit to encourage re-evaluation.

If it’s a savings goal, this can ensure you actually take that family vacation. If it’s a debt payoff target, a time limit means you can see an end in sight or at least be able to examine the progress you have made.

9 – Create Substitutions

If you want to reach your financial goals, you’re probably going to need to cut things from your budget.

But while it can be healthy to cut things, I also believe in understanding what really matters to you. If cutting your Netflix causes you some serious anxiety because your 30 minutes of TV at night is how you turn off your brain before bed, then this should not be cut. You can find wiggle room in another area of your life.

However, you can always consider substitutions to reduce your spending. Frugal tradeoffs can save you a ton of money while maintaining your quality of life.

For you, this may mean investing in an espresso machine from Facebook Marketplace instead of stopping at Starbucks every morning. Or you may trade your Audible subscription for free Hoopla downloads from your local library.

You won’t stick to a budget if it removes all the happiness from your life. You can cut the fat from your budget while keeping the things that bring you the most relaxation and joy.

10 – Stay Flexible & Adjust According to Life

By now you probably have a few pages of notes, a good sense of what matters to you, and at least a few goals under your belt.

You are ready to start building your budget with a clear head and a system in place.

But even with all this preparation, remember to stay flexible.

A budget is not set in stone. A money goal timeline can be adjusted. Sometimes life throws you curve balls. We are humans and make mistakes. Don’t let it destroy your new budgeting habit.

As someone who doesn’t always like rules, I think of my budget as a path to money success. It allows us to control our money instead of letting it control us. Which now that feels a little like breaking society’s rules and creating my own.

No More Midweek Kitchen Table Meltdowns

These ten steps are what finally led to me actually sticking to a budget for the first time in years. I no longer sit at the kitchen table with sweaty palms, stressed and nervous, trying to figure out what to do about money. I no longer make vows to myself about not spending on certain things.

Instead, I create a budget that gives me the freedom to spend on the things that are truly important to us while working to reach our goals and eliminate the money stressors.

When you feel organized, you feel empowered. When you’ve dealt with your emotions around money, you can get rid of your limiting beliefs. And that is the most important step in reaching your goals.

What steps did you miss before creating budgets in the past? What are you going to do differently this time? Share below in the comments!