“A goal without a plan is just a wish.” – Antoine de Saint-Expurery

We all have dreams of what we will achieve with our money over time. Paying for our child’s college tuition. Retiring comfortably. Buying our dream house on a lake. But until we can break those goals into smaller chunks – knowing how much we need to save each month or year – we won’t be able to track our progress and have confidence we are moving towards those big dreams.

LINK by Prudential is a new tool that can help you do that, even if financial projections (or even that phrase) usually makes your head spin.

This post is sponsored by Prudential, but – as always – opinions expressed are entirely my own.

What is LINK by Prudential?

LINK by Prudential is a free tool that brings some of the benefits of a financial advisor to everyone by providing guidance on your unique financial goals.

The tool walks you through your family structure and personal goals, down to the specifics like where you want to retire or where your kids might go to college and tells you whether your current savings rates will help you reach those goals.

Prudential is a 140-year-old company that sells insurance and investment products like mutual funds, financial advising services, annuities, and life insurance. While LINK by Prudential is free to use, you do need to create an account and Prudential does tie in their other services to offer you products that align with your goals.

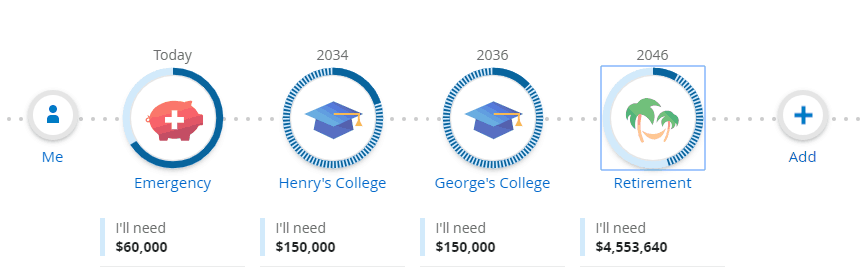

LINK by Prudential makes it easy to get a quick overview of your goals and savings needs, spread out on a clear timeline to help you visualize and prioritize the work you want your money to do throughout your life.

How Do You Use LINK by Prudential?

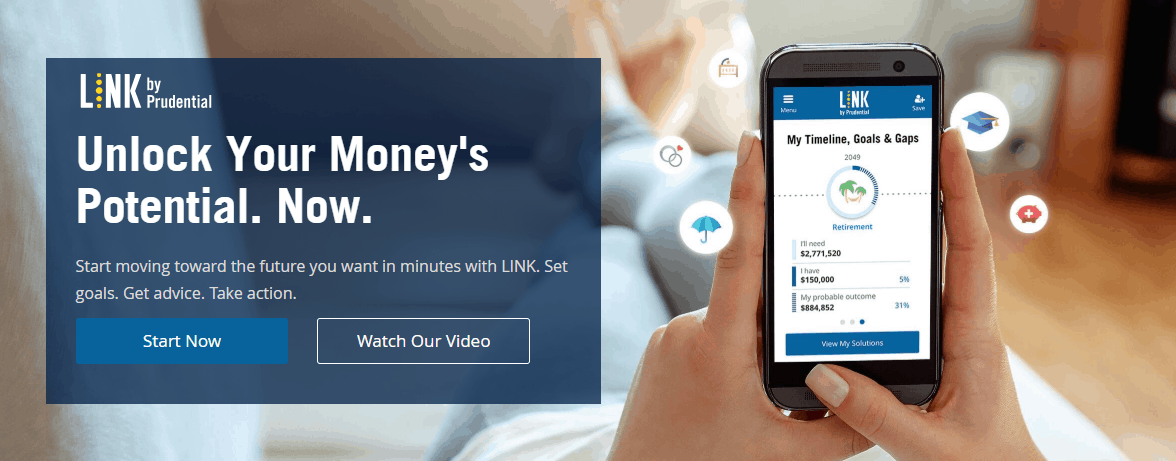

You can sign up for LINK by Prudential quickly and easily from their homepage. Simply choose “Start Now” and enter some basic details about your family and financial goals (such as when you plan to retire.)

As you go through the setup process, LINK will automatically add goals like retirement and saving for your child’s college tuition. But don’t worry – you can remove, add, or change goals once you create an account.

After entering your annual household income and current liquid assets (for things like emergencies or day-to-day expenses), LINK asks questions about your risk profile and how aggressive you want to be about investing for your financial future.

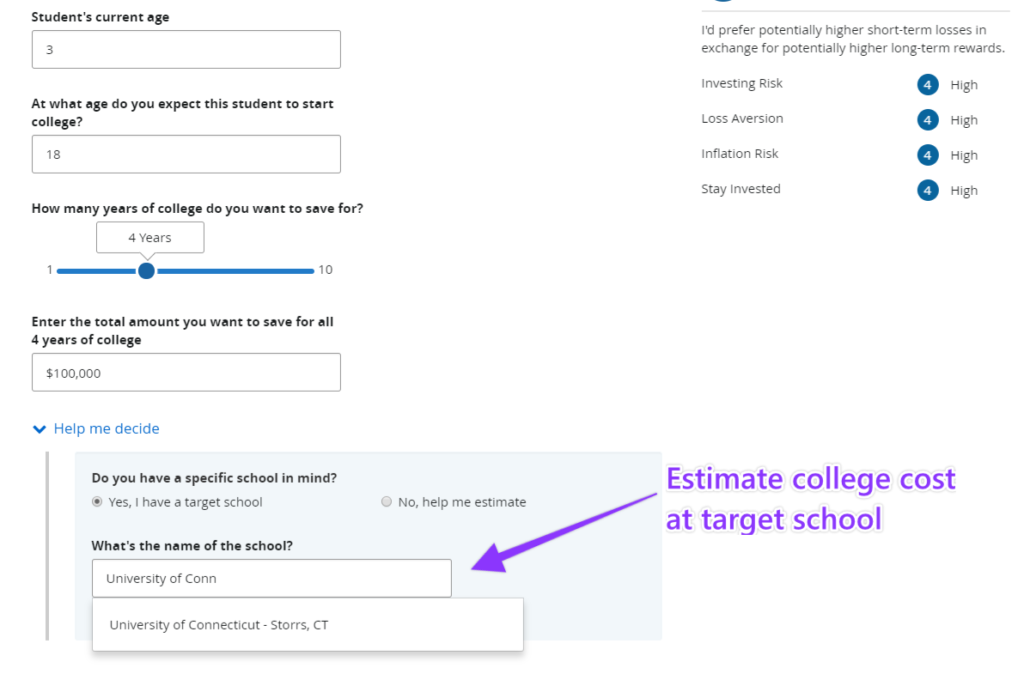

The best part of this step is how each level of risk explains how you might feel choosing that level. For instance “High” risk states, “I’d prefer potentially higher short-term losses in exchange for potentially higher long-term returns.”

In my experience, asking a new investor their risk profile is a pointless question. They simply don’t know! Prudential’s accessible explanation of these risks levels makes it easier to make the right choice for you.

In addition, once you get into customizing your account, you can select different risk levels for different goals. If your child is 3 years from college, you’ll probably want to be less aggressive with his college fund than if he or she were still a toddler.

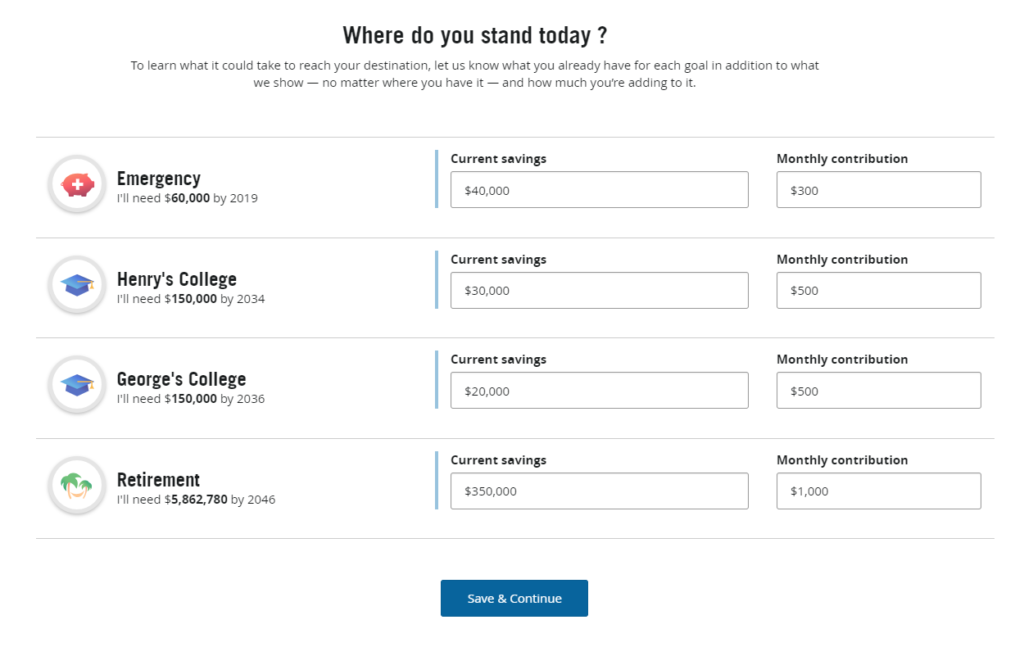

Next, you’ll enter how much you currently have saved towards each of your goals. The tool can’t be expected to know how much you need to save if it doesn’t know how much you’re starting with!

Finally, you’ll have to create an account with Prudential to further customize your financial picture and track progress over time. You’ll need to include your name, address, and phone number. If you have an account with Prudential already, you can use that account.

Now you can dive in to customize your goals!

Creating Goals With LINK by Prudential

The power of LINK by Prudential comes from its range of available goals and ability to alter savings rates and assumptions to see what is possible for you. Playing with this tool may make you realize some goals aren’t as important to you if giving them up means increasing your chance of achieving other goals.

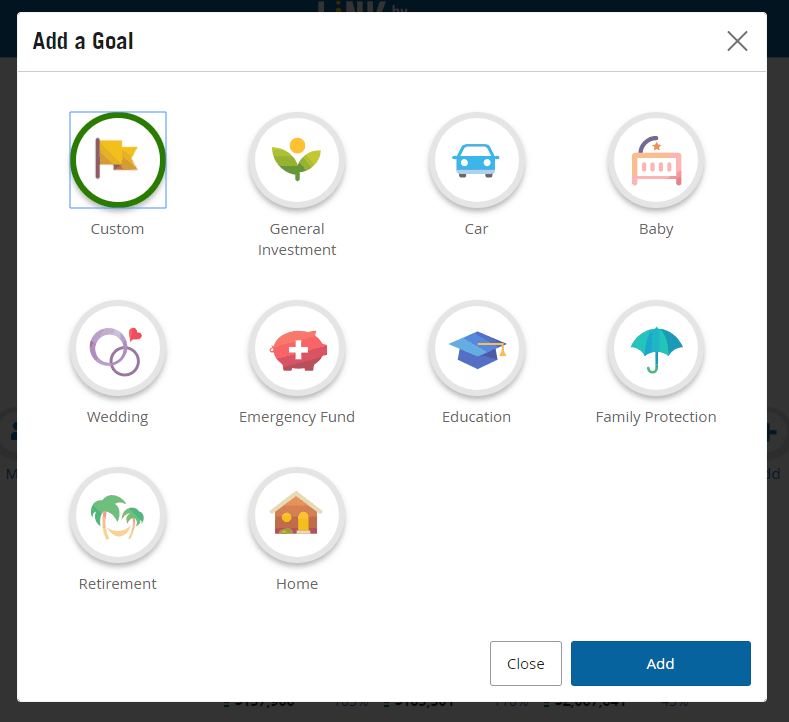

Once you’ve created your account, you can remove the standard goals as desired and add a number of unique ones. Saving for a wedding or a baby? Want to make sure you can afford your next car when your current one putters out? Add all the money goals you’re working towards to give yourself a full financial picture.

The one goal you might notice is missing in the chart above is one to tackle existing debts. While Prudential does offer a debt calculator to help you prioritize which debts to pay off first, this isn’t integrated into LINK.

Saving for a Baby

Babies are expensive, especially in that first year. (My goodness the cost of formula for my first born was like an extra mortgage payment!)

To reduce new parent stress, or to simply add another child to your home with confidence, LINK by Prudential lets you create a savings target for your little one.

Armed with your current savings, monthly contribution, marital status, and average household income, LINK by Prudential sets a target based on the average first-year spending for a family at your income level.

If you already have a child (and all the stuff that goes with babies), this target will be a bit high. In which case, you might be comfortable with LINK projecting that you only save a fraction of that amount.

But the national average is a great benchmark – especially as many people tend to underestimate long-term costs.

Saving for a Home

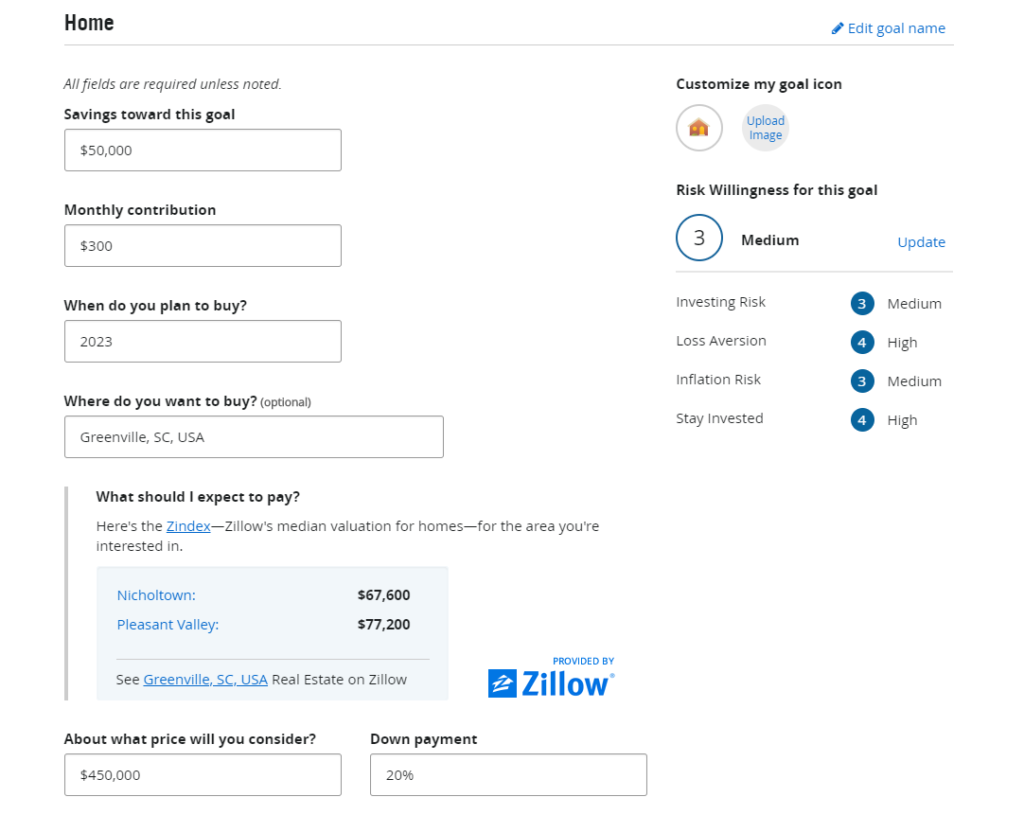

I’m more than a little obsessed with Zillow. So, I was very excited when I saw that Zillow price estimates were integrated with LINK by Prudential’s home purchase goal.

By entering where you want to buy, LINK’s Zillow integration pulls median home values in the area you’re interested in. If you’re planning to move to a new area, this can help you see if your target home price is in line with the local market.

Then, choose the home price you would consider, target down payment amount, and year you plan to buy to help LINK estimate your savings.

While this can be great for shorter-term home buying goals, it can be especially powerful if you want to relocate after your kids go to college or purchase a vacation house. Setting up the goal years before you actually plan to take action will let you save in smaller, less overwhelming chunks.

Retirement Goals

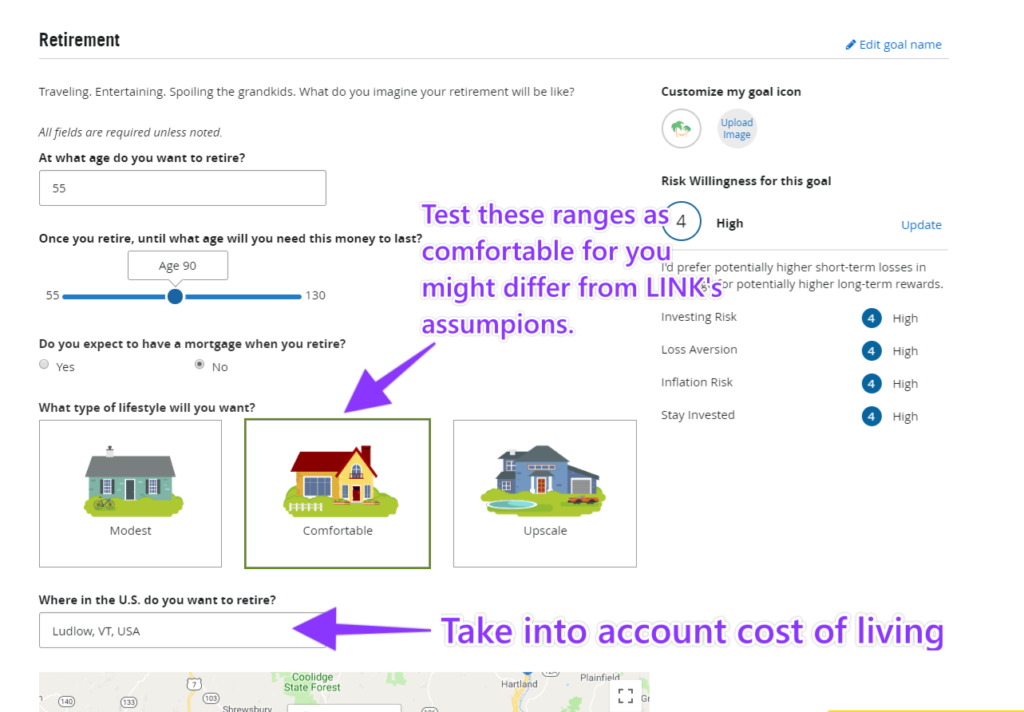

While LINK by Prudential’s tool is remarkably robust for an interface that is so easy to navigate, the retirement savings tracker was one area where I would have liked to see more depth.

The standard form allows you to set a target retirement age, how long you want your retirement assets to last, whether you’ll have a mortgage in retirement, and where you want to retire. (The ‘where’ is a great question because cost of living can make a huge difference in savings needs.)

But LINK’s retirement savings tracker doesn’t seem to be based on your current monthly spending rates and you can’t see what ‘modest’, ‘comfortable’, or ‘upscale’ means in terms of monthly expenses.

For instance, I entered a target retirement age of 55 with a modest lifestyle in Vermont. LINK by Prudential’s tool estimated I would need to save $4,553,640 to achieve this goal. Using the 4% safe withdrawal rate, this would amount to a safe spending rate of over $15,000 a month. Which seems a bit extreme when I selected we wouldn’t have a mortgage in retirement.

In addition, you can’t add other expected streams of income (like a pension or rental property) in retirement or where your savings are tucked away. Money in a Roth IRA or 401K will go farther than traditional accounts of the same type come retirement, as you won’t owe income taxes.

I recommend using the retirement tool as a rough guide to see how altering the retirement age and location impacts savings needs. Give LINK scenarios such as, “will living in Las Vegas or Boston be more financially feasible?” But I wouldn’t panic if savings goals seem especially high.

College Tuition Goals

Anyone still struggling to pay off their own student loans knows college is absurdly expensive. And while we can cross our fingers and wish on shooting stars that it’s free by the time our kiddos are ready for school, that’s probably not the most secure plan.

Maybe you want to pay all of your child’s tuition. Maybe just half to so they have some skin in the game.

But whether or not you’ve opened a 529, LINK by Prudential can keep you on track for the day you drop your kids off at their new dorm.

The tool assumes college tuition rates increase 5% a year and base projected prices off actual tuition, room and board for the school you choose. It doesn’t estimate financial aid or let you choose expected scholarships, but for all those parents wondering how much college will cost in the future, this is a great starting point.

Moving Towards Your Goals With LINK by Prudential

In just 10 minutes, LINK by Prudential can give you a timeline of your financial goals and probable outcome – including reminding you of a few goals you may have forgotten, like getting the right insurance in place to protect your family.

Have multiple money goals floating around in your head but aren’t sure if they are actually achievable? Sign up for LINK by Prudential for free and see where you stand.

We want to know – How are you tracking your financial goals? Are you confident you can achieve them?