Ringing in a new year has a way of helping us wipe the slate clean – giving us a fresh start and getting us excited about this being the year we crush all our goals.

It’s a great time to reflect on what worked and what didn’t, what truly matters to us, and what we can probably live without.

That reflection is the key though. This has to be about your desires. What matters most to me likely won’t be what matters most to you. And if our goals don’t align with what we want most, it’s difficult to stay motivated and keep taking the actions that will get us closer to success.

But when we define what we really want, for ourselves and for our families, it allows us to take small steps every day to direct our time, energy, and money toward creating a life full of what is most important to us.

As we look ahead to what we want in 2021, consider these ways to afford more of what matters to you.

Table of Contents

Affording More of What You Want

1 – Change Your Mindset About Budgeting

Too many of us think saving and budgeting go hand in hand with being tied down. You might feel restricted and like you can’t do anything when you budget.

Too many of us think saving and budgeting go hand in hand with being tied down. You might feel restricted and like you can’t do anything when you budget.

It’s like your mama telling you ‘no.’ But that’s not the case!

Budgeting is empowering. Think of it this way: would you take a road trip without a map? Most people wouldn’t. Now, think of your money as the car – it needs direction. When you tell it where to go, you can save and spend more.

It all starts with creating a budget. It doesn’t have to be restrictive. Here’s how to start:

- Look at your expenses over the last year. Write down the essentials – the bills you must pay, like the mortgage or rent, utilities, phone, food, car payment and insurance. These are non-negotiable. You have to pay them or you won’t have a place to live, food to eat, or a way to get your kids to the doctor.

- Review your negotiable expenses. These are the expenses you may be able to reduce or eliminate, and it’s where the power of budgeting shines. When you see where you can cut, and you choose to cut, it won’t feel restrictive. There’s a difference between being told what to do and choosing to do it. (Just ask your kids!)

My favorite way to budget is zero-based budgeting with You Need a Budget. With zero-based budgeting, you only budget the money you have, giving each dollar a job until there are no dollars left.

Because budgeting this way encourages you to think about money differently, it can take some getting used to. But once you get YNAB set up, it’s a really powerful tool that can completely change your relationship with money.

The key is to find the system that works best for you and your family.

2 – Earn Cash Back on Your Purchases

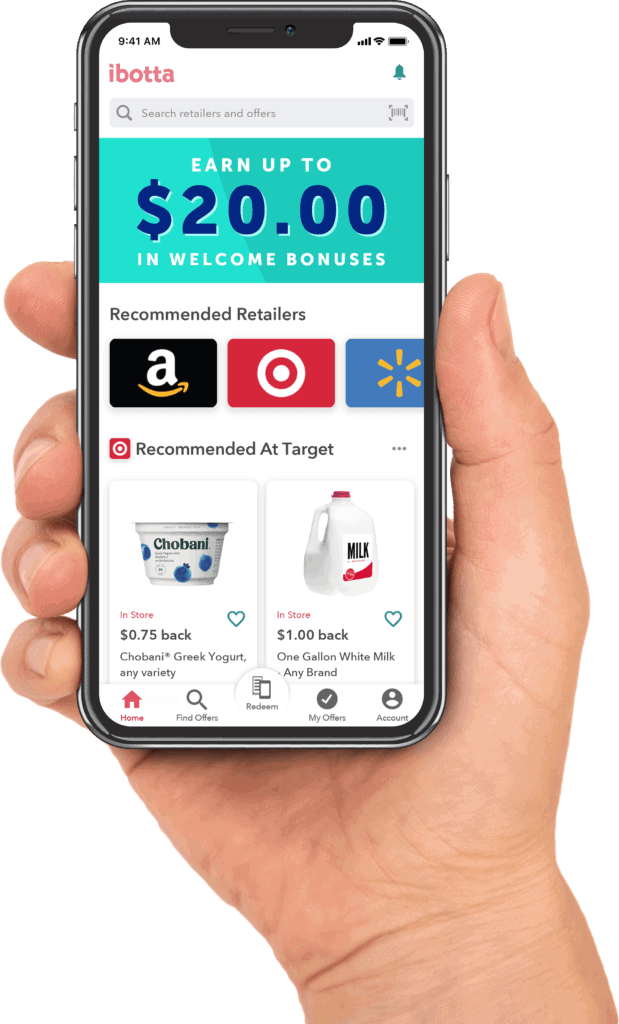

Mamas need to spend – groceries, clothing, toys, and household goods are a must. Finding ways to save is crucial to stretching your dollars to afford more of what you want. For me, Ibotta is a big part of how I save money on everyday items.

Ibotta is a free cash back app that lets you earn rebates on items you purchase. It also has several bonus promotions that give you cash back above and beyond what you usually save.

This January, Ibotta is running a ‘Resolutions with Rewards’ campaign. To help you meet your New Year’s resolution for a healthy lifestyle, you’ll earn cash back when you buy healthy grocery items.

Getting cash back with Ibotta is a great way to make healthy choices for your family, even if you’re on a tight budget.

3 – Prepare for Emergencies

Nothing makes a mama more frantic than being unprepared. Rather than letting the universe take you by surprise (hello, 2020!), create a budget for emergency savings.

Nothing makes a mama more frantic than being unprepared. Rather than letting the universe take you by surprise (hello, 2020!), create a budget for emergency savings.

Experts recommend you set aside at least three to six months of expenses for emergencies. Ideally, this is an excellent goal. But many families felt the sting of shrinking paychecks and unemployment in 2020.

Many families had little saved for an emergency. Nearly 60% of Americans would have to use a credit card or borrow money to cover a $1,000 emergency – and that was before the pandemic began.

If 2020 taught us anything, it’s the importance of being financially prepared when disaster strikes. You may not be able to save much if you lost your job or were furloughed, but every little bit helps.

Create a plan to reach your savings goal. Start with $5, $25 or $50 per week and contribute what you can. Once you reach your emergency savings goal, you won’t need to put yourself further in debt when an emergency pops up.

And that can unlock more freedom to spend money on more of what you want.

4 – Align Your Spending with Your Values

The only way to afford more of what you want is to know what you want in the first place. When’s the last time you thought about your values? I’m not talking about what makes you happy in the moment – I’m looking at you, Grande Skinny Vanilla Latte with two pumps of sugar-free caramel – but what helps you create lifelong memories or achieve goals in life?

The only way to afford more of what you want is to know what you want in the first place. When’s the last time you thought about your values? I’m not talking about what makes you happy in the moment – I’m looking at you, Grande Skinny Vanilla Latte with two pumps of sugar-free caramel – but what helps you create lifelong memories or achieve goals in life?

List your values and include the important things in the way you live and work. What means the most to you in life? Your list might consist of time with your kids or significant other, traveling, helping others and your hobbies.

Next, think about how you can fit these things into your budget. Consider it an investment in yourself, which is the most valuable investment you can make.

5 – Cut Out What Doesn’t Serve You

To afford more of what you want, you may need to cut out the things that don’t serve you. Think about what you spend money on that doesn’t add value to your life. Here are a few ideas to start:

- Subscriptions you don’t use

- Shopping habits that make you feel remorseful rather than fulfilled

- Credit cards or other debt that charges interest

- Eating out when it exceeds your food budget

By not spending on things that drag you down, you’ll have more money available to spend on what you want.

6 – Make Your Money Work for You

We’re big advocates of high yield savings accounts. Earning more interest on your savings is a no-risk way to make your money work for you. The downside is that interest on bank accounts are at an all-time low thanks to the Federal Reserve lowering interest rates to help the struggling economy.

We’re big advocates of high yield savings accounts. Earning more interest on your savings is a no-risk way to make your money work for you. The downside is that interest on bank accounts are at an all-time low thanks to the Federal Reserve lowering interest rates to help the struggling economy.

But there are other ways to make your money work for you.

If you’re not a risk-taker, leaving your cash in high yield checking or savings accounts might be your best option. Many banks don’t have a minimum balance requirement, and you’ll earn a higher rate of interest than you might get at your local institution.

If you’re ready to take some risk, consider investing. Robo-advisors are a great way to jump into investing for beginners. You could even invest your spare change with money-saving apps like Acorns.

The goal is to let your earnings compound and let your interest earn even more interest.

7 – Track Your Progress to Afford More of What You Want

Tracking your progress is an excellent way to reach your goals. Once you have these steps in place, take some time to assess how you’re doing. Are you reaching your goals? Or does your budget feel more painful than necessary?

If it doesn’t feel right, give yourself grace and make adjustments.

It can require some trial and error while you work out the kinks, and that’s okay! The key to making it work is to go with the flow while keeping your eye on the prize. Then, you can afford more of what you want and enjoy your money the way it’s meant to be enjoyed.

How are you aligning your budget with what you most want this year?