When it comes time to move your family to a new home, it sometimes feels like your only option is to put your current house up for sale, fight for the highest value, and take whatever the market is ready to offer you. In some cases, however, there is another option. You could turn your home into a rental property!

When it comes time to move your family to a new home, it sometimes feels like your only option is to put your current house up for sale, fight for the highest value, and take whatever the market is ready to offer you. In some cases, however, there is another option. You could turn your home into a rental property!

There are many reasons you may consider making your primary residence a rental property, all with their own merits. Maybe you have tried listing the house for sale and you can’t get the price you need. Maybe you need to move quickly and don’t want to firesale your home. Maybe you just want to rock your finances and add an extra source of income as a real estate mogul.

Table of Contents

Turn your home into a rental

Turning our home into a rental property someday is something Daddy Fish and I discuss all the time. Despite the headaches we have had with homeownership, this could be a great way to dip our toes into the world of real estate investing. In thinking about that future investment decision, I have done tons of work (my Type A personality means research is a reflex) on what we would need to do, the tax and legal considerations, and how to ensure you get tenants that don’t destroy your house. In doing so, I have created this comprehensive guide to turning your home into a rental property to help other families make the switch!

1 – Decide if being a landlord, particularly in a house that was your home, is right for you.

Being a landlord is hard work. It requires being on call for your renters, dealing with maintenance for multiple homes, and learning how to deal with crappy tenants that don’t take the same care of the home that you would. You also have to be willing to be heavy and collect overdue rent.

Rental income can be a great source of additional cash flow for your family, but there are plenty of instances where rental properties become a major cash drag because of unexpected maintenance, tenant damage that exceeds the security deposit, or a rental market in an area not supporting the cost of running the property.

Before diving into the full process of converting your home into a rental, I would recommend reading this post thinking about what it will mean to be a landlord and what your expected return on investment is. Keep in mind that your time is valuable too! If your expected return is similar to the market (which requires almost none of your time) maybe this house isn’t the right first rental property.

2 – Determine if you will need to refinance your mortgage.

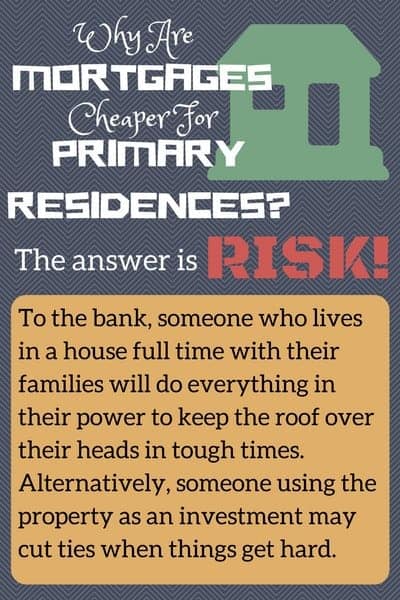

Living in a house before renting it out can be a very  smart investment decision. Mortgages for primary residences offer lower interest rates and lower down payments. However, your mortgage lender does expect you to actually live in the property.

smart investment decision. Mortgages for primary residences offer lower interest rates and lower down payments. However, your mortgage lender does expect you to actually live in the property.

Different lending agreements have different rules about how long you need to use the property as a primary residence. Standard agreements today are 1-2 years. Check your Occupancy Clause in your mortgage agreement to see what your restrictions are.

You do not want to violate your occupancy clause. Some would argue that the bank has few ways to discover that you are renting the property. However, if they do it could result in your mortgage coming due as soon as they find out or being charged with mortgage fraud. Not. Fun.

A note on VA loans

If you own your current home with a VA loan you must always be the primary resident of the property. If you try to rent the property you can be charged with mortgage fraud, like civilian borrowers, and lose the right to a VA loan for life.

In this case, you will have to refinance into an investment property mortgage. All investment mortgages require 20% down because PMI (private mortgage insurance) isn’t available for investment mortgages. Any equity you have built up in the home while you owned it, from paying off your mortgage, will be counted in your down payment.

Many investment mortgage lenders also require 2 years of rental manager experience if you want to use the expected rental income to cover the cost of the mortgage. If you don’t have rental experience, you may have to show you can support the mortgage for the investment property and the mortgage for your new house on your regular income.

3 – Update Insurance

Once you are sure you have a suitable mortgage for your property, you want to make sure the house is properly insured and that your family is protected from liability in the best way possible. Landlord insurance to protect your property is higher than typical home insurance for the same reason mortgage rates are more expensive – rental properties see more wear and tear!

Shopping for Landlord insurance

Basic landlord insurance covers building insurance for damage to structures on the property, property maintenance equipment that you own, and protection for sheds, pools, and other outbuildings. Basic insurance should also provide some coverage for minor accidents or injuries that happen on your property.

Landlord insurance can also have benefits such as covering legal fees if you are sued, coverage for loss of rent if damage makes the property unlivable, or storm & flood coverage but these things usually cost extra.

Be sure to get quotes from a few insurance providers and ask a lot of questions about what the policies cover and how deductibles work for different claims. Asking questions gets you good information on your policy, but also shows you how easy the company will be to work with in the future. In most cases, you will have more claims on your landlord insurance than you ever did on your homeowners. You want to be sure it won’t feel like pulling teeth every time you call to make a claim.

Consumers Advocate has a great ranking of the top landlord insurance providers by region, which is a good place to start.

4 – Protect Yourself with an LLC or Umbrella Policy

Creating a rental property opens your family up to liability. A rejected tenant may sue for discrimination. A tenant’s friend may slip and fall on their way down the stairs and sue you for medical expenses. Since a rental property is supposed to be a source of cash instead of a drain on cash, you want to make sure people on your property aren’t able to come after your family and their other assets (retirement accounts, other homes, etc).

The two main ways to protect yourself as a landlord are creating an LLC or purchasing an umbrella policy. If your home will be your only rental property, one or the other is probably enough. However, there are some states where both are recommended or one provides better coverage than the other. I recommend getting a consultation with a real estate attorney in your state before you make your decision.

Limited Liability Corporation

An LLC (Limited Liability Corporation) is a form of business structure that protects the owners from lawsuits against their personal property. If something happened and you were sued, the plaintiff could go after the value of the rental asset but not any of your other assets or investments. The cost of an LLC is higher the first year when you have to pay set up costs, but then there is a maintenance fee each year to make sure the LLC is structured and reporting in a proper way. You can find the details for how to form an LLC in each state at Nolo.

Umbrella Insurance Policy

An umbrella policy is a form of insurance that adds protection above and beyond what a typical landlord policy would provide. A policy like this can sometimes be added to your landlord policy and reduce the number of checks you are writing a month by one. An umbrella policy is usually paid for monthly and works as a shield to your personal assets. If a lawsuit goes beyond what your landlord policy would cover, the umbrella policy kicks in to cover the remainder. However, if the cost of the lawsuit exceeds both the landlord and umbrella policies and you don’t have an LLC, your family will be liable to make up the difference.

5 – Determine how much you want to charge

Now that you have yourself properly protected, the fun begins! You started this journey to get rental income and now you get to determine how much you want to charge. Of course, the standard landlord response is “more”. But how do you determine what the right number is?

- Do some market research. There are a lot of free resources to help you evaluate what rental rates look like for your area. Check out Zillow, Trulia, or Rent.com and see what rates are for properties that are similar in size, location, and amenities.

- Think about your costs. Make sure to give yourself some profit above the costs of running the property. If you have a mortgage, that profit number will probably be small (<$150 in most cases) but remember that every rent check is building equity in the property as well and profit will jump once that mortgage is paid off.

- Consult with a real estate agent. The easiest way to get a good feel for what a property should rent for is to talk to a real estate agent. One of the number one rules in investing is to know what you don’t know and be willing to ask for help. A good real estate agent will be able to show you the best comps, give you an achievable range of rental rates, and even help you find a tenant faster.

- General rules. Typically, landlords can charge 0.8%-1.0% of a home’s value in rent. So if your home is worth $250,000, you should be able to charge $2,000 – $2,500 in monthly rent. However, this is very dependent on where in the country you live so you need to compare to other properties in the market.

6 – Set the Rules

Your first lesson in being the heavy! If you plan to be the understanding, flexible landlord that you never had, you are going to face a rough road. People will take advantage and if you allow them to pay the rent late without a late fee once, they will think they can do it the next month as well.

Decide what you are willing to allow at your property and what just has to be a no go.Be sure the rules are clear and universal. Deciding rules on a case by case basis could lead to discrimination lawsuits or a tenant who is constantly coming to you with requests for exceptions to your rules.

Things to consider are

- Occupancy: It is smart to set a limit on how many people can occupy your home. The usual way to do this is by the number of people per bedroom. If you limit to 2 people per bedroom, your 3 bedroom house is available for families or groups of 6 people or less.

- Pets: Cats and dogs are the obvious ones. Particularly if you are willing to allow dogs but not certain breeds. Also think about whether you want rules for birds, reptiles, or exotic pets.

- Yard Maintenance: It is important to lay out whether you will be responsible for maintaining the landscaping or if it will be the responsibility of the tenant. If it will be the tenant’s responsibility, explain what needs to be done. Lawn mowed once a week, watered daily the summer, leaf cleanup in the fall, etc.

- Garbage removal: Is there garbage pick up in your area? Will you pay for it or will the tenant?

- Cleanliness: A dirty home is both a health hazard and a great way to attract pests. Set rules for cleanliness. While you can’t dictate how often they vacuum, you can set rules on open food containers and clutter that obstructs doorways. This gives you the ability to evict a tenant if upon an inspection you find the house a disaster.

- Right of entry: When the house is rented out, the tenant will have certain rights that dictate when you are allowed to enter the home. Most states require 24 hours notice so make sure your rules comply with your state laws and are clear and fair to your tenants.

7 – Decide if you want a property manager

A property manager helps handle all the stress and craziness that comes with owning a rental property. They collect rent, oversee maintenance, find tenants, and complete lease agreements. A good property manager can make rental income feel automatic.

However, for that peace of mind, you are going to have to pay a pretty penny. The average property manager charges 10% of rental income in addition to ~50% of first month’s rent when you get a new tenant. If you have a mortgage on your property and an already slim amount of profit, this may not be an option you can afford.

Also, keep in mind that a good property manager is hard to find. Work off references from acquaintances and sources like Angie’s List and interview potential candidates thoroughly. If you don’t feel like you can trust them in the first interview, move on! These people will be handling your property and your money, you want to be sure you are comfortable with them.

HGTV has a great article on how to find a good property manager that I found really helpful.

If you decide to hire a property manager, they will be responsible for the remaining steps in the process! I still recommend reading the basics so you know what the steps are.

8 – Know the Law

The last thing you want to do as a landlord is run afoul of the law. In most states, tenants have a lot of rights and not understanding what they are, what occupancy is allowed in your district, and what rules your town has could get you into a mess of expensive legal trouble.

The easiest place to get information is most likely your town’s housing department. They will have the up to date rules on tenant rights, whether there are different property taxes for rental homes, and whether zoning restrictions in your area limit occupancy. The other option is to call a real estate attorney for a consultation but this will likely cost you some money.

Tenant rights control what you can charge for late fees and security deposits, abilities of tenants to withhold rents if maintenance isn’t completed, fair housing rules, and a number of other things. Make sure you have an understanding of the laws and follow them. This way you have your research to fall back on if a tenant lawsuit arises.

9 – Create a tenant application form

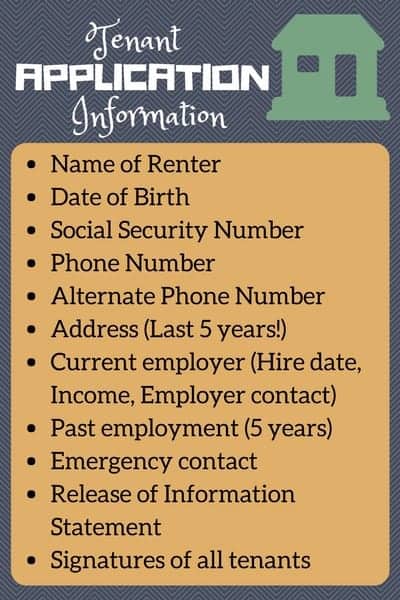

When you post looking for tenants, you will need a standard application for them to fill out. This includes things like their name, social security number, address, phone number, employment information, and contact information for references. You will also ask for an application fee to cover the cost of a background check.

When you post looking for tenants, you will need a standard application for them to fill out. This includes things like their name, social security number, address, phone number, employment information, and contact information for references. You will also ask for an application fee to cover the cost of a background check.

This document will be your key source of information for screening potential tenants. Make sure the application covers things you want the answers to, but remember that there are some things that can not be asked on a tenant application. For instance, race or religion are no-no’s due to federal discrimination laws.

There are a number of free forms for standard tenant applications online, but you can also easily make your own. If you choose to make your own, be sure to include everything noted on the left.

If you choose to use a realtor or property manager, they will have a standard form and will manage processing applications for you.

10 – Find a Tenant!

You are finally ready to find a tenant! List your property on real estate sites like Zillow and Trulia with clear, professional photos of the property. Be prepared to manage applications yourself or hire a real estate agent.

Whether or not you have professional help, you should have some automatic disqualifiers to help quickly sort through poor candidates. Some good automatic disqualifiers are if a tenant doesn’t have gross monthly income at least 3x rent, solid references, or a year of continuous employment.

When managing a tenant search yourself, I recommend giving an application to anyone who is interested. While this might be more of a time suck for you, it helps protect from discrimination lawsuits if someone is unhappy that they couldn’t get an application from you.

Background & Credit Checks: You want to be sure to run a professional background and credit check on all potential tenants. Just because someone seems very nice and clean cut doesn’t mean they haven’t been kicked out of their last 3 apartments.

A good option for background checks is SmartMove by TransUnion. They make it very easy to start a background check using the prospective tenant’s email. They then send an email to the prospective tenant so they can submit all the necessary information. SmartMove offers 2 levels of checks, one for $25 and one for $35, and these can be covered with the application fee.

When you look for a tenant, be patient! You may see many poor applicants before you find the perfect one and that is ok. A few weeks of lost rent while you search for the right tenant may seem like a big deal now. But avoiding issues down the line (missed rent payments, property damage) will make it well worth it.

Begin Your Life as a Real Estate Investor

Congratulations! You now own an investment property! As you can tell, the process isn’t as easy as throwing up a “For Rent” shingle and finding a tenant. But doing all this work up front will make your years as a landlord much, much easier. Good luck!

Do you still have questions about renting your home? Been a landlord and have something I missed? Let me know!

This is a great step by step guide for homeowners becoming first time landlords!

Thank you so much.

Loved your in-depth article.

I am a single parent mum with a large home.

I have a studio within my large home (under same roof with own entrance) and thinking of renting it out along with one of my bedroom.. (2spaces)So your article was extremely helpful.

Any other advice appreciated.

Excellent condensed article, thank you.