I am a big believer that your house is not an investment, but an expense. For many American families, whose home is the biggest component of their net worth (total assets minus total liabilities), this is a tough pill to swallow. Families convince themselves to make expensive upgrades to their home because it is an “investment” in their greatest asset. The problem is that unless you plan to stay in your home for the long-term, your primary residence is unlikely to return what you could have made investing in the market.

Lucky for you, buying a home for the short term (5-7 years) was a major mistake my family made. In our case, not only will our return on the investment be less than the market, it will likely be negative. Even though we will probably sell it for more than we bought it for! To illustrate why a home should be viewed as an expense, not an investment, I have compiled the tale of Papa Fish and my first two years of homeownership.

Table of Contents

The Beginning is a Very Fine Place to Start…

Homeownership is the good old American dream. So in February of 2015, Papa Fish and I closed on our first house. We moved in during the first major snowstorm of what would turn out to be a record month of snow for Boston. While there was definitely some level of excitement around having our own home and a yard for our dog, there was also a lot of joking around about the down payment. Would Papa Fish have to pry the check out of my white-knuckled hands? Would I be able to be excited about the house, or would I panic about the incredibly large liability we just signed on for? Did we have enough saved up for emergency expenses? Whatever the answers, we were about to find out.

How Did We Compare Renting to Buying?

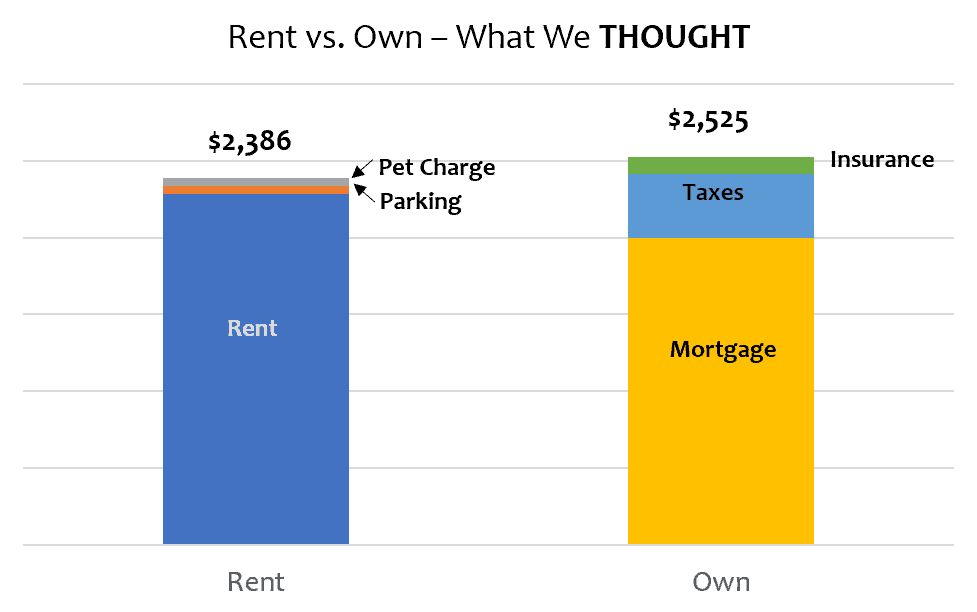

One of the conversations Papa Fish and I had before buying a house was how housing expenses would compare to our rent expense. We took mortgage payments, home insurance, and property taxes (like they do on Zillow) and compared it to rent. Here is how it looked:

We would pick up about $139 a month in strict housing expenses, but some portion of our mortgage payments would be going to principle (~$720/mo early on) so it looked like a slight benefit towards the house. Plus, we would pick up a bedroom and a yard, and lose those annoying downstairs neighbors who had parties at 2 am.

What Did We Plan For?

I knew the Zillow housing cost calculator was an overly simplistic way of looking at housing costs. We budgeted for unforeseen expenses, every item we thought we would need to furnish the house (we literally had a budget for kitchen shelf liners), and closing costs. We put a full 20% down on the house and planned to be there 5 to 7 years, at least, until we had kids and needed to decide where to send them to school.

Here is a snippet of the expenses we planned for as a first-time homeowner, if anyone is curious. I’m just a bit Type A so I still have the spreadsheet of every individual item and its budget. Lucky you! Washer/dryer, lawn mower, snow blower, grill, dining room set, spice rack, new blinds, curtains, rugs for every room, paint, light, tool bench, side chair, mirrors, and on and on.

What Happened Next

The Evil Ice Dam

Remember when I said we moved into our house in a snowstorm in what would come to be the heaviest snowfall month in Boston’s history? Yeah. Well, we may also be the fastest homeowners to need to call their home insurance. 5 days after we closed on the house, I was unpacking when I saw a puddle on the floor in our foyer. Lo and behold, there was water coming through the ceiling. An ice dam on the roof caused water to flow from the attic, through the wall between the master bedroom and the guest room closet, and into the foyer. Cha-ching! $1,000 deductible to home insurance. (Update: After a year the contractor had never billed our insurance so we got this deductible back.) Our first “emergency expense”!

Not to mention, it took 3 months to get someone who was available to fix all the damage that year…

From Cold to Hot, Bye-Bye Central Air

The snow melted, our home was fixed, and summer came on fast. That’s New England weather for you. Soon it was 80+ degrees and we were ready to kick on the central air. The system started up fine, but every few days we came home to no AC and the house at 80 degrees. We used Angie’s List to find a good HVAC provider who told us our unit was shot. We chose a new energy-efficient unit. Cha-ching! $12,000 for a new central AC unit. My “super conservative”, Murphy’s rule emergency fund was starting to look smarter to Papa Fish at this point.

Our Feathery Roommates

It was Friday afternoon of Memorial Day weekend and I was working from home. I heard a sound that almost seemed like someone was in the house. After freaking out, calling Papa Fish and walking around with a baseball bat, I figured out the sound was coming from the wall. It turned out a pair of birds had flown into an open vent on the side of the house, panicked and broke through the venting and fallen into the wall. We had to cut a hole in the wall, remove the birds (did I mention birds are my worst fear?), fix the wall and put a new vent cover up. Cha-ching! $125 in repair expenses.

Shoddy Construction – The roof Is coming in on our heads

Things had started to calm down. The AC was running, my brand-new vegetable garden was blooming, and we started to laugh off our early home ownership mishaps. Sitting on the covered deck one afternoon, we looked at the decking and brought up getting some new Trex put down. Maybe we would look around and ask for some quotes.

We had a few people come in, but what we quickly discovered was that (a) the deck was not properly connected to the house and (b) the beam holding the roof up was much too small. From that point on, all we could see was that bowed 4×4 trying to hold up our roof. The only way to fix it, correcting for the load of the roof and building codes was to rebuild the deck from scratch. We got a second opinion, but that was just what we had to do. Cha-ching! $13,780 for a new deck.

How do We Look at Homeownership Costs Today?

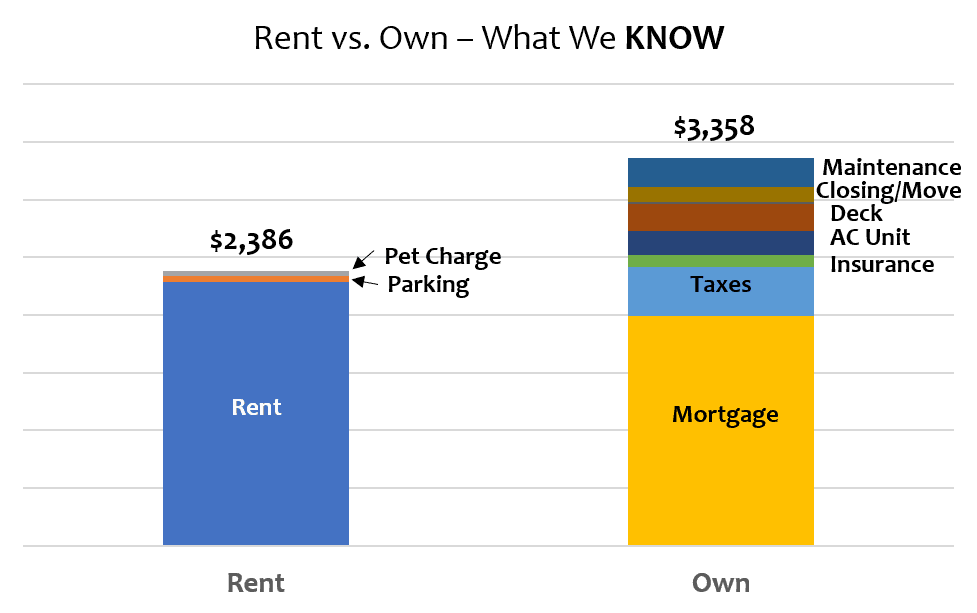

Today, any expense that is related to owning a home that we wouldn’t have if we were renting goes into our housing costs. This includes lawn maintenance, driveway resealing, fence repairs, HVAC maintenance and so much more.

Here is how the updated chart looks, assuming no more major expenses hit us in the next few years. This chart also assumes we stay in this house for five years, which is the minimum amount of time we would be here. For us, owning a house will be ~$972/mo more expensive than staying in our rental apartment for this 5-year period.

What Did We Learn?

Homeownership is Expensive.

In addition to those major maintenance expenses that crop up unexpectedly, the little costs of homeownership add up as well. When we ran the side by side comparison of renting versus buying, we should have included a monthly budget for all the little expenses we didn’t have when we rented: salt in the winter, lawn fertilizer, HVAC maintenance, mulch, plumbing repair, etc. We budgeted for them, but we didn’t use them to compare renting versus owning which might have changed our thinking.

Buy for the Long-Term.

Buying a house we could comfortably afford at the time and up-sizing to a house we could see ourselves in permanently after a few years seemed financially smart at the time. However, the cost of that new AC unit would be less if we were actually going to be here the full 15 years it runs. Instead, I have to spread that cost out over only 5-6 years.

Houses are long-term assets. For most Americans, your house was standing before you were born and will be standing after you pass. Similarly, most housing costs have long lives. A boiler lasts about 30 years, a roof +20 years, an AC system +10. If your luck is bad, like ours was, and you have to fund one or more of those costs in the few years you own a short-term home, you will end up bearing all the cost for the next owner.

Pay Attention to Workmanship.

The previous owners of our house did an exceptional job keeping it clean but a pretty shoddy job keeping it well maintained. That isn’t entirely their fault, some of the issues are behind the walls from the builders (no junction boxes, are you kidding me?), but we may have noticed the red flags if we had known to look for them. Now that we have been here a while, we can see that when they painted they didn’t quite reach the ceiling, the plastic vents outside were old and brittle, and everything is crooked. We will be doing more knowledgeable home inspections in the future.

A House is not a Good “Investment”.

I ran a Return on Investment (ROI) calculation on our home for what I believe we could sell it for at the end of 5 years of ownership. I didn’t include any more major costs. The expected return is -11.7%. Even if we didn’t have those large, one-time expenses, our ROI would only improve to -9.5%. If I considered our house an investment, it would be by far the worst I’ve made.

Over the long-term (~100 years), the average inflation-adjusted return of real estate is 1%-2%. It can be higher if you are renting the property, but you won’t be renting your primary residence. Alternatively, the long-term return of the stock market is +7%. Even when you are buying for the long-term, putting more money into your home likely isn’t as strong of an investment opportunity as putting that money in the market.

Do you view your home as an investment? What return do you expect to get on your home?