Sometimes it seems like the only side hustle or online business stories on the web are about people raking in hundreds of thousands of dollars. And while these reports are motivating for many, what if you don’t want to quit your job or start a full-time business? What if your plate is already way overloaded and you don’t have 30 hours a week to commit to what is effectively a second job?

Well, a side hustle can still change your life.

What does it take to earn $200 per month?

I get it. You’re busy. Adding anything to your plate seems downright crazy. But earning an extra $200 a month is an incredibly low threshold. In most cases, you can make that much with just 5 to 10 hours a month of work. Given that the average American watches 35 hours of TV per week, I think you can swing it.

There are so many ways to earn $200 I could not possibly list them all. But here are some prime options to consider.

- Teaching English online with VIPKid for 10 hours a month.

- Three to four nights of babysitting.

- Walk dogs on your lunch break with Wag!

- Writing a handful of articles, or even just one, as a freelance writer. (I regularly get paid $200 or more for one article.)

- Driving for Lyft for less than 12 hours a month (less than 3 hours a week).

- Working as a virtual assistant for two to three hours a week.

- Mow a few lawns in the neighborhood.

So, you’ve got your new side gig. Or at least you have some ideas. But what can you really do with $200 a month?

Adding $200 a month to your debt snowball

If you’re in debt, even a small side hustle will change the game. It will mean you can pay off debt faster and watching those balances fall will keep you motivated. And it will save you a ton of money in interest.

Let’s do a little hypothetical. Imagine you have $5,000 in credit card debt with an 18% interest rate. Your monthly minimum payment, which is interest plus 1%, comes out to $125 a month. You don’t have a ton of wiggle room in your budget (or don’t think you do), so are just merrily dancing along paying that minimum payment.

Making only the minimum payment will mean it takes 273 months (that’s almost 23 years, ya’ll!) to pay off your debt. And you’ll have racked up $6,923 in interest. Oh man, that gives me heartburn just thinking about it.

BUT if you picked up a little side hustle and chunked $200 extra dollars towards that whopper of a bill? Your credit card debt would be gone in 18 months. For you mathematicians out there, that is over 21 years sooner. 18 months of minor hustle, for 21 years of freedom. Seems like a good deal to me.

(Oh, and that ugly interest cost? Only $728. Your baby side hustle would save you almost $6,200 you would have otherwise had to send to your credit card company.)

If you were working 10 hours a month at your side hustle, making $20 an hour, that extra interest savings would mean those hours really earned you $54 an hour. Not too shabby for taking Fido around the block.

And if you’re not in debt?

$200 a Month Rocks Your Retirement Savings

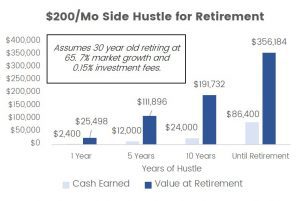

Maybe you want to do the mini side hustle game for a year. Perhaps you want to make it a regular part of your life. The joy of side hustles is that you are the boss. Whatever you decide, an amount as small as $200 per month can change your retirement picture. Here are a few examples of what you could achieve.

Try to keep something in mind while you scan through these growth examples. The average pre-retirement baby boomer has only $136,000 saved for retirement. Total.

The Short-Term Hustler

Let’s say you’re 30 years old. Each month this year, you work to make $200 extra dollars and drop it into your retirement savings. Then you don’t touch it until you retire at 65.

With a relatively conservative 7% annual market return and 0.15% of investment fees, your $2,400 of side hustle cash will have turned into over $25,000 by retirement! Over ten times your money? Not too shabby.

The Medium-Term Hustler

If you can stick to your hustling lifestyle for five years, the impact grows exponentially. You will have earned $12,000 between the ages of 30 and 35, but by retirement age, you could be sitting on almost $112,000!

The cool part the medium-term hustle? Following the 4% rule, this $112,000 will give you $373 a month in extra retirement spending. Forever. That is almost double what you made while you were putting in those side hours, and you can benefit from that sum for far longer than five years.

The Uber Committed Hustler

Alright, let’s say you’re a little crazy. You find a side hustle passion, you just enjoy driving for Lyft on Saturday nights (driverless cars may take this one from you before you’re 65…), or you create a source of passive income that earns your $200 with you lifting a finger. In some form, you find a way to make an extra $200 a month, every month, until you retire at 65.

In your years of work, you will have earned $86,400. A hefty sum. But nothing compared to the $356,000 your investment will have grown into. This is well more than double what boomers have saved, and that is just from your side hustle savings.

This side hustle gold mine will give you $1,187 of extra cash every month after you retire. Imagine the fun you could have with that much extra money in retirement. Pina Coladas and toes in the sand!

There is Only One Catch. You Have to do the Work.

Earning $200 a month isn’t hard. And it can change your financial future. But to benefit, you have to do the work. Find a side hustle, or two or three, that work for you and put in the hours. Then put the money towards your financial goals.

A mini side hustle or side job might not be a sexy, “I made 6 million dollars” blogging headline. But it will make a difference.

Challenge Accepted?

If you think $200 a month could improve your financial life, I want to help you find a side hustle that works for you. Comment below, or shoot me an email at chelsea[@]smartmoneymamas.com and I’ll do anything I can to support you. Help you find the right gig, check in that you’re meeting your goals, answer questions. I’ve got your back.

Great write up Chelsea, we are already making a bit on the side but we will take the challenge and increase our monthly hustle by $ 200!

Thanks for the motivation.

Great post. I think a lot of people forget that even small things add up to large amounts over time. $200 a month is $2400 a year. Considering that the average American doesn’t even have $500 in an emergency fund, $2400 a year is a lot!

I’ve been trying to think of what I could do to start a side hustle. I’m interested in free lance writing. Do you have any other articles about how to start?