Last month, I received a very sad call. My first boss on Wall Street had passed away after an almost three year battle with brain cancer. He was in his early 50s. My boss was an incredibly kind man who taught me a lot, but one of the most valuable things he taught me was to always purchase long-term disability insurance. The way things turned out, I’m eternally glad that when the time came, he had it.

In his honor, I want to share why long-term disability insurance may be even more important for your family than life insurance.

Table of Contents

What is Long-Term Disability Insurance?

When I first joined my first job out of college, the other first-year hires and I had an hour long-session on our available benefits. Not surprisingly, I passed on long-term disability coverage. What are the chances, I thought, of me getting an injury sitting at a desk on Wall Street? It was my boss who asked me, about a month into the job, whether I had signed up. He gave me a better explanation and I added the coverage at year end.

Here’s what you need to know.

Long-term disability insurance insures you against any long-term illness, injury, or accident; not just one faced on the job. A long-term disability policy kicks in after short-term disability would usually have run out (60-90 days) and pays you 50%-70% of your gross (pre-tax) monthly income. Policies typically cover you for periods of 2, 5, or 10 years; or can cover you until retirement age.

Long-term disability insurance is also referred to as income replacement insurance. It protects you and your family in case you cannot work for extended periods but don’t have the savings to live long-term (6+ months) without any income.

Why Do You Need Long-Term Disability Insurance?

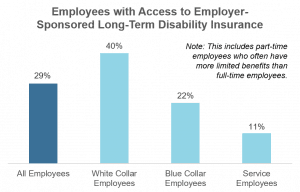

While long-term disability is usually offered as part of a standard benefits package by employers, most people don’t opt to pay the fee. It is something not well covered in those benefits seminars when you join the company, and people don’t want to pay for something they don’t understand or think they need. Sadly, this means they are potentially missing out on one of their more important benefits opportunities.

Worker’s Comp doesn’t cover most disabilities

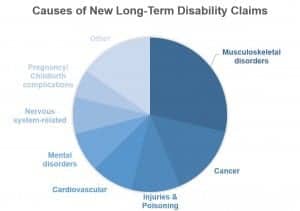

When most people think of disabilities, they think of work-related accidents. Falling off ladders, throwing out your back, and things like that. However, most disabilities don’t occur from anything work-related, meaning they won’t be covered by worker’s comp. In fact, fewer than 5% of disabling accidents and illnesses are work related. That is because 90% of long-term disability claims are for illnesses, not accidents. Just because you sit at a desk, doesn’t mean you don’t need long-term disability.

You’re more likely to need it than you think

The estimates on the likelihood of needing long-term disability insurance vary, but the consensus is that you are far more likely to face a disability than an early death. At least twice as likely, in some cases much higher.

The U.S. Census Bureau states that the average employee has a 1 in 5 chance of becoming disabled at some point in their career. Can you afford not to be covered if it happens to you?

If you have to use it, you’re probably out of work for longer than you think

Let’s say you face some kind of disability during your career. How long do you think you would be out of work? 3 months? A year? While it is impossible to tell what kind of disability you might face and how long your recovery would take, the average employee with long-term disability from illness, injury, or accident loses 2.5 years of work! That is a very long time to face without income or benefits.

“Own Occupation” coverage protects your investment in your education and career

Some long-term disability insurance covers you not just for disabilities that prevent you from working entirely, but from any disability that prevents you to do your job. Young doctors, lawyers, or professionals – especially those with large student loan balances – can benefit from this type of coverage.

There are a variety of “own occupation” coverage types, but true “own occupation” policies continue to cover you even if you are gainfully employed in another profession as long as you remain unable to perform your prior duties.

The classic example is a surgeon who permanently injures her operating hand. She could become a university professor, lawyer, hospital administrator, or any other paying job. But as long as she can’t operate, she will continue to receive her long-term disability benefits. This preserves her high-income earnings potential and would help her to handle student loans, providing for her family, and any necessary new job training.

Most families can’t cover an income loss

There is a saying that goes, “Insure what you can’t afford.” In the case of long-term disability insurance, the sentiment holds true. Over 50% of Americans couldn’t cover a $500 unexpected expense without going into debt. If your emergency fund or assets can’t protect you for more than a few months and you have debt or dependents, you need to ensure your income through long-term disability.

For my old boss, long-term disability meant they could stay in their home, afford his hospital bills, and not put his wife in dire straits. They weren’t living as comfortably as they once were, more due to hospital bills than the quality of his disability policy, but they were alright. I can’t imagine the difficulty his wife faced with his unexpected illness, the last stressor she needed to add at that point was money.

How Can You Get Long-Term Disability Insurance?

Employer-sponsored plans

For most people, the easiest and cheapest way to get long-term disability insurance is through employer-sponsored plans. Usually, you pay a portion of the fee to access the insurance through your employer’s plan. The downside here can be that you have little ability to adjust coverage terms. However, given the lower cost of buying it in the market, it is usually the best place to start.

My company offers stellar long-term disability coverage. For $12 a month, I would receive 60% of my monthly gross income averaged over the prior 3 years (including my bonuses!) after short term disability runs out and up to age 65, as a max period. It is also “own occupation” coverage, meaning I get paid even if I can do something else besides be a hedge fund analyst.** But, outrageously, I have colleagues that don’t opt into this company benefit. Even for those with personal savings, the risk/reward here is solidly in the camp of reward.

Be sure to check the terms of your employer’s policy to make sure you don’t need or want additional coverage. You could want additional coverage because you believe your family would need more income in a disability scenario, you want to be covered for a longer period of time, or because you plan to be self-employed longer term and want to secure coverage while you are young and healthy. If you do, check out self-purchased plans.

**I have considered many times what disability would prevent me from working at my desk job, but allow me to do something else. I generally assume if something happens where I can’t sit at a desk and fiddle with numbers, I probably wouldn’t be able to do much else. But since “own occupation” is a higher quality policy, I guess I’m glad they offer it!

Self-purchased plans

If you are self-employed, your employer doesn’t offer a plan, or you want additional coverage; you have the option of buying long-term disability policies directly through an insurance agent. You will likely have to get a health exam and fill out some health history forms as well, which you may not have to do with an employer plan. These plans are more expensive and can represent 2%-3% of your gross income.

For example, let’s say you are a 28-year-old woman making $70,000 a year. A policy that covers 60% of your gross income tax-free (any payments to you are not subject to income tax), would pay you $3,500 a month in case of disability and would likely cost ~$120 a month. It sounds like a lot These plans are more expensive when purchased directly and can represent 2%-3% of your gross income. For example, let’s say you are a 28-year-old woman making $70,000 a year. A policy that covers 60% of your gross income tax-free (any payments to you are not subject to income tax), would pay you $3,500 a month in case of disability and would likely cost ~$120 a month.

If the cost sounds like a lot, remember two things.

First, if you work full-time you likely have an employer-sponsored plan that costs a lot less. Don’t get sticker shock until you see what it will really cost you.

Second, think through the people you know. Has anyone in your life faced periods where they couldn’t work? It doesn’t have to be as catastrophic as what my boss faced. A bad back injury, birth complications, or health issue could put a person out of commission for months. Is it harder to imagine finding the room in your budget for the policy or covering months and months without income or benefits?

You can compare quotes from numerous long-term disability providers in just a few minutes with PolicyGenius.

Like life insurance, age and health matters

Unsurprisingly, it is easier and cheaper to secure long-term disability insurance when you are young. Pre-existing health conditions, even things like sleep apnea, can exclude your coverage for a variety of other potential longer-term ailments. It is better to secure a policy while you are young and healthy, to control costs and have the most potential disabilities covered.

Be sure to look for a policy that is both non-cancelable and guaranteed renewable, meaning the insurance company can’t raise your premiums in the future or cancel your policy. This will ensure that you can keep your policy, at your current cost, even if new health considerations arise over time.

Secure Your Family’s Financial Knight in Shining Armor

When it comes to long-term disability insurance, obviously the hope is that your policy gets nice and dusty on the shelf. But if the time comes that you need it and you don’t have months of savings to draw on, it can be your savior. A disability, whether illness or injury, is one of the fastest ways families see their financial security destroyed. Lack of income and medical costs can eat away at your savings or push you into debt. A sad outcome when your employer likely offered a reasonably priced plan to protect you.

I like to think about long-term disability like my husband’s trusty Epi-Pen. Yes, he hasn’t had to use it in well over a decade and it sucks to pay that absurd co-pay for new ones every year. But we never leave the house without it. I know that regardless of the minor hassle and cost if one of those pesky bees ever gets him, we’ll be thankful we had it.

Do you have long-term disability insurance? Do you know someone who has ever needed it? Drop a note in the comments and let me know what you think about long-term disability insurance as part of a prudent family financial plan.

Very informative post, thanks.

We are covered through work but once comes the time to shop on our own, we will definitively come back to your resources. Thanks

Thanks!

I have long-term disability insurance through work and didn’t have the option to opt out of it. Honestly, if I did have the option there’s a very good chance I would opt out, depending on how expensive it was every month.

I know insurance is there for a reason but we do like to think we’re invincible, don’t we? I also work a desk job and would certainly weigh the unlikely chance of significant injury impacting my job. You never know what can happen though, and as much as our finances are prepared for an emergency, a long-term issue would be a challenge for sure. And the last thing you want is to have to worry about money when you’re trying to recover.

We certainly do like to think we’re invincible!

Assuming it will be difficult for us to face injury is the hardest part for LTD insurance. The fact is, an injury is not the main use of LTD. And if you think you’ll want kids, any issue related to pregnancy (like bed rest, complicated birth, postpartum depression) will most likely be covered. An important resource once your short-term runs out.

Sorry to hear of the loss of your boss. Great post in his honor.

I’ve always been fortunate to have both long-term and short-term disability through employers. The older I get, the more I see old friends needing it, luckily most have it.

Thanks, Amy! It definitely becomes more real when you start to see people needing these types of security. Hard to imagine at 21, but something you could end up missing down the road.

Good post, although one of your paragraphs is doubled up (the end of the first paragraph that gives the example with “it sounds like a lot.”) I didn’t do long-term disability coverage at first either, but I have been recommended it since then and seen so many people use it. The most impactful I remember is the nurse who broke her leg. Ran out of short-term disability and paid leave, but the company did not want her back until she was out of the wheelchair, so she and her husband were using months and monthe of savings that could have been saved for other things. She said never to no take long-term disability.