Recently I wrote about the three-fund portfolio. A simple, well-diversified investment strategy that is easy to manage and can be achieved with low-cost funds. However, for such a simple investment strategy, people have a lot of questions about the three-fund portfolio! And this is good! You should never use an investment strategy you don’t understand. For one, you need to understand what you’re buying so you can understand the real risks and realistic growth potential. But more importantly, if the person selling you the strategy (a broker, financial advisor, personal finance blogger) can’t explain it to you simply enough for you to understand, you’ll know they don’t really understand it either. In which case, it is time to find a new source of advice.

So what do people want to know about the three-fund portfolio? Let’s take a look!

Table of Contents

Common Questions About The Three-Fund Portfolio

How much should I allocate to U.S. stocks versus international equity?

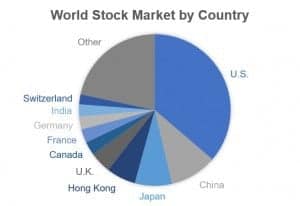

This is a personal choice, determined by how global of a portfolio you want to hold and how much diversification you want. To have a truly balanced global portfolio, you would need only 36% of your total stock allocation to be U.S. equities, while 64% would be international. This would match the total balance of the world stock market today. However, very few investors do this for a variety of reasons.

John Bogle, founder of Vanguard, and famous investor Warren Buffett both dismiss the need for international stock investing for the average family. Both believe it adds unnecessary complexity (another fund, currency considerations, etc.). Also, some international stock markets are less developed than the U.S. or have higher government involvement, which can drive higher volatility. Note, however, that neither says that this bias is based on any historical analysis. It is just a preference to keep things simple for a household investor and using only the U.S. market for long-term investments has been successful historically.

Overall, the average U.S. investor holds ~15% in international equities. Other countries may be on different economic cycles than the U.S., which adds to diversification while giving you broader exposure to growth elsewhere in the world. There isn’t a lot of backtesting done on international markets that I’ve seen and your allocation to international stocks is a personal choice. In general, 10%-20% is a good starting point to give you some exposure to the global economy without having major concerns about foreign currency moves or other factors as you approach retirement.

Does it really matter what asset manager I use?

Personally, I love Vanguard as they are the biggest low-cost index fund provider in the world, they consistently lower fees, and their website and support staff are easy to work with. However, there has been a bit of an arms race between some low-cost index fund providers in the past several years, which creates options for investors!

The top three low-cost index fund providers currently in the U.S. are Vanguard, Charles Schwab, and Fidelity. All are great options and you can’t go wrong with any of them. If you already have a 401(k) or brokerage with one of these companies, it may be easiest just to keep your other investments there as well. The differences in fees are very minimal and simplification is always great.

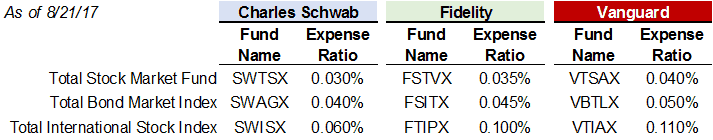

Here are the current fees for Vanguard, Charles Schwab, and Fidelity for a three-fund portfolio.

Both Charles Schwab and Fidelity have recently cut fees to be lower than Vanguard, and Charles Schwab is the only one of the three providers that doesn’t have an investment minimum to get these low fees. (Fidelity and Vanguard require $10,000 per fund to get the lowest fees.) However, there is one thing this chart is missing. Scale.

For Charles Schwab, total assets managed by the three funds listed here is $11.3 billion. For Fidelity, total assets managed across the three is $76.3 billion. Compare either of those to Vanguard, which manages $312.2 billion over just those three funds, and the other two are dwarfed. When it comes to fees, scale is what allows asset managers to reduce costs. It wouldn’t be surprising to see Vanguard lower fees again to come in line with either of the other two players.

What does it mean to rebalance your portfolio?

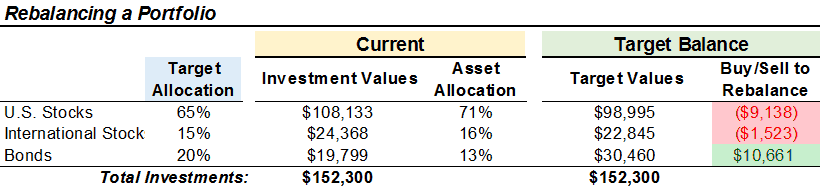

Rebalancing your portfolio is a pretty simple process, it just requires a small bit of math! All you do is sell some of one fund and buy some of another to achieve your target asset allocation.

Even if you invest in line with your desired allocation, over time your three investments (U.S. stocks, international stocks, and bonds) won’t grow at the same rate. That’s the beauty of diversification! Your three-funds move independently. Over the long-term, stocks should grow faster than bonds, meaning you will have a higher allocation of stocks than you intended. You occasionally need to sell stocks and buy bonds to rebalance (or vice versa in a market downturn).

How often should I rebalance my portfolio?

This is based on your risk tolerance (how committed are you to that 80%/20% split?), cost considerations (are your investments largely in taxable accounts where you may have to pay taxes on what you sell to rebalance?), patience for the process (how often do you want to do the math to rebalance?).

Vanguard put out a white paper on best practices for rebalancing and concluded that a semiannual or annual rebalancing, with an 5% threshold to do so, was a fair compromise on the above considerations.

In other words, if your target allocation was 60% stocks, 40% bonds you would check every 6-12 months to see if your allocation had drifted to 65% stocks, 35% bonds and rebalance. In most cases, you wouldn’t be that unbalanced and you could continue on your merry way. Personally, that is the strategy I use.

For an example of how this works, Vanguard showed that from 1926 through 2009, you would have rebalanced only 28 times in 82 years. Your average stock allocation over time would have been 60.7% (pretty darn close to 60%!), with an average annual return of 8.6% and the lowest volatility of any of the rebalancing frequencies. Rebalancing 28 times in 82 years sounds like a pretty manageable strategy to me!

How do I manage a three-fund portfolio over multiple accounts?

Managing a portfolio of only three funds at only one investment provider sounds like heaven. However, for most of us, we have investments in at least two places. For instance, I have a 401(k) through my work with one provider, a legacy brokerage account that holds stock from an old employer (fun fact: I can’t actually buy and sell single securities at my current job, so I’m stuck with those old employer shares!), and my rollover IRA, personal investments, and Fuss Fish’s 529 plan at Vanguard. Plus my husband has an old 401(k) that we have yet to roll into a Vanguard IRA.

While multiple accounts can be frustrating, it also gives you options. Your employer 401(k) or 403(b) may not have a low-cost index fund option for bonds or international stocks. In these cases, you can focus your investments in those accounts on U.S. stocks – almost every 401(k) or 403(b) account has a relatively low-cost S&P index fund – and balance your other allocations with investments in personal IRAs or taxable accounts where you have control of using a low-fee provider. Just remember to review your overall asset allocation once or twice a year!

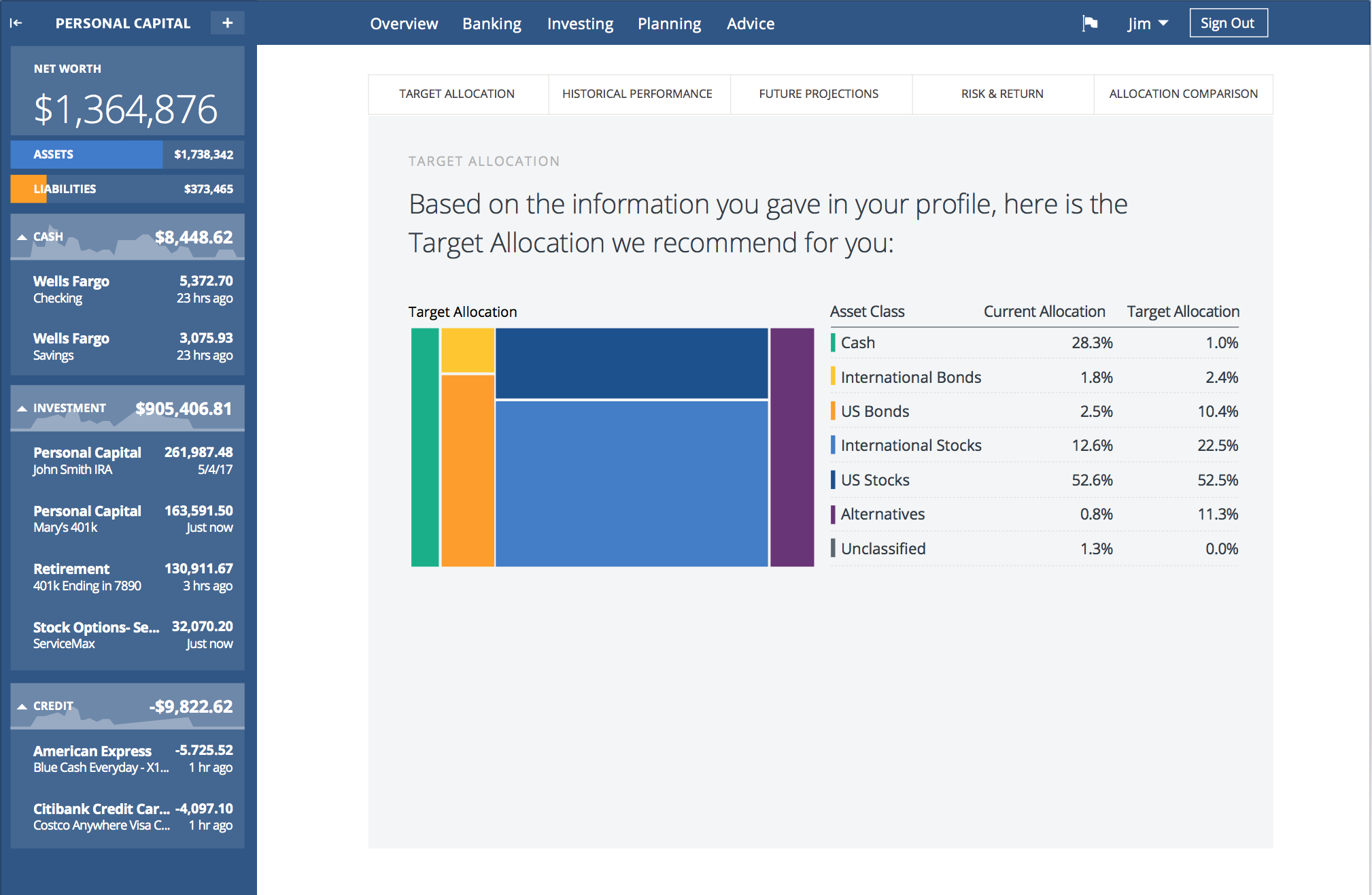

Monitoring Asset Allocation with Personal Capital

While I do my best to maintain a consistent asset allocation and three-fund portfolio approach, I do need a little help to monitor all our accounts. Personal Capital offers a free service that connects all your investment accounts and helps you monitor asset allocation, performance, and your preparation for retirement over time. It also helps you calculate your net worth by adding your home, mortgage, and any other debts! Below is a sample screenshot of Personal Capital’s asset allocation page. Click here to join Personal Capital and start monitoring your investments and goals!

Note: Part of Personal Capital’s free services is that they also have in-house financial advisors. When you sign up, they may call you to see if you are interested in further hands-on 1×1 services. These will cost money and you are welcome to say no and continue using their free tools.

If you use a three-fund portfolio, what issues or questions have you run into implementing or maintaining it? Drop a note in the comments to share your experiences! Maybe I’ll add your question to this post!

How often do you monitor all of these accounts? As a teacher, there is no 401k, and I can check our stock summary and 2 ROTH IRA’s on the same screen. It’s unnecessary, but I typically check it every day after dinner. It would drive me nuts having to login to investments at 5 or 6 locations.

I monitor via Personal Capital about every 3 months, mostly to check on our net worth. Since most things are automated I don’t usually have to login to all the different places. I spend my 9-5 staring at the market so I have a general idea of where things are headed and don’t want the temptation to fuss with it so I try to just leave it alone.

Do you have a 403(b)? How are your investment options there?

Hmm, the 36% international idea makes sense when you look at the value of the stock markets. I wonder if it’s different if you look at other factors (GDP, others). I tend to go with a 2:1 US/intl ratio myself. Do you have a specific ratio you go with?

I actually don’t have any international stock exposure in my liquid investments today. My personal investments (401k, IRA and taxable) use a two fund approach.

I some have coinvest opportunities through work so have exposure to our Asian and European private equity funds that way. Overall, international debt and equity probably makes up <10% of my portfolio. Not including all the international exposure most large cap companies have naturally.

Thank you for the article and the chance for discussion. I have a slightly different analysis.

When I put the three fund portfolio into the efficient frontier analyzer in portfolio visualizer, I get a portfolio with 7.78% expected return and 12.38% risk. When I look at a 63%/37% VTSMX VBMFX portfolio I get 7.79% return and 9.6% risk, or the same return for 22% less risk. The 2 fund portfolio is on the efficient frontier, the three fund portfolio is not. It is clear all you get from the 3 fund portfolio is more risk. More risk is bad juju. The 2 fund portfolio is trivial to keep in balance even across multiple accounts and tax treatments. The 2 fund portfolio is cheaper to own.

Why would I own a three fund portfolio when a 2 fund portfolio is clearly superior? Maybe this is why Bogel and Buffet suggest the 2 fund alternative.

Hi Gasam! Thanks for commenting and your thoughtful analysis.

I believe I noted in my initial post introducing the three-fund portfolio that I personally use the two-fund portfolio. In my opinion, there is sufficient international exposure in the domestic market holdings and I prefer the simplicity.

However, I think many would comment that the efficient frontier analyzer is only a good way to quantify risk if you believe the future will hold exactly what the past did. Historically, foreign stock markets were less developed than the US and those markets saw greater strain from wars on their soil and so forth. In addition, the 100 year historical period includes the United States’ explosion to world power. With foreign markets more well developed today, the US approaching a more mature economy grappling with the realities of automated workforces, and other socioeconomic issues it is unclear if the relative stability of the US versus other countries will continue. For those who are more concerned about the US’s position as the world leader over the next few decades, I would assume they prefer the three-fund option.

I guess it depends on what you call historic. The “historic” part of the analysis merely looks at a period of time to establish an average return and standard deviation for a given asset or asset class. I have found 5 years of data to be pretty good, 10 years a little better. The efficient frontier calculator is not a reward looking analysis like FIREcalc Trinity or Begnan. Over 50 years one might see an emerging market grow to dominate, but over 50 years you likely will be dead, and your “just in case” insurance will have cost you 22% per year in excess risk. If you analyze 22% excess risk and covert it to missed return, your 3 fund choice will cost you 0.87%/yr in return, 8.65% vs 7.6% at the same risk. So people who own the three funder are giving away free money every year in the mistaken notion they .are buying diversity. The correlation between VTSMX and VGTSX is 0.86 which is hardly any improvement in diversity at all. When the crash comes the vectors of these two assets both point strongly into the ground. People are all head over heels about saving 2 bp on fund cost, yet willing to give up 87 bp on return. Over 30 years 0.87% extra return turns $1M into $1.3M, aka 300K extra safety when you are old.

If I can do this analysis ANYBODY can do this analysis for themselves. I am just using off the shelf calculators, same as those used by Fidelity retirement planner, Personal Capital and a million professional financial advisers. I’m not being contentious, simply offering a differing analysis. Personally I don’t find the common bogelhead 3 fund to be a very good deal compared to a simple 2 fund account. I think whomever the person was that cooked this fund up really doesn’t understand risk management any better than making a guess. Thanks for your kindness in allowing the discussion. I hope someone finds it useful.

This is so interesting! We personally use Vanguard Target Retirement funds for the simplicity, despite the slightly higher costs. They actually consist of a 4 fund portfolio. But I’ve been following these types of discussions in case I ever want to switch to individual funds and rebalance myself.

Great post idea and execution. Wish I’d thought of it first.