When I was writing about debt management in the Roadmap to Financial Health I started thinking about how much of our income goes purely to interest – aka fees we pay to banks for things we purchased, and possibly finished with, in the past. How much of our income aren’t we able to save, invest, or spend as we like because of commitments we made either out of necessity or lack of financial discipline?

When I was writing about debt management in the Roadmap to Financial Health I started thinking about how much of our income goes purely to interest – aka fees we pay to banks for things we purchased, and possibly finished with, in the past. How much of our income aren’t we able to save, invest, or spend as we like because of commitments we made either out of necessity or lack of financial discipline?

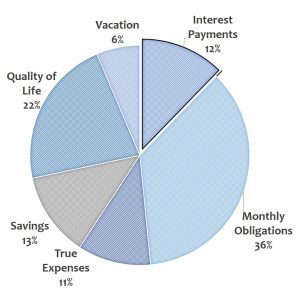

I’m proud to say that our mortgage is currently our only outstanding piece of debt, but, even with ~40% equity in our home and a low-interest rate, interest accounts for 12% of my monthly base income. We pay our bank double digits of our monthly income as a fee to live in our house. If we are at 12%, where were our friends with student and car loans? How much of our income has our debt leached onto?

Tiffany and Rob

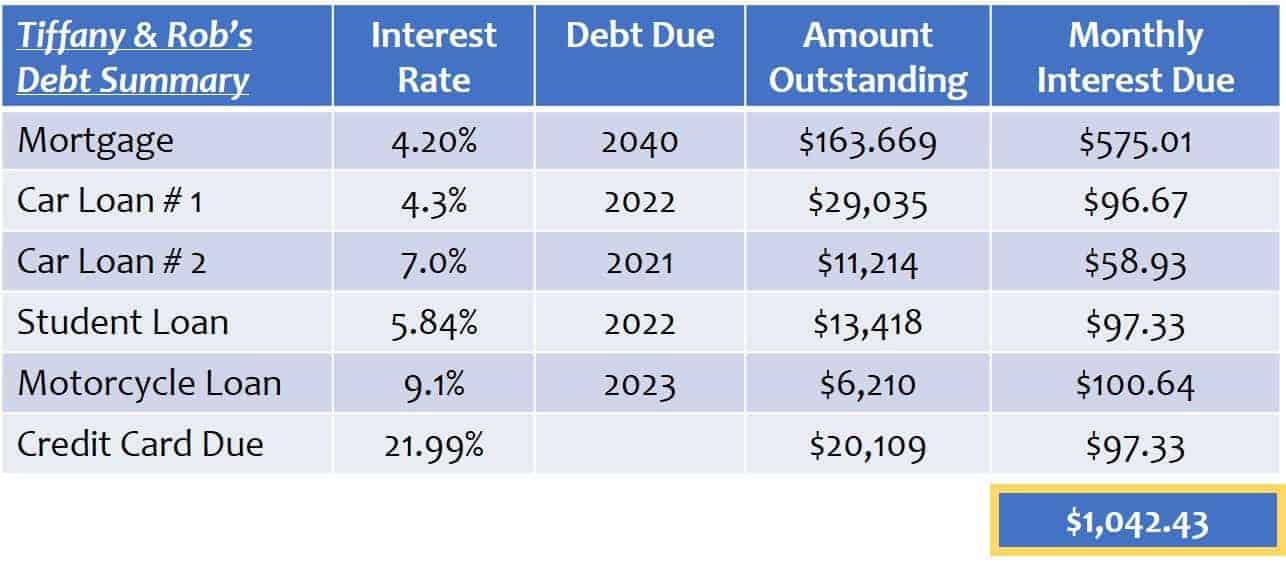

My friends Tiffany and Rob (names have been changed) have graciously allowed me to use their budget as an example of the significant drag interest becomes on your budget. Tiffany and Rob are married, live in NH, and have one child Fuss Fish’s age. They are just working on developing a budget, so they were willing to trade some anonymous information with you all for some custom tips on maintaining their budget. Yay Tiffany and Rob!

Tiffany and Rob have six sources of debt: mortgage, two car loans, a motorcycle loan, Rob’s student loan and a credit card balance. Tiffany makes $30,000 a year and contributes 2% to a 401(k) and $200 monthly to an HSA (Health Savings Account). Rob makes $40,000 a year and contributes 3.5% to a 401(k). Their total monthly take home pay is $4,698. So what does their interest look like?

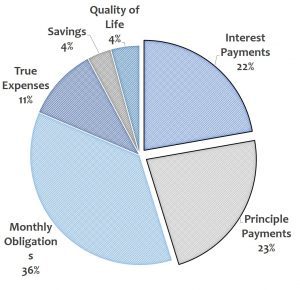

Interest alone, before adding in required principle payments for these debts, is 22% of Tiffany and Rob’s monthly income. Tiffany’s comment upon hearing this was “ARE YOU KIDDING ME? More of those payments don’t go to principle?! No wonder they never seem to feel like they are declining!” Tiffany had the same feeling I did when I looked at our mortgage interest – rage. Anger, while not always helpful, can be excellent motivating you to make big changes.

So we took that rage and renewed motivation and made a plan. What did Tiffany and Rob’s budget look like today, and how would it look if they paid down all their debt except for their mortgage?

With required principle payments on all debt except the mortgage (we included principal payments for the mortgage in Monthly Obligations), 45% of Tiffany and Rob’s monthly income goes to serving their debt. For now, they plan to put $200 a month towards an emergency fund until they get to $1,000, then add that extra $200 a month towards debt pay down.

To keep themselves motivated to pay down the debt, Tiffany and Rob are putting the below charts on their current budget and potential future budget on their bathroom mirror.* Every morning and every evening they will see that if they can focus and get that debt paid down, they can hit their retirement savings goals AND start saving for that first vacation with their little. We are rooting for you guys!

*Life Pro Tip: Your bathroom mirror is a great spot to put motivational quotes and information that you want to see on a regular basis, but don’t necessarily want your neighbors and friends scrutinizing.

How much of your monthly budget is gobbled up by the interest boogie man? What is your plan to throw him out of your home for good? Get mad to get #FinanciallyFit!

I tried to resist not commenting, but I have a strong urge to chime in here. Can Rob and Tiffany reconsider their vehicle choices? Over 40k in car loans, almost 6k in motorcycle loan @ 9%, while simultaneously owing on student loans and 20k credit card balance? The motorcycle costs $100/month in Interest alone! Sell the bike and put the money towards credit card debt or student loan debt or the 7% car loan! Or trade in the cars for a decent used car (I bought a gently used Camry hybrid for $15k) and use the difference in monthly outlay to crush the student loans and credit card debt. 22% of their take-home goes straight to bank profits (interest) instead of helping them get ahead with their family goals. I don’t want to be a jerk, but I think they should consider some radical changes.

I’d definitely urge a consideration of the all-in expenses for the motorcycle (debt, maintenance, insurance) and divide that by the number of times per year that they ride it. They may find they can rent a bike for less than they’re paying on a per-ride basis. And here’s my final Judgy McJudgerson comment: toys are for when your debts are paid off. Get rid of credit card debt, car loans and student loans, and you can easily afford the bike! I truly wish them well.

Jover – Don’t worry! This is basically what we talked about when they saw these numbers. (This post was about a year ago.) Sometimes you need a radical wake up call!

They have since sold the motorcycle and traded in the car with the higher loan balance to put more towards their debt. They realized $200 a month towards debt would have still meant YEARS of being in the hole, and they didn’t want that. Still have a ways to go, but they are doing well 🙂