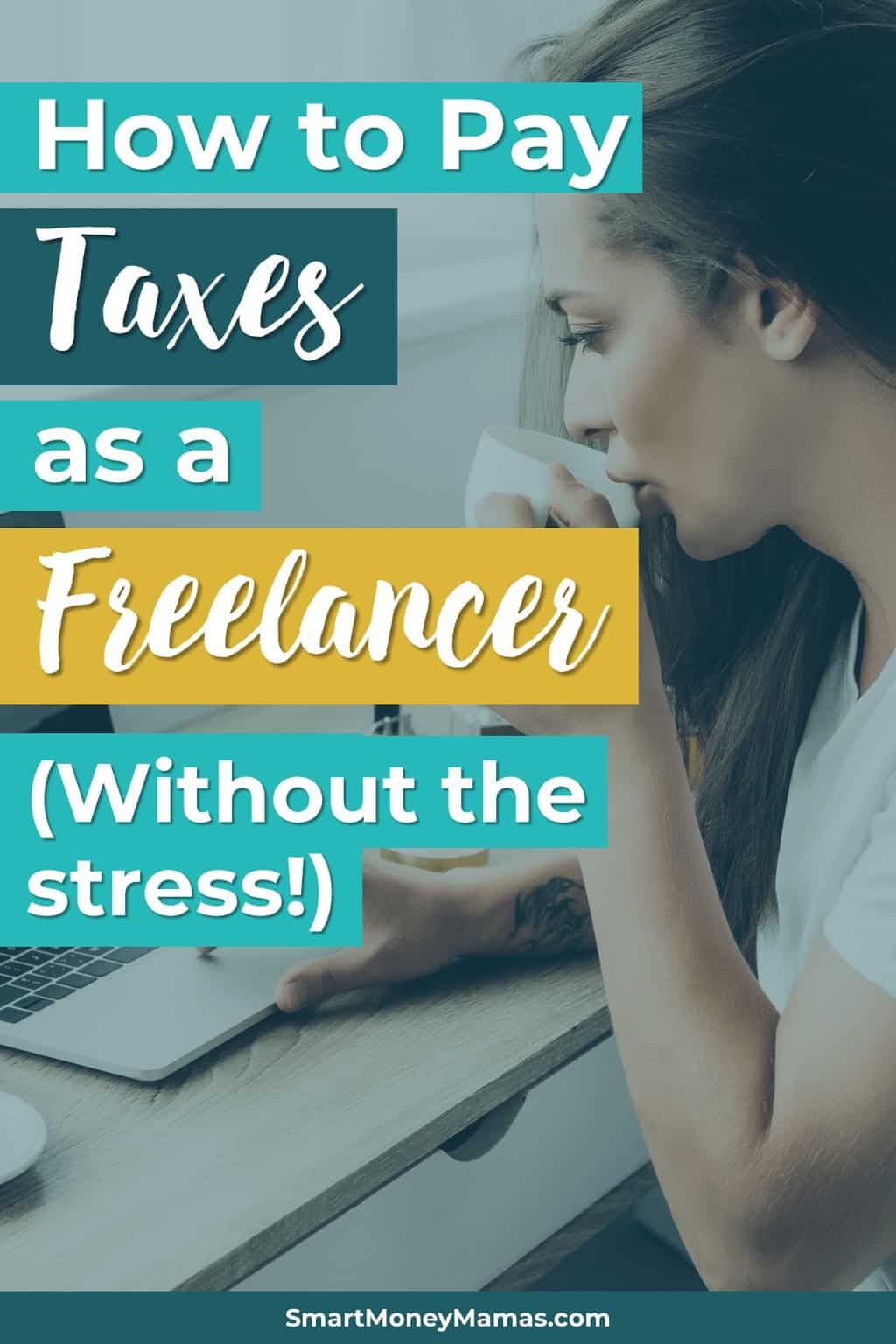

Freelancing is incredible. You get to be your own boss and create your own schedule around family time and your life.

But then there are the not so sunny sides.

The hustle to find clients, sending invoices, and the big one – handling taxes.

Freelancers, even part-time freelancers, are considered self-employed by the IRS. Which requires us to follow slightly different tax rules than standard W-2 employees.

But if you dove into freelancing before getting a handle on the tax system, don’t fret! Here’s what you need to know to get organized.

Table of Contents

First Things First: Freelancers Have More than One Tax Season

Freelancers – or any sole proprietor, LLC, or any other business type – need to pay taxes more than once a year. In fact, we have two types of tax seasons.

Once a Year Personal Taxes

This is the annual April tax season you’ve experienced (I hope) since you got your first job. You receive a W-2 from your employer(s) and file a Form 1040 with the help of TurboTax, H&R Block, or an accountant.

But there is an extra step when you’re a freelancer. You’ll fill out a Form 1040 as you have in the past, but you’ll also need to file using Schedule C (or C-EZ if you made less than $5,000).

The Schedule C is where you report your freelancing income from that year and any 1099’s you received from clients. (But even if you don’t receive a 1099, you still need to report all income.)

Out of your Schedule C income, you will be paying a self-employment tax and your states’ income tax. It will cover things like Social Security and Medicare, both as an employee and an employer.

Paying Your Quarterly Taxes

Until I started freelancing, I never even considered quarterly taxes. But as a freelancer, you aren’t getting taxes withdrawn from your paycheck automatically. So quarterly taxes are the estimated taxes you pay 4 times a year. That way, you’re paying as you go, just like an employer.

When Quarterly Taxes are Due: (Exact dates vary, but circle around the 15th)

- April

- June

- September

- January of the following year

You can calculate quarterly taxes by using accounting software, like Quicken Self-Employed, or use the IRS Form 1040-ES to estimate what is due based on your income.

Since quarterly taxes are just estimated, it is typically recommended to set aside 30% of your income for your payment.

Do You Really Need to Pay Freelancing Taxes?

Think you don’t make enough to need to worry about freelancing taxes? Or that since you’ve just started you can think about it later?

Unfortunately, the government wants its money. No matter how little you’ve made.

If your total freelance income is $400 or more in the year you will be filing, you need to report the income and pay taxes.

Three Steps to Getting Organized

You can shuffle through emails, receipts, and invoices at the end of the year to try and throw together what you need to fill out a form 1040.

But that sounds about as fun as stepping on a Lego.

Keep your finances organized all year long so when quarterly or annual taxes roll around, you have everything you need.

1 – Calculate your Total Income

The IRS will want to know how much you made all year. (And I assume you will as well.)

While you can calculate your total income by collecting and adding up 1099 forms from your clients, that may not give you the full picture. Clients aren’t required to fill out a 1099 form if they paid you less than $600. But you are still absolutely required to report that income.

The easiest ways to do this is using an invoice tracker like Quicken Self-Employed or PayPal. These services will easily let you see how much you’ve made each month.

You can also keep a quick tally in a spreadsheet showing the month, client name, service provided, date invoiced and date paid.

If you decided to seek professional help come tax season, the output from your invoice tracker or your spreadsheet will be incredibly helpful.

2 – Know What You Can Write Off

Since you will only be paying taxes on your net profit (gross income minus expenses), it’s important to keep track of any purchases or expenses for your business.

But before you go deducting the coffee you ordered while working at Starbucks, know that there are limitations on what the IRS will let you deduct. Qualified expenses must be ordinary and necessary for running your business.

So let’s look at what that might include. Qualified expenses are:

- Required equipment or materials (Adobe subscription, new laptop, backpack)

- Office Expenses (Paper, printer, invoicing application)

- Business food and lodging (Conferences or trips related to your clients)

- Lodging or Office Space (No, you cannot write off all of your utilities if you work from home. But there is a standard home office deduction.)

Reminder: Make sure to save receipts or purchase orders for any items you will be writing off. For example, your new laptop or office furniture can be deducted from your income, but you need an itemized receipt.

Luckily, the IRS has deemed photos of receipts are sufficient. Simply snap a photo of any receipt and email it to a special tax email or folder in case you’re ever audited. (Fingers crossed that never happens.)

3 – Start a Separate Account for Paying Taxes

One of my favorite parts of the Profit First business management strategy is to have a separate savings account for end-of-year and quarterly tax payments.

It’s easy to look at our bank balance and think we have all that money to spend. Our experiences as W-2 employees have trained us not to think about taxes. But as a freelancer or business owner, we need to set aside money for taxes to avoid being blindsided by large tax bills.

Open an account just for your savings and link it to your checking. Every time you are paid or make a deposit, automatically transfer 30% of that into your tax account for taxes. That way, tax time is never stressful.

As an alternative: If you tend to have the same repeat clients or a consistent level of income, you can set an automatic monthly transfer that approximates 30% of your total earnings.

Freelancing Bookkeeping Isn’t Hard

Working as a freelancer has many incredible benefits. But being your own boss makes you a boss, and that means dealing with basic bookkeeping and paying Uncle Sam what he’s owed.

If you stay organized, track your income and expenses, and save consistently for quarterly and annual taxes, you’ll avoid stress, penalties, and be prepared if an auditor ever comes calling.

You can do this!

Further Resources

If managing your bookkeeping and taxes still seems overwhelming, don’t be afraid to enlist help. There is no shame in getting a professional opinion to ease your mind or save you time.

Be sure to find a CPA (Certified Public Accountant) or tax professional who is familiar with freelancers and small business owners. Check with your friends and see if they use a tax preparer. Turbo Tax is a powerful tool, but it can only take you so far. Especially as your business grows, it may be helpful to bring in a professional to make sure you are on track.

For more information and specific forms please visit the IRS Self Employment Tax Center.

What questions do you have about filing taxes as a freelancer? Drop them in the comments!

Thanks for putting this information out there. It’s an increasingly common scenario. At least the penalty for not paying estimated tax isn’t huge. It also doesn’t affect your status as being able to request a one-time forgiveness for an honest mistake. Not that I would ever advise someone to not pay their estimated quarterly tax.