Do you need to find a way to make your income stretch further than you can imagine? Have you already cut cable and called your cell phone company to “cancel” your plan to get a better deal? Are you already shopping sales and using coupons? I can completely relate!

I’m a single mom of toddler twins. As if that isn’t enough, I have a medical condition which I’ve been told will keep me from ever working full-time again.

Sounds rough, right?

We’re incredibly lucky to have family that we can count on and this journey has taught me a thing or two about being frugal. Here are some of my favorite tips to get you out of the rut you’re in so you can stop spending so much money!

1. Make The Most of Your Freezer

Any ingredient you’ve seen in the freezer aisle can be frozen!

If there are carrots in your favorite frozen weight-loss meal, they can be frozen.

Spaghetti you’re sick of but don’t have the budget to throw away, freeze it for later.

Does it come in a smoothie mix? Stir-fry? On a pizza? You can freeze it!

Buy food you know you’ll use in bulk when it’s on sale and freeze it for later.

See if your area has a local program that bulk buys food close to the freeze by date at a discount. Where I live we have a program that gets me 40% off grocery store prices on meat, cheese, and some fruits and veggies. It is all frozen while it is still good. You just have to use it within a few days of thawing.

2. Use Cash Back Apps

Have you discovered Ibotta yet? If not, it’s a free app where you can earn cash back on your regular grocery purchases just by taking a picture of your receipt. Watch out for ways to earn the most rewards, like watching for special bonus offers for submitting a certain number of receipts.

If you’re ordering anything online, check Ebates and BeFrugal to see which offers the biggest rebate. At stores like Kohl’s, you can stack great coupons with 3% or more cash back for necessities.

3. Make Your Own!

Bread, snack boxes, granola, yogurt, laundry detergent, cleaning products, deodorant, gifts, anything! If you can buy it, there’s a good chance you can make it. And doing it yourself is usually cheaper and easier than you think.

If you’re new to DIY, Youtube is your friend! Skin Cleanse by Adina Grigore is a great book for recipes of household products.

Related post: How to Make Bread Without A Bread Machine

4. Don’t Go Out to Eat

Don’t go out to eat.

Ever.

I could soften this, but let’s be honest. We can’t afford it. Plus, it’s not worth the money and you can make it healthier at home for less.

And while we’re at it… Don’t buy drinks.

Water is free and it’s much more affordable to buy a good quality water bottle to refill. This is better for your body, the environment, and your wallet!

If you need coffee to survive, make it at home.

5. Don’t Waste Food

Make a goal to go through all the food in your freezer and on your shelves before buying new. Eat any leftovers and save half eaten toddler meals to offer them later.

Yes, you can still buy fresh fruits and veggies and such, but use up that meat, pasta, cereal, and whatever else you don’t know how to use.

You can look up recipes based on ingredients you have on hand at sites like Supercook. If you’re really in a pinch, this is the best tip to cut out a portion of your spending for a bit.

6. Embrace Meatless Meals

Do a few no-meat dinners per week. This can save you a lot of money and is actually good for your health.

Try to pick one or more meals per week that are under $2-3 per person.

For instance, rice and beans, spaghetti, tomato soup, grilled cheese, and oatmeal are all quick and easy options. Eggs can also be an easy, cost-effective, and protein filled dinner that even kids like!

7. Don’t Buy Disposables

Stop buying non-food consumables! Did you know you can buy non-paper towels? They’re called… towels.

Things like reusable snack and meal containers might seem expensive, but they are much cheaper in the long run than zipper storage bags. And that’s how it works for almost all disposables – you pay more for something that doesn’t last.

Cloth pads or a menstrual cup mean no trips to the store for your time of the month.

Real plates and bowls can be inexpensive and will last years longer than paper or plastic. You can even find used ones at Goodwill, Savers, or yard sales.

And if you have a baby or are expecting, cloth diaper! You can use them for multiple kids, or sell them when you’re finished! We love the quality of Lalabye Baby. If you want to go super inexpensive, flats and covers are your best bet.

If you’re buying something that is designed to be thrown away after one or two uses, find an alternative.

8. Sell Anything You Don’t Need

SELL, SELL, SELL!

Do you have things you don’t use often? Sell them!

Baby things you no longer need, that appliance someone bought you for Christmas last year, books, furniture, anything you don’t need. If you can get money for it, it’s probably worth it.

You can also keep an eye on out for things others are giving away for free that you can clean up and sell. Watch LetGo, Facebook Marketplace, Craigslist, and even your local transfer station.

9. Re-think Gifts

Focus on the essentials for gifts. My kids get lifejackets, the next size up in clothing and shoes, shampoo and toothbrushes, and whatever else I had to get them anyway.

For others in your life, you can learn to make gifts. I recently learned to knit and all of my kids’ teachers will be getting homemade washcloths and homemade granola for Christmas this year. The girls are picking the yarn and are helping make the granola.

Even better, give the gift of your time! Family and friends would likely appreciate a day with you more than the gift you’re stressing to get (and afford) for them.

10. Make the Most of Free Offers

Check out free things you can get!

We’re on WIC so we get a free membership to the children’s museum, discounts at the science museum, and can qualify for a discount on swim lessons and many other places. I don’t buy any experiences or lessons without a multiples or low-income discount.

If you ask, you might qualify for something or they might have a free or discount day or time!

Check out your local library for free kid’s classes. Many libraries even have passes for local museums, aquariums, and zoos that you can check out with your card.

11. Plan Your Driving

Don’t drive if you don’t have to.

If you have to, before you go, think about what else you could or should do in the area if you do have to drive. Can you get to the pharmacy, grocery store and visit Grandma in one trip? Do it!

Gas is expensive and wear and tear on your car adds up. Plus, if you reduce your miles driven, you might be able to get a lower price on your auto insurance.

Be Thoughtful About Every Expense

Saving money when you’re on a tight budget requires you to change your mindset when it comes to bills. I was a spender ten years ago. I’m still naturally a spender. I’ve learned to curb this by looking forward to getting my bills paid. It makes me feel secure and accomplished. If possible, extra money goes to pay months ahead to give me a cushion in case something comes up.

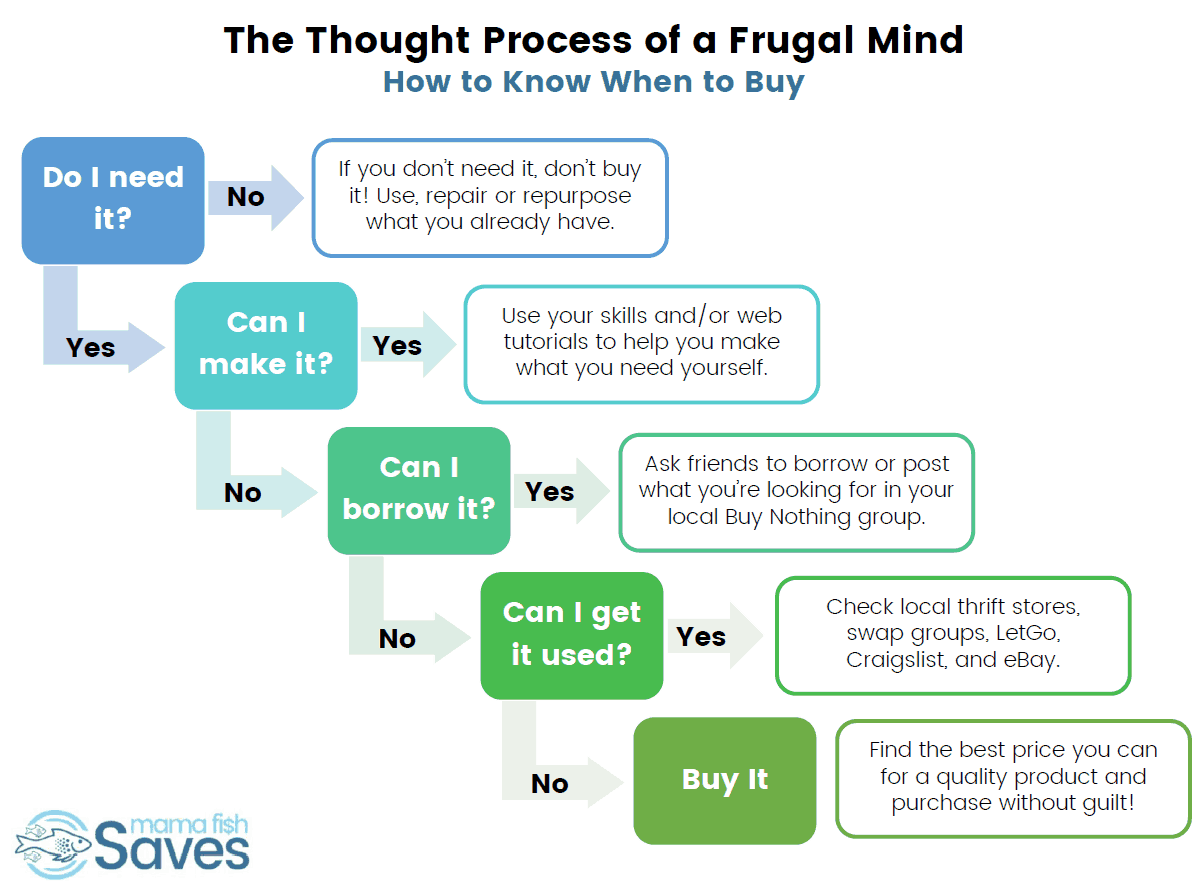

And before you buy something, stop and think about it. Thinking through the steps below might help you find a cheaper alternative. So, do your homework!

Lastly, remember quality over quantity. If you can save up a little extra to get better quality it will save you in the long run. Sometimes name brand isn’t worth it, other times it is.

Most importantly, never feel guilty for not being able to afford everything you see parents sharing on Facebook and Instagram. While they’re young, your kids will have no idea how much money you have. They don’t know that other kids have ten pairs of shoes and they have two. Your kids don’t know that other kids order pizza while you make it at home.

They do know that you do your best and that you love them.

And as they grow up, they’ll appreciate all the hard work you’re doing to keep their lives stable and full. Plus, the more you can simplify your life, the easier it is to focus on them!

Hey Kate,

What a great, encouraging article. Love the “how to know when to buy” chart. I think I’m gonna print that thing out and stick it on my fridge!

Lots of great ideas. Probably some that people won’t, in all honesty, want to hear, but they can definitely help patch a leaky budget.

Great post!

Great blog, Kate! You’re really inspiring and encouraging.